When placing a trade in the market, professional traders always include a plan for managing their risk. One traditional method for setting risk levels is through the use of technical indicators. In previous articles we discussed using ATR and the PSAR indicator exactly for this purpose. Today we will examine another method of trailing stops using a custom pricing channel.

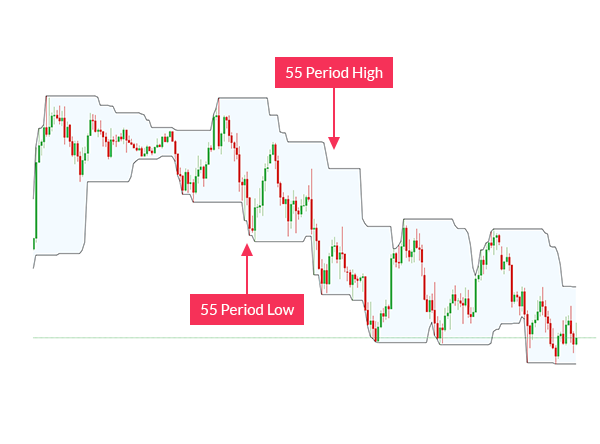

DNC (Donchian Channels) can be used to establish initial and trailing stop levels on a trade. The indicator is designed to display the current high and low for a specified number of periods. Typically a setting of 55 or 20 periods is used for this purpose. Traders that prefer wider stops should opt for a higher DNC setting while, lower settings offer tighter stop entries.

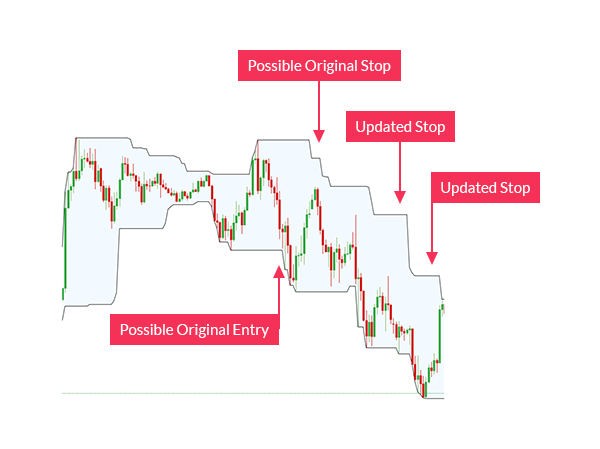

The Chart below depicts the EURJPY downtrend developing from the March 2nd high at 111.42. Since this point we have entered three trades using multiple strategies. Regardless of our entry mechanism, one fact remains the same. We need to manage risk! Primary stops can use the 55 period high depicted with pricing channels as our first point to place our original stop. This level is important, if a trend begins making higher highs in a down trend we would want to exit our position as quickly as possible.

Pricing channels can also be used to lock in profit as a trend develops. As lower highs are made, our top channel will move lower as well in accordance to the new 55 period high. Traders can use this trailing component by manually update their stop to the current reading of the DNC indicator. Below we can see the upper channel residing at 102.86 on the EURJPY 8HR chart. From our initial entry, this would allow our primary trade on the EURJPY placed at 108.09 on April 4th lock in profit of 523 pips. This process can continue until price touches our top pricing channel or an established limit is taken.

Next: How to Read Risk 'OFF' or Risk 'ON' Sentiment (14 of 50)

Previous: What You Need To Know About Your Trade Position Size Strategy

---Written by Walker England, Trading Instructor

To contact Walker, email WEngland@DailyFX.com . Follow me on Twitter at @WEnglandFX.