Article Summary: Trading the forex market may seem over your head but understand that you control when you trade, what you trade, and how much you trade. This means that you control your destiny more that you realize. Here’s a quick guide to show you how you can control your outcomes in the Forex arena.

“There are two mistakes one can make along the road to truth...not going all the way, and not starting.”

-Prince Gautama Siddharta

Historically, September is a month that turns a lot of investors’ attention to the Forex market. This is due to the fact that September is one of the worst performing months for the Dow Joes Industrial Average going back to its creation in 1896 with an average monthly drop of 1.07%. As stocks tend to perform poorly, investors and traders look to other markets and are naturally attracted to the Forex market as it measures as a $4 Trillion daily volume market that is readily tradable by the likes of you and me.

However, many well-meaning and talented traders are scared away from the Forex market due to a few misperceptions that can easily be cleared up. Sadly, traders new to the Forex market shy away from many trading opportunities because they don’t understand how much control they have over their access to the market. Here are the key points about the control you have when accessing Forex.

Leverage – How large of a trade you’re controlling

Presented by FXCM’s Marketscope Charts

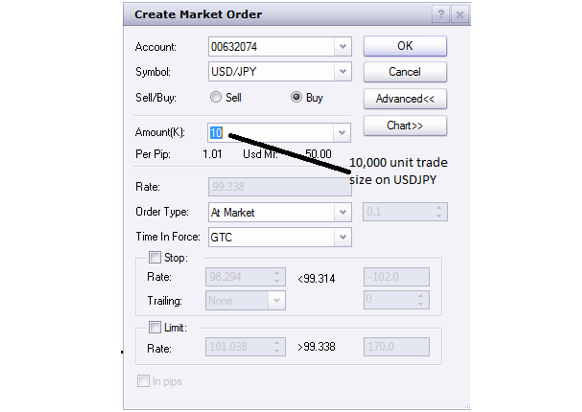

Few things scare new traders like the leverage in the Forex market. If you’re familiar with our Traits of Successful traders report (sign up to access the report here), one of a few important findings that we share is that many traders do best with not leveraging their account more than 5x. However, it’s important to understand that when you open a trade, you decide the trade size and in effect, the leverage you will be using.

Learn Forex: Opening a Trade is Where You Determine Trade Size & Leverage

When To Trade – Determining Which Market Environment You Participate In

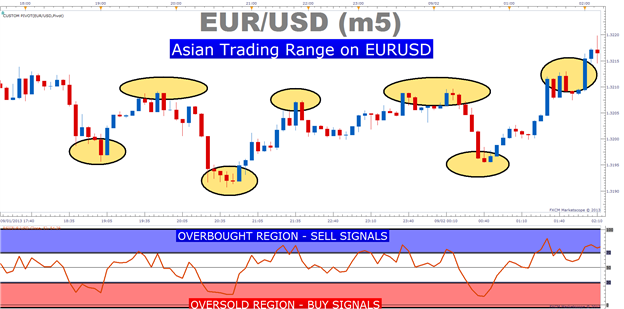

Another misconception that a lot of traders have is that the currency market runs wild around the clock. However, what we found is that depending on what time of day you’re available to access the opportunities in the Forex market will likely determine the market environments you witness. In other words, if you’re trading from 6pm – 2am ET also known as the Asian trading session, then you’ll likely see a lot of ranges in which you can take entries near support or the bottom of a price channel to try and get into the trade until the top of the range.

Learn Forex: The Asian Trading Session Typically Displays Ranges with “English Speaking” FX Pairs

Presented by FXCM’s Marketscope Charts

What You Trade Determines the Volatility You Will Likely Experience

If you’re unfamiliar with the ATR or Average True Range, it’s time to understand it. ATR tells you how much a currency has moved on average over the last 14 periods. Therefore, if you’re looking at a daily chart and you apply the ATR over the last 14 days, you will notice a wide range in the average distance a currency pair travels.

Learn Forex: Average True Range Varies Significantly Across the Board

The way to read ATR is as simple as the table that I put together for you implies. This table tells you that by and far, you can expect the GBPJPY to travel more than the others based on its average movement over the last 14 days. Similarly, if you’re new to FX and you don’t have the stomach or confidence to handle large moves, then you can trade the EURGBP or USDCHF which move a fraction of the GBPJPY.

Learn Forex: GBPJPY is Often Too Volatile for Any Trader to Conservatively Trade

Presented by FXCM’s Marketscope Charts

Putting It All Together

If you’re a new trader who is excited about trading the Forex market but you’re also nervous about what you’ve heard prior to reading this article, pleased understand this. You have more control over your results and exposure than you were likely first led to believe. You can control how much you trade, when you trade and what you trade to determine how exposed you are to the FX market.

Lastly, if you take the extreme example and trade GBPJPY which has the largest ATR at 144 pips per day on average over the last 14 days and trade it during the volatile London Session with too much leverage you are likely setting yourself up for more volatility and account equity swings then you can likely stomach. If you’d like a smoother introduction into live trading, it is better to trade with little to no leverage the low ATR currency pairs during the Asian trading session.

Happy Trading!

---Written by Tyler Yell, Trading Instructor

To contact Tyler, email instructor@dailyfx.com

To be added to Tyler’s e-mail distribution list, please click here.

New to the FX market? Learn to trade like a professional with DailyFX!

Signup for this free “Trade like a Professional” certificate course to help you get up to speed on Forex market basics. You can master the material all while earning your completion certificate.

Register HERE to start your Forex learning now!