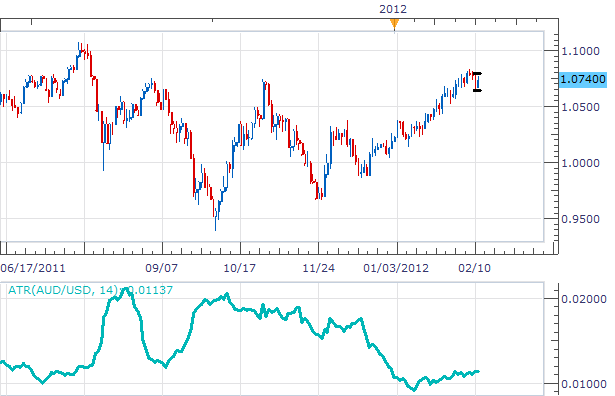

Just like the AUD/CAD , the AUD/USD has had a considerable run already in the 2012 trading year. The AUD has recently formed a yearly high on February 8th at 1.0843. The pair has currently paused below this level, but has yielded an impressive 651 pip uptrend from 1.0192, the January 2nd low. As the pair pauses, traders will look for price action clues as to the direction of the next AUD/USD breakout.

Zooming the graph in to our most recent candles, we can see the AUD/USD developing an inside bar. This setup is similar to the inside bar developed on the GBP/USD for the January 30th Chart Of The Day. The key is to apply the same strategy with entry orders above the previous day’s high and lows. Price action on Friday printed a daily high of 1.0789 and a low of 1.0639.

ATR can again be used to determine our profit targets. A suggested value is 20% of the daily ATR. Currently daily ATR resides at 113 pips . 20% would offer a suggested target of 22 pips.

My preference is to sell a break out of either support or resistance. Entrys should be put directly above/below the previous daily high/low. Limits should be set looking for a 22 pip profit target, with stops set to employ 1:1 Risk / Reward ratio.

Alternative scenarios include price remaining “inside” prior to a breakout.

---Written by Walker England, Trading Instructor

To contact Walker, email instructor@dailyfx.com. Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, send an email with the subject line “Distribution List” to instructor@dailyfx.com.

DailyFX provides forex news on the economic reports and political events that influence the currency market. Learn currency trading with a free practice account and charts from FXCM.