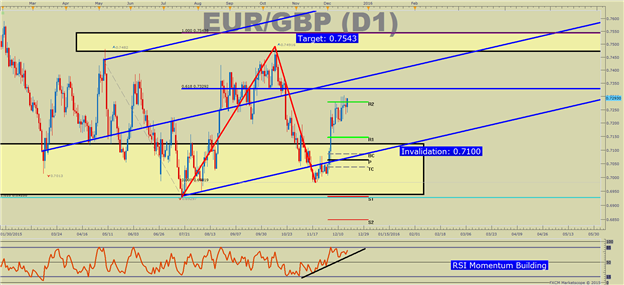

Bias: Bullish EURGBP toward that Aug 24th High

Point to Establish Long Exposure:Bullish OR Break on Monday

Target 1:Early May Closing High of 0.7485

Swing Target 2: 100% Fib Ext. 0.7543

Invalidation Level:0.7100 (61.8% Of Current Move Off Higher Low)

This Week’s Price Action Recap:

EURGBP has put in an impressive December performance thus far. However, looking forward, the next large move in EURGBP may come from GBP weakness. January seasonality tends to show strong moves lower in sterling, and EUR seems unable to stay offered against weaker currencies like GBP & CAD. Often, it can be helpful to answer the question, ‘what is the market not doing’ to see? Currency, we do not see an aggressive bid in cable or a willingness to aggressively sell this pair. Additionally, since March, EURGBP has moved sideways, which seems to favor a basing process is in place.

Trade Idea for EURGBP:

Many traders may stay reluctant to sell EUR blindly after the very aggressive bid displayed on December 3rd. The 12/3/15 move came within onepip (463 vs. 462 pips) of the March 18th move that spurred a multi-month rally in favor of the EUR. Now, it appears the onus is on the Bank of England to support the GBP, and if they fail to prop up the falling sterling, we could soon see a move to the top of the range near 0.7540. In large part, the resurgence of BoE dovishness and Brexit risk is something the market is beginning to price in. Similar to the GBP weakening in late-summer of 2014 when the Scottish Independence Referendum came to light, we could see a move that takes Sterling lower across the board.

The end of the year is infamous for gappy liquidity, which means moves can be erratic. However, the lower high that has lead to this strong move may be a base that trader can build into 2016. For now, we can watch opening range breakouts as well as sentiment as triggers for entering the trade. Currently, sentiment sits at -3.9942.We use our SSI as a contrarian indicator to price action, and the fact that the majority of traders are short gives signal that the EURGBP may continue higher.

Levels for EURGBP:

2nd resistance:0.7382 78.6% Fibo of Oct.-Nov. fall

1st resistance: 0.7298 Multiple daily rejections at 61.8% Fibo of Oct.-Nov. fall

Spot: 0.7295

1st support: 0.7241 Dec. 17 low

2nd support: 0.7218/15 100-DMA, Dec. 15 low