Canadian Dollar Price Outlook:

- The Canadian Dollar has been on the backfoot in recent weeks as coronavirus cases surge globally

- Meanwhile, the Japanese Yen has been a beneficiary of weakness in growth-linked currencies

- As a result, CAD/JPY has fallen to a critical area of support that is struggling to hold of an extension lower

Canadian Dollar Price Forecast: CAD/JPY Looks Vulnerable

A global rise in coronavirus cases has hamstrung risk appetite in recent days, leading to pain in many growth-linked markets. Since the Canadian economy has significant exposure to the crude oil industry, a drawdown in the price of the fossil fuel typically weighs on the Canadian Dollar. While this relationship is not always so clear cut, the Canadian Dollar has also been weakened by comments from Bank of Canada officials which most recently suggested interest rate hikes are off the table until at least 2023.

As a result, the Canadian economy is battling low interest rates and declining crude oil prices amid renewed covid lockdowns and recent weakness in the Canadian Dollar is largely a byproduct of that skirmish. While the Canadian Dollar is weak across many pairs, CAD/JPY might be one of the more intriguing as the two currencies stand on roughly opposite ends of the risk curve. Often regarded as a safe haven currency, the Japanese Yen is relatively insulated from some of the concerns held by CAD.

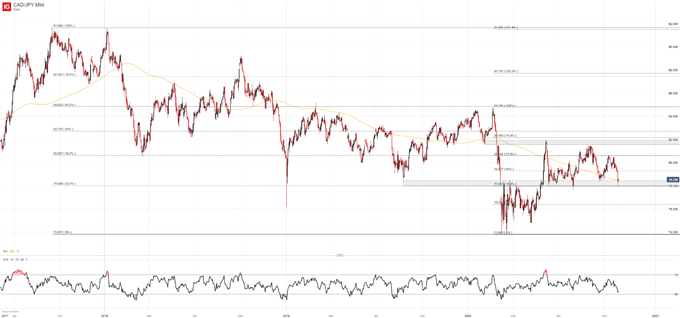

CAD/JPY Price Chart: Daily Time Frame (September 2017 – October 2020)

Coupled with the fundamental backdrop, the technical landscape of CAD/JPY also suggests more weakness might be ahead for the pair. Critically, recent declines have seen the pair fall beneath the 200-day moving average as it clings to support around the 78.00 mark. While further declines might not materialize immediately, it can be argued CAD/JPY seems tilted to the downside over the longer-term.

CAD/JPY Price Chart: 4 – Hour Time Frame (March 2020 – October 2020)

With the fundamental and technical attributes suggest potential weakness ahead, further patience might be required before entering a trade at this stage due to a low RSI reading and proximity to support. Furthermore, the daily chart reveals two long lower wicks that suggest buyers are not ready to forfeit the level.

Since there is little to suggest CAD/JPY will break lower in the immediate future, a brief recovery higher – perhaps to 79.23 or even 80 – might occur before the pair pushes beneath 78 in earnest. Should price rotate higher, bearish biases might be better explored at those levels while using the areas slightly above resistance as zones of invalidation.

If price plummets beneath 78 suddenly, the strategy would shift to a breakout trade, looking for exposure at the highest possible price with areas of interest around 76.43 initially. In the meantime, follow @PeterHanksFX on Twitter for updates and analysis.

--Written by Peter Hanks, Strategist for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX