Looking for Forecasts, Trade Ideas, and Educational Content? Check out the DailyFX Trading Guides page.

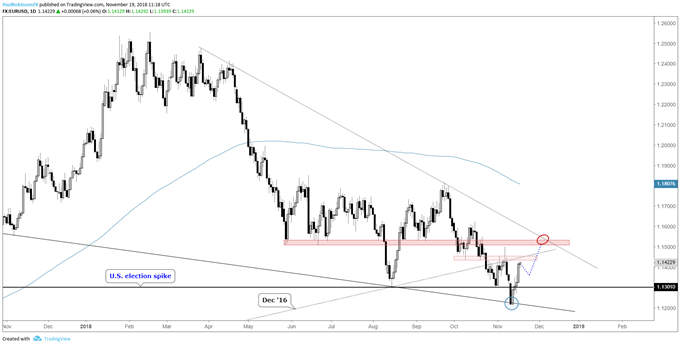

EUR/USD pop off long-term level has more short-term upside in sight

The drive off the one-year underside trend-line has been surprisingly strong, and with it momentum looks set to take EUR/USD further into resistance over the 11500-mark. From a risk/reward perspective a pullback before entry looks like a prudent play. No pullback, no trade, from where I sit.

A smallish decline though could offer dip-trippers an opportunity to take on a trade of 150 pips or so. The exact timing at the moment is still up in the air with weakness needed first, but the Euro at least looks primed to make good on last week’s surge.

Looking for strength to carry higher into the low-11500s before arriving at a big test. A decline below 11300 would be concerning for longs and put the Euro back at risk of declining further, possibly below last’s low and the underside trend-line from last November.

EUR/USD Daily Chart (More momentum into resistance)

Struggling right now? It happens to the best. Check out these four core ideas to help boost your Confidence as a Trader.

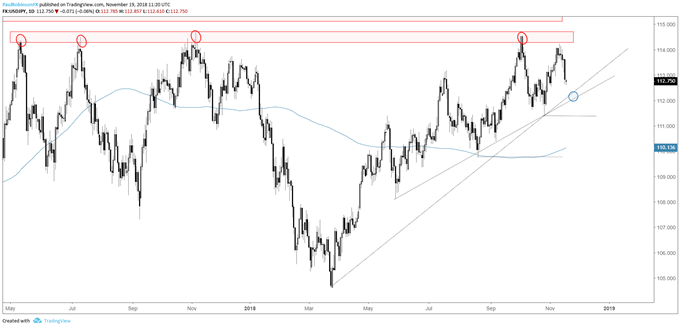

USD/JPY out of wedge, bounce may offer entries for another leg lower

USD/JPY fell out of a wedge last week after coming very near a strong area of resistance running over from May of last year. Ideally, the initial entry was on the wedge break, however; a small bounce from here could still offer traders a chance to catch more weakness down to around 11200 or worse if trend support doesn’t hold. It’s not a great set-up at this juncture for the swing trader, just as is the case with EUR/USD, but the path of least resistance for short-term traders looks fairly clear at the moment.

USD/JPY Daily Chart (turn from near big resistance)

USD/JPY 4-hr chart (Looking for another entry after wedge-break)

***Updates will be provided on these ideas and others in the trading/technical outlook webinars held on Tuesday and Friday. If you are looking for ideas and feedback on how to improve your overall approach to trading, join me on Thursday’s for the Becoming a Better Trader webinar series.

Resources for Forex & CFD Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX