- Updated levels on trade setup we’ve been tracking in NZD/USD and EUR/USD

- Join Michael for Live Weekly Strategy Webinars on Mondays on DailyFX at 12:30 GMT (8:30ET)

- Check out our 2018 projections in our Free DailyFX EUR/USD Trading Forecasts

New to Forex? Get started with our Beginners Trading Guide !

NZD/USD 120min Price Chart

In my most recent NZD/USD Technical Outlook we noted that Kiwi had, “turned from multi-month consolidation resistance and keeps the focus on a reaction just lower near the 2018 trendline. From a trading standpoint, we’ll favor fading weakness while below 6889” Price has broken below this threshold with Kiwi now approaching downside support targets at the 200-day moving average near 6735. Subsequent objectives are eyed at the 61.8% retracement at 6722 and the yearly open at 6705- ultimately a break below this region would be needed to suggest a more significant high is in place.

Initial resistance stands at the highlighted trendline confluence around ~6790 with a near-term bearish invalidation now lowered to 6807/19- a region defined by the March / weekly open and the 100-day moving average. A close above this threshold would shift the focus back towards the weekly opening-range high at 6837. Review my latest NZD/USD Weekly Price Outlook for a look at the longer-term technical trade levels.

Review this week's Strategy Webinar for a in-depth review of these setups and more!

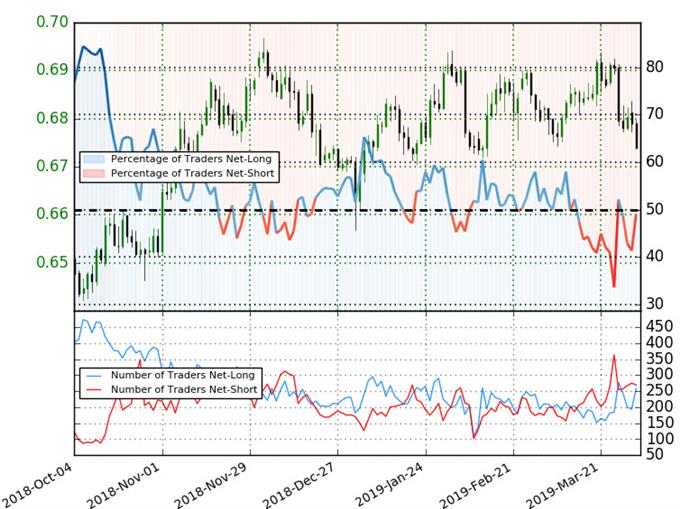

NZD/USD Trader Sentiment

- A summary of IG Client Sentiment shows traders are net-short NZD/USD - the ratio stands at -1.11 (47.4% of traders are long) – neutral reading

- Long positions are21.2% higher than yesterday and 25.5% higher from last week

- Short positions are 4.9% lower than yesterday and 9.3% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests Kiwi may continue to rise. Yet traders are less net-short than yesterday & compared with last week and the recent changes in sentiment warn that the current NZD/USD price trend may soon reverse lower despite the fact traders remain net-short.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

EUR/USD Daily Price Chart

In our last Euro Price Outlook, we noted that EUR/USD had, “pulled back from a BIG resistance-confluence last week at the yearly open and we’re looking for a low wile within the confines of this near-term formation. From a trading standpoint, the immediate risk remains for further losses while below the monthly open but we’re looking for a reaction / more favorable entries on a move towards the lower parallel.” Price has broken lower with Euro now testing critical Fibonacci support at the 61.8% retracement of the 2017 advance at 1.1186.

There’s no setup here just yet, but we’ll be looking for a reaction around this threshold. A daily close below would keep the focus lower in price targeting the multi-year pitchfork support of the formation extending off the 2015 / 2017 lows, currently around ~1.1131 (are of interest for possible downside exhaustion). Initial resistance steady at 1.13 backed by the 100-day moving average at 1.1354. Critical resistance remains with the yearly open at 1.1445.

From a trading standpoint, we’re looking for a stabilization (constructive price action) above 1.1186 over the next few days IF Euro is going to rebound. That said, the threat remains for a larger decline towards longer-term parallel support near 1.1130. Click here for the latest EURUSD scalp report.

Find yourself getting trigger shy or missing opportunities? Learn how to build Confidence in Your Trading

-Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex