- Technical trade setups we’re tracking into the start of the week, month & quarter

- Check out our New 2019 projections in our Free DailyFX USD Trading Forecasts

- Live Weekly Trading Webinars on Mondays on DailyFX at 8:30ET

New to Forex Trading? Get started with this Free Beginners Guide

Key USD Setups in Play Heading into the Start of 2Q

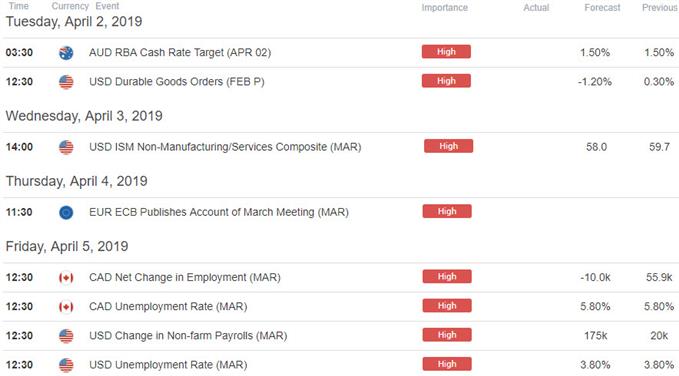

It’s the start of a new week, month and quarter with the US Dollar majors trading within well-defined technical setups as we head into the open. Keep in mind we have the Reserve Bank of Australia (RBA) interest rate decision on tap tonight with US Non-Farm Payrolls (NFP) and Canada employment data slated for Friday. The In this webinar we review updated technical setups on DXY, EUR/USD, NZD/USD, USD/CAD, GBP/USD, Crude Oil (WTI), Gold, AUD/USD, EUR/NZD and EUR/AUD.

Why does the average trader lose? Avoid these Mistakes in your trading

Key Technical Levels in Focus

EUR/USD – Focus is on a reaction of confluence support around the 2018 low at 1.1215 – a break / close below exposes key Fibonacci support at 1.1186. Initial resistance at 1.13 with near-term bearish invalidation at 1.1330.

NZD/USD – Kiwi rebounded off slope support last week with price still trading within the 2019 consolidation range. Key support at last week’s low – resistance at 6837 backed by 6870/76. A break / close lower would exposes the 200DMA at 6735 and 6722.

USD/CAD – Key near-term confluence support at 1.3327– Initial resistance at 1.3407 with 1.3435/37 still critical. A break lower shifts the focus towards subsequent support objectives at 1.3280 & 1.3250.

Gold – Near-term risk remains lower after last week’s outside reversal just pips away from the high-week close at 1327. Looking for a low in gold prices closer to 1275 or 1253/58.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

Key Event Risk This Week

Economic Calendar - latest economic developments and upcoming event risk

Active Trade Setups:

- Canadian Dollar Price Outlook: USD/CAD- Break or Bend, Monthly Highs

- Oil Price Outlook: Crude Breakout Battles 60- WTI Trade Levels

- Kiwi Price Outlook: NZD/USD Post-RBNZ Sell-Off Targets Yearly Support

- Gold Price Outlook: XAU/USD Rally Folds from Fibonacci Resistance

- Euro Price Outlook: EUR/USD Battle Lines Drawn into March Close

Learn how to Trade with Confidence in our Free Trading Guide

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex