- Update on trade setup we’ve been tracking in AUD/USD,NZD/USD and GBP/USD

- Join Michael for Live Weekly Strategy Webinars on Mondays on DailyFX at 12:30 GMT (8:30ET)

- Check out our 2018 projections in our Free DailyFX Trading Forecasts

Here's an update on the Australian Dollar, New Zealand Dollar and British Pound trade setups we’ve been tracking this week. For a complete breakdown of these trades and more, review this week’s Strategy Webinar.

New to Forex? Get started with our Beginners Trading Guide !

AUD/USD 240min Price Chart

I highlighted this setup in this week’s AUD/USD Technical Outlook as price was probing fresh yearly lows. Out ‘bottom line’ noted that, “The downside is getting risky here near-term with upcoming support targets likely to offer some back-and-fill. From a trading standpoint, look to adjust any short exposure heading into these lower targets and be on the lookout for possible exhaustion.”

Price registered a low at 7345 on building RSI divergence yesterday with price now eyeing resistance at the May low-day close / weekly opening-range highs at 7456- a breach there is needed to keep the long-bias in play targeting the upper parallel / 7500/12. Key near-term support still 7327. Scaling out of longs here with stops at breakeven. Look for a pullback early next week for possible re-entry while above 7327.

Learn the traits of a successful trader in our Free eBook!

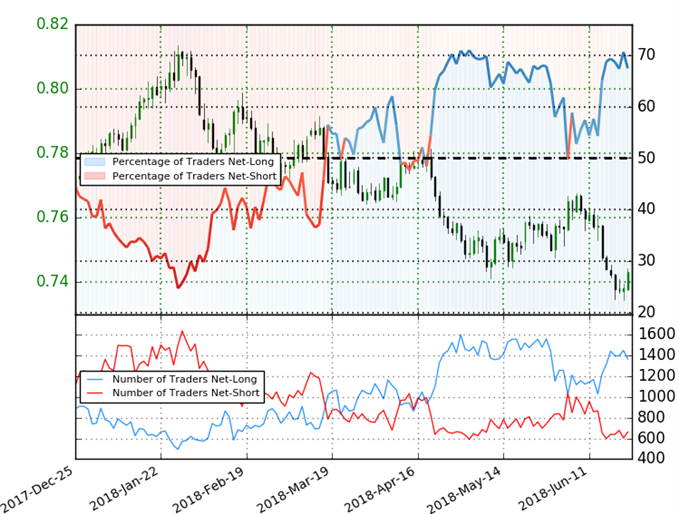

AUD/USD Trader Positioning

- A summary of IG Client Sentiment shows traders are net-long AUD/USD- the ratio stands at +2.07 (67.4% of traders are long) – bearishreading

- Traders have remained net-long since June 5th; price has moved 2.9% lower since then

- Long positions are 4.9% lower than yesterday and 3.5% higher from last week

- Short positions are 1.8% lower than yesterday and 3.0% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests AUDUSD prices may continue to fall. However, retail traders are less net-long than yesterday but more net-long from last week and the combination of current positioning and recent changes gives us a further mixed AUDUSD trading bias from a sentiment standpoint.

See how shifts in AUD/USD retail positioning are impacting trend- Learn more about sentiment!

NZD/USD 240min Price Chart

Our bottom line in this week’s NZD/USD Technical Outlook noted that, “The near-term risk is for a larger recovery on this rebound with our focus higher while above 6850. Ultimately a larger recovery should offer more favorable short entries near structural resistance. From a trading standpoint, I’ll favor fading weakness while above today’s low targeting a move back towards former the underside of the May trendline.”

The price rally turned just one pip ahead of our second resistance target today! Note that 6915/20 and 6944 were both marked as areas of interest for possible exhaustion if reached and with the broader risk in the New Zealand Dollar still lower, it’s a good idea again here to scale out a portion of the longs and set stops to breakeven. Initial support now 6881 with near-term bullish invalidation now raised to 6860.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

GBP/USD Pending

The British Pound turned from a key long-term support confluence this week around 1.3164 with price posting and outside-day reversal on the heels of the BoE (Bank of England) interest rate decision. Price is now virtually unchanged on the week- watch the close - a weekly doji off support would further support the reversal play. We’ll be tracking for a near-term setup early next week but for now, I’ll want to see price hold above the 1.32-handle. Initial resistance on the topside 1.3330 (61.8% Fibonacci retracement of the recent decline).

-Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex or contact him at mboutros@dailyfx.com