- USD technical setups we’re tracking this week post-FOMC

- Check out our 2018 USD projections in our Free DailyFX Trading Forecasts

- Live Weekly Trading Webinars on Mondays on DailyFX at 13:30 GMT (8:30ET)

USD Gains Post-FOMC on Updated Interest Rate Outlook

Markets have re-priced interest rate expectations on the back of last week’s FOMC policy meeting with consensus now calling for four hikes this year. The US Dollar is up more than 2% against all its major counter-parts year-to-date (save the Japanese Yen which is up 2%) with index (DXY) rallying more than 7.5% off the February lows to fresh yearly highs. The advance is currently testing the 200-week moving average and while the immediate threat is for a near-term pullback, the broader outlook remains constructive while above the 94-handle.

Key Levels in Focus

DXY – Initial resistance at 95 (200WMA) backed by 96.04/20. Initial support at 93.90s, Bullish invalidation at 92.28/50

EUR/USD – Price is testing 2016 slope support- break targets 1.1448. Key Resistance 1.1910/30

AUD/USD – Key support confluence at 7327. Initial resistance 7480

AUD/JPY – Testing key support zone at 81.50-82 – Break targets 80.57. Near-term resistance at 82.50/59

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

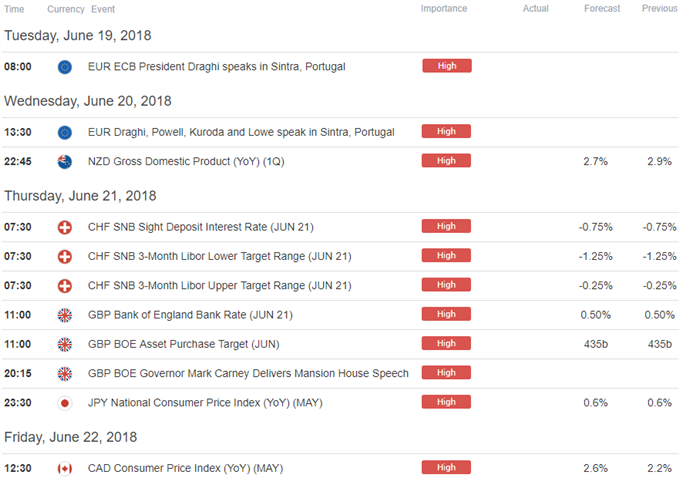

Highlighting this week’s economic calendar are central bank rate decisions from the SNB (Swiss National Bank) and the BoE (Bank of England). We also have New Zealand GDP, Japanese & Canada CPI and a host of central bank speakers on tap. In this webinar we review updated technical setups on DXY, EUR/USD, AUD/USD, AUD/JPY, USD/JPY, GBP/USD, USD/CAD, NZD/USD, USD/CHF, Gold, Bitcoin (BTC/USD), Ethereum (ETH/USD), Ripple (XRP/USD) and Litecoin (LTC/USD).

New to Forex? Get started with this Free Beginners Guide

KeyEvent Risk This Week

Economic Calendar - latest economic developments and upcoming event risk

Other Setups in Play

- ETH/USD Price Analysis: Ethereum Rebounds from Multi-month Lows

- XAU/USD Technical Outlook: Gold Price Breakout Stalls

- LTC/USD Technical Outlook: Litecoin Prices Plummet towards Yearly Low

- AUD/JPY Technical Outlook: Rally Rejected at Resistance

Why does the average trader lose? Avoid these Mistakes in your trading

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com

https://www.dailyfx.com/forex/fundamental/daily_briefing/daily_pieces/scalping_report/2018/06/14/ETHUSD-Price-Analysis-Ethereum-Rebounds-from-Multi-month-Lows-Ether-Outlook.html?ref-author=Boutros