CAD/JPY TRADING Strategy: BEARISH

- Canadian Dollar testing two-year trend resistance versus Japanese Yen

- Near-term positioning suggests a reversal downward is brewing ahead

- Fundamental backdrop appears to be supportive of a bearish scenario

Check out our Q4 Japanese Yen forecast to see what will drive the price trend through year-end!

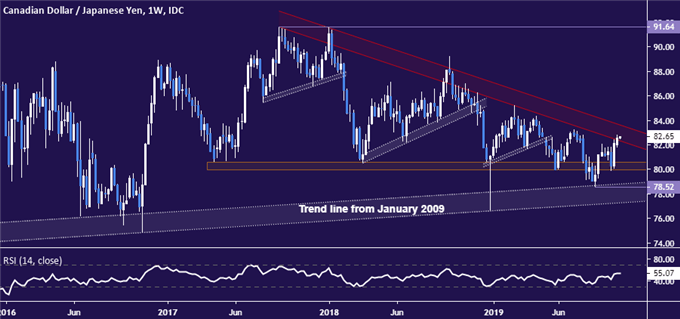

The Canadian Dollar bounced after testing support a rising trendline support capping losses against the Japanese Yen for over a decade. Prices are now testing the bounds of the more recent downward push initiated in early 2018. The outer layer of resistance is currently at 83.67.

Weekly CAD/JPY chart created with TradingView

A break above this barrier would threaten to fundamentally alter the dominant directional bias, marking a major bullish reversal. Zooming in to the four-hour chart suggests rejection downward may be emerging as the more likely path however.

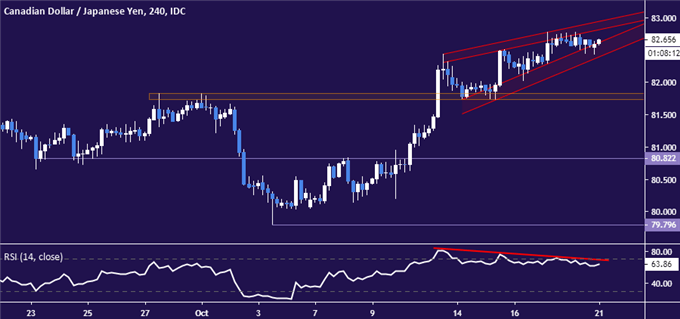

Recent price action has carved out a bearish Rising Wedge pattern. This long with acutely negative RSI divergence appears to suggest that upside momentum is ebbing, which might set the stage for a downturn. Breaking through the wedge floor would act as confirmation, initially exposing the 81.73-83 zone.

4-hour CAD/JPY chart created with TradingView

The fundamental backdrop seems consistent with a downside scenario. The down move started in 2018 is consistent with a peak in global economic growth and subsequent slowdown. This makes sense for the pairing of a cycle-sensitive “commodity” currency like the CAD with the anti-risk Yen.

The latest economic forecasts from top central banks, private-sector economists and the IMF all point to continued deceleration. Meanwhile, a slew of political risks from the US-China trade war to Brexit uncertainty tip the scales in favor of a broadly risk-off bias.

CAD/JPY TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free live webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter