USD/SEK TECHNICAL ANALYSIS

- USD/SEK edging toward key resistance at 9.3110

- Breach with follow through may result in bullish spike

- US NFP data may cause short-term volatility ahead

See our free guide to learn how to use economic news in your trading strategy !

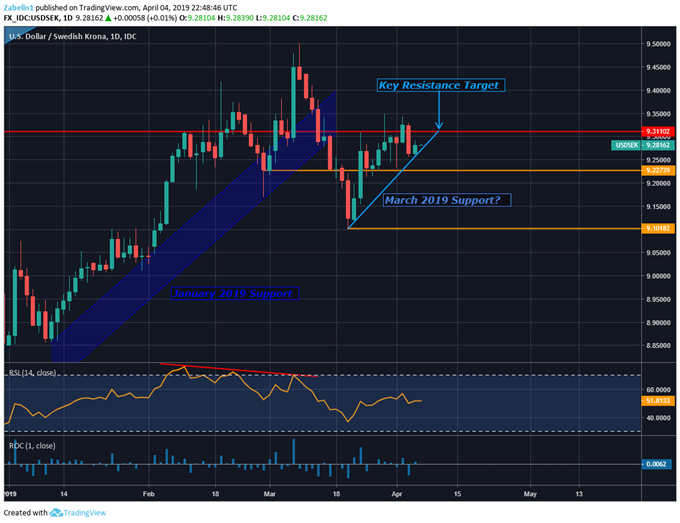

USD/SEK is approaching a key psychological barrier at 9.3110, which if broken and confirmed with follow-through could result in a price spike as traders’ confidence in the pair’s bullish momentum is solidified. Since breaking through the upward-sloping January 2019 support area, the pair appears to have now found a new incline guiding in from March. This support will be tested as the pair approaches the psychological milestone at 9.3110.

If March support holds and the pair climb through 9.3110, it will signal that its upward trajectory is stronger than the selling pressure associated with upcoming resistance. To receive updates on the Swedish Krona’s price action, you may follow me on Twitter at @ZabelinDimitri.

USD/SEK – Daily Chart

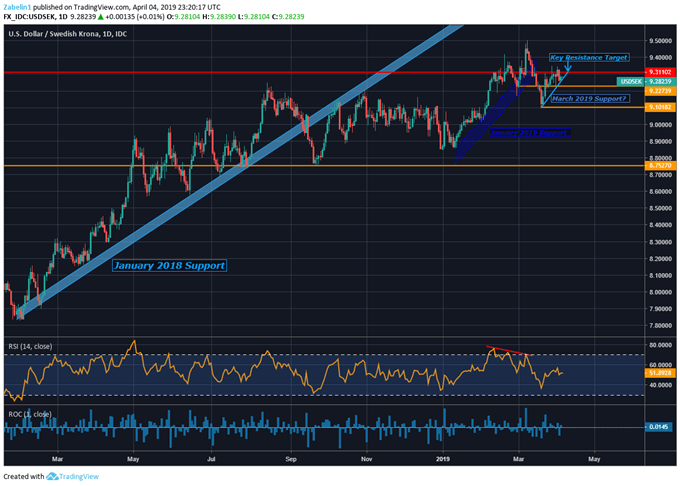

Short-term volatility from the upcoming US non-farm payroll data may rattle the chart formation and could cause violent swings in the pair in either direction, though it is unlikely to alter the broader uptrend the pair has seen since the start of 2018. The default for the pair appears to be bullish despite small retreats and congestions it has experienced along the way.

USDSEK – Daily Chart

FX TRADING RESOURCES

- Join a free Q&A webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter