EUR/USD retraces the sharp selloff following the European Central Bank (ECB) meeting as recent data prints coming out of the U.S. highlight a slowing economy, but the recent rebound in the exchange rate appears to be sputtering ahead of the Federal Reserve interest rate decision on March 20 as it fails to extend the series of higher highs & lows from earlier this week.

The U.S. dollar struggled to hold its ground as updates to the U.S. Consumer Price Index (CPI) showed an unexpected downtick in both the headline and core rate of inflation, and signs of subdued price growth may encourage the Federal Open Market Committee (FOMC) to endorse a wait-and-see approach throughout 2019 as Chairman Jerome Powell warns that ‘some risks to the downside had increased, including the possibilities of a sharper-than-expected slowdown in global economic growth, particularly in China and Europe.’

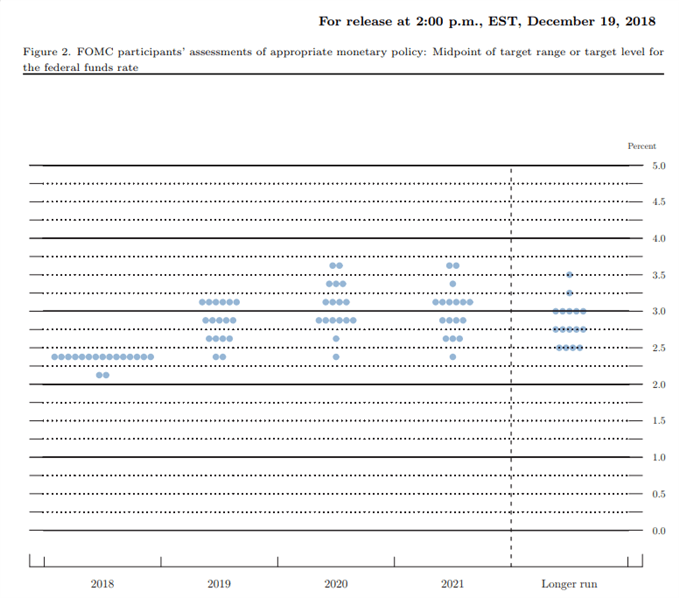

In turn, the FOMC may face accusations of committing a policy error after implementing four rate-hikes in 2018, and the central bank may have little choice but to wind down the $50B/month in quantitative tightening (QT) over the coming months especially as ‘several participants judged that risks that could lead to higher-than-expected inflation had diminished relative to downside risks.’ With that said, the updates to the Summary of Economic Projections (SEP) may show a further reduction in the growth and inflation forecast, but it remains to be seen if Chairman Powell & Co. will adjust the interest rate dot-plot as a growing number of Fed officials show a greater willingness to abandon the hiking-cycle.

With that said, a material change in the Fed’s forward-guidance may produce headwinds for the U.S. dollar, but the recent rebound in EUR/USD appears to have sputtered ahead of the monthly-high (1.1409) as it fails to extend the series of higher highs & lows from earlier this week. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

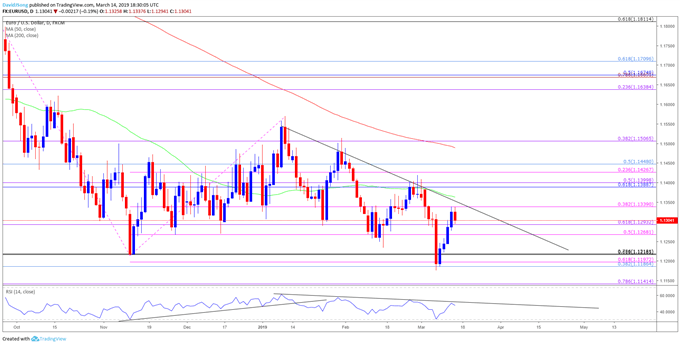

EUR/USD Daily Chart

Keep in mind, the broader outlook for EUR/USD remains mired as both price and the Relative Strength Index (RSI) track the bearish trends from earlier this year, but the exchange rate may continue to consolidate over the coming days following the failed attempt to close below 1.1190 (38.2% retracement) to 1.1220 (7.86% retracement).

Need a break/close above 1.1340 (38.2% expansion) to favor a larger rebound, with the next area of interest coming in around 1.1390 (61.8% retracement) to 1.1400 (50% expansion). However, failure to hold above the Fibonacci overlap around 1.1270 (50% expansion) to 1.1290 (61.8% expansion) may spur a run towards the yearly-low (1.1176), but need a close below the 1.1190 (38.2% retracement) to 1.1220 (7.86% retracement) region to open up the next downside hurdle around 1.1140 (78.6% expansion).

For more in-depth analysis, check out the 1Q 2019 Forecast for the Euro

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.