AUD/NZD Trading Strategy: Long Setup on Standby

- Fundamentally, AUD could be heading higher in the long run versus NZD

- But an Evening Star & negative RSI divergence warns AUD/NZD may fall

- For the time being, it is best to stand aside to watch the reversal warnings

Build confidence in your own AUD/NZD strategy with the help of our free guide!

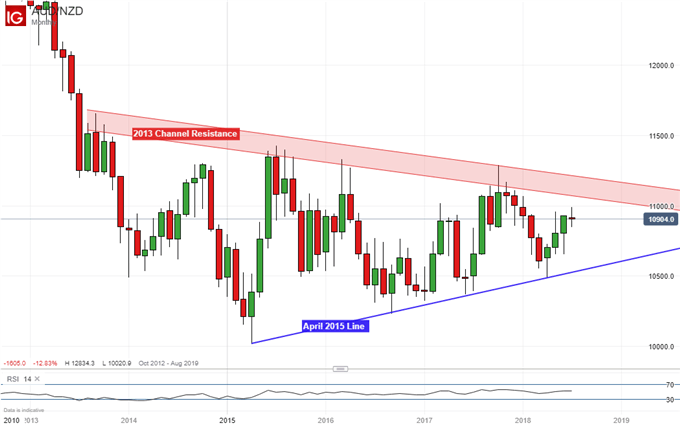

Last time we looked at AUD/NZD, we projected that the pair would gain more upside momentum as the RBA was more relatively hawkish compared to its New Zealand counterpart. The pair did rise since then and AUD/NZD tested a descending trend line from November 2017. Looking at the monthly chart, fundamentals seem to continue providing an argument that it may eventually reach the descending channel from 2013.

The Fundamental AUD/NZD Long Argument

Since then, the fundamental background has not changed meaningfully. The Reserve Bank of New Zealand still holds that its next rate move could either be a hike or a cut. Meanwhile, the RBA maintains that a rise is on their minds. This past week, higher core inflation sent the New Zealand Dollar higher while a solid jobs report bolstered AUD.

The next week could offer more Australian Dollar gains relative to its New Zealand counterpart. There, we will get Australian second quarter CPI data and the headline rate is expected to rise. However, the trimmed mean measure, which represents underlying inflation, is anticipated to remain unchanged at 1.9%.

Australian economic data has been tending to outperform relative to economists’ expectations as of late. This opens to door to an upside surprise in the inflation data, potentially sending AUD/NZD higher as RBA rate hike bets overshadow RBNZ ones.

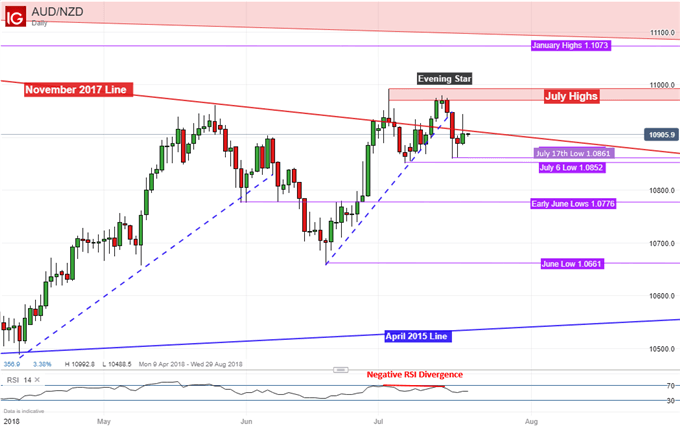

Technical Long Setup: Overshadowed By Reversal Warning Signs

Before entering a long position, there are a couple of technical warning signs in AUD/NZD that suggest it is best to stand aside at the moment. Perhaps until after CPI crosses the wires next week. For starters, the pair is struggling to get above the November 2017 trend line below. In addition, we have a couple of reversal warning signs.

First, an Evening Star candlestick pattern formed after AUD/NZD’s recent attempt to push above the 2017 line. This is a bearish reversal formation that warns the pair could turn lower ahead. In addition, the emergence of negative RSI divergence shows that upside momentum is ebbing. However, to technically argue that the pair is turning lower, I would like to see a close below both the July 17 and 6 lows.

As far as resistance goes, the July highs are at this point the nearest potential targets. This is a range between 1.0970 and 1.0992. A break above this area could pave the way for an attractive long setup. But in the meantime, we shall see if these reversal warnings carry any weight.

AUD/NZD Trading Resources:

- Join a free Q&A webinar and have your trading questions answered

- See how AUD and NZD are viewed by the trading community at the DailyFX Sentiment Page

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Just getting started? See our beginners’ guide for FX traders

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter