USD Technical Outlook

- US Dollar Index (DXY) poised for a breakout this week

- Eventful week with FOMC as the big potential mover

US Dollar Technical Analysis: New Cycle Highs Around the Bend

The US Dollar Index (DXY) has been treading water the past few days following the CPI print last Tuesday that sent markets into scramble mode. This week we have FOMC as the big headline event, with BoJ and BoE following within the same 24-hour period.

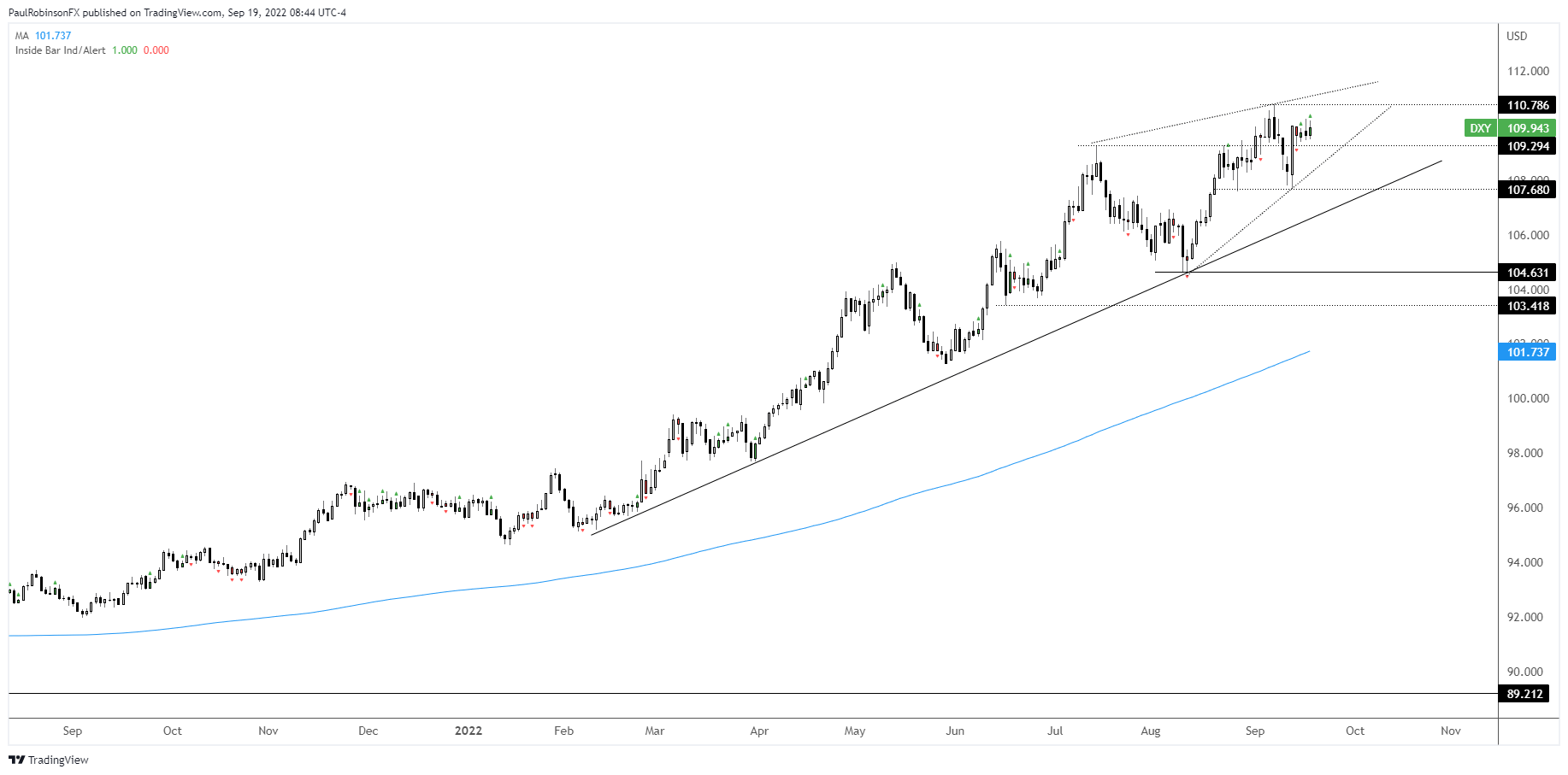

From a technical standpoint, the trend is up and the Dollar index appears poised to break above the recent high at 110.78. Whether that happens pre or post Fed is of course to be seen. In any event it is going to take a lot of turn the trend around, but we could see the DXY weaken near-term before higher.

If this is the case in the very near-term keep the bottom of the recent rage at 109.27 in focus as the first line of support. The index is digesting nicely around the July high at 109.29. A small breakdown could put in an order for a potential validation of the budding trend-line off the August low.

If a real bout of selling comes in then look to the low prior to CPI at 107.68. It appears unlikely we see that level anytime soon, but it can’t be ruled out given the explosive moves we have seen around the Fed.

Seasonality for stocks, which is applicable to the dollar given the inverse relationship, is at the weakest point right now, so this would suggest a dollar tailwind. The thinking is that we will see a new cycle low in stocks next month and perhaps a tradable low.

With the above in mind, this would mean the dollar is likely to stay bid for a bit longer before any kind of meaningful correction can develop.

US Dollar Index (DXY) Daily Chart

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX