US Dollar, USD/SGD, USD/THB, USD/PHP, USD/IDR – ASEAN Technical Analysis

- US Dollar roared higher this past week against ASEAN currencies

- Key uptrends eyed for USD/SGD, USD/IDR, USD/THB, USD/PHP

- As prices aim for new highs this year, what are key levels to watch?

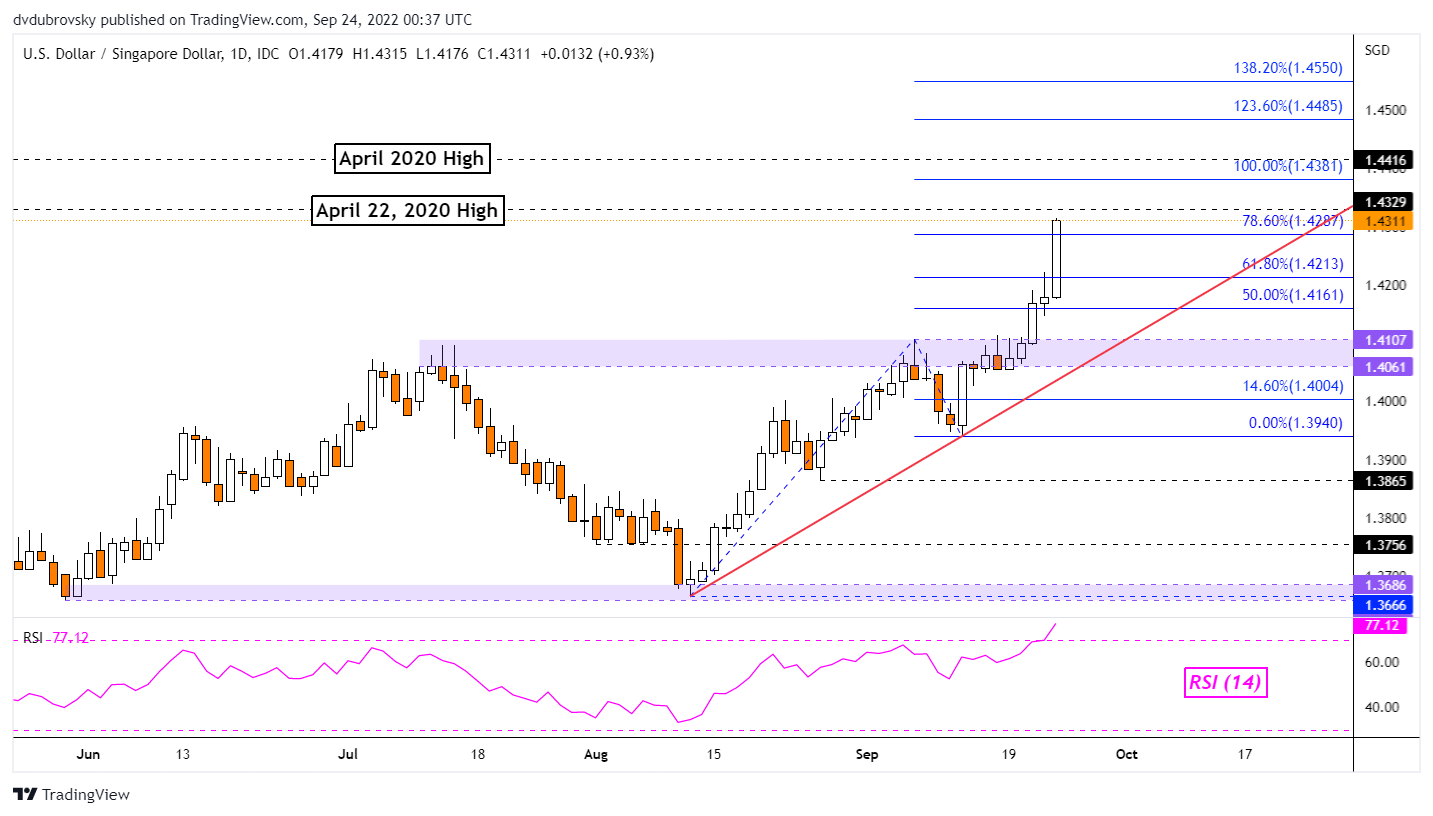

Singapore Dollar Technical Outlook – Bearish

The US Dollar surged higher against the Singapore Dollar last week. USD/SGD climbed 1.81% in the best 5-day performance since March 2020. This has brought the currency pair to within inches of the April 22nd, 2020 high at 1.4329. Confirming a breakout above the former could open the door to extending gains, exposing the April 2020 high at 1.4416. In the event of a turn lower, there is some room to fall before the rising trendline from August kicks in. The latter could reinstate the upside focus.

USD/SGD Daily Chart

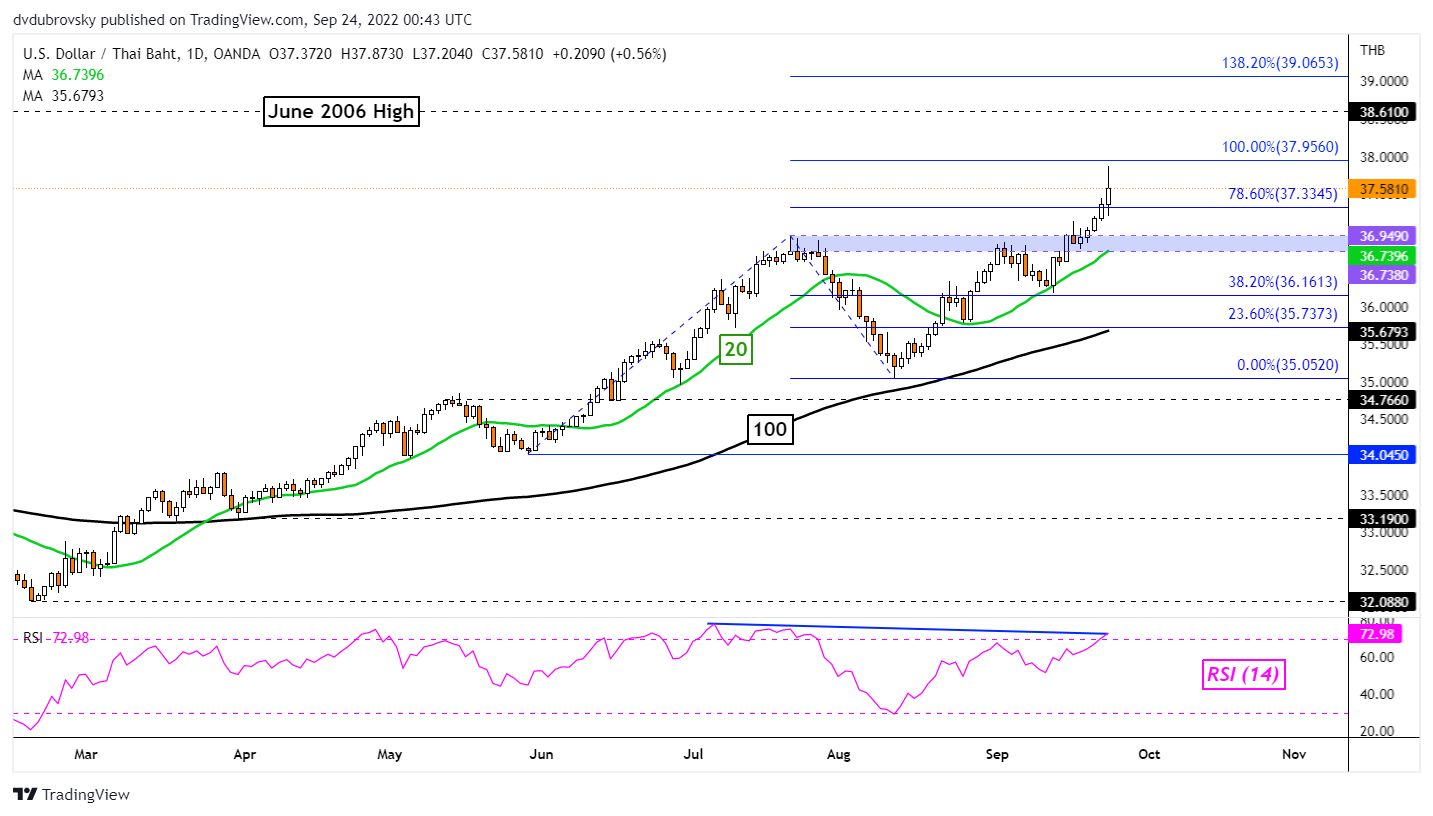

Thai Baht Technical Outlook – Bearish

The US Dollar also soared against the Thai Baht this past week, with USD/THB gaining 2 percent. Prices confirmed a breakout above the 36.738 – 36.949 resistance zone, opening the door to extending gains. Immediate resistance appears to be the 100% Fibonacci extension at 37.956. Beyond this price is the June 2006 peak at 38.61. There is negative RSI divergence, showing that upside momentum is fading since July. In the event of a turn lower, the 20-day SMA could hold as support, maintaining the broader upside focus.

USD/THB Daily Chart

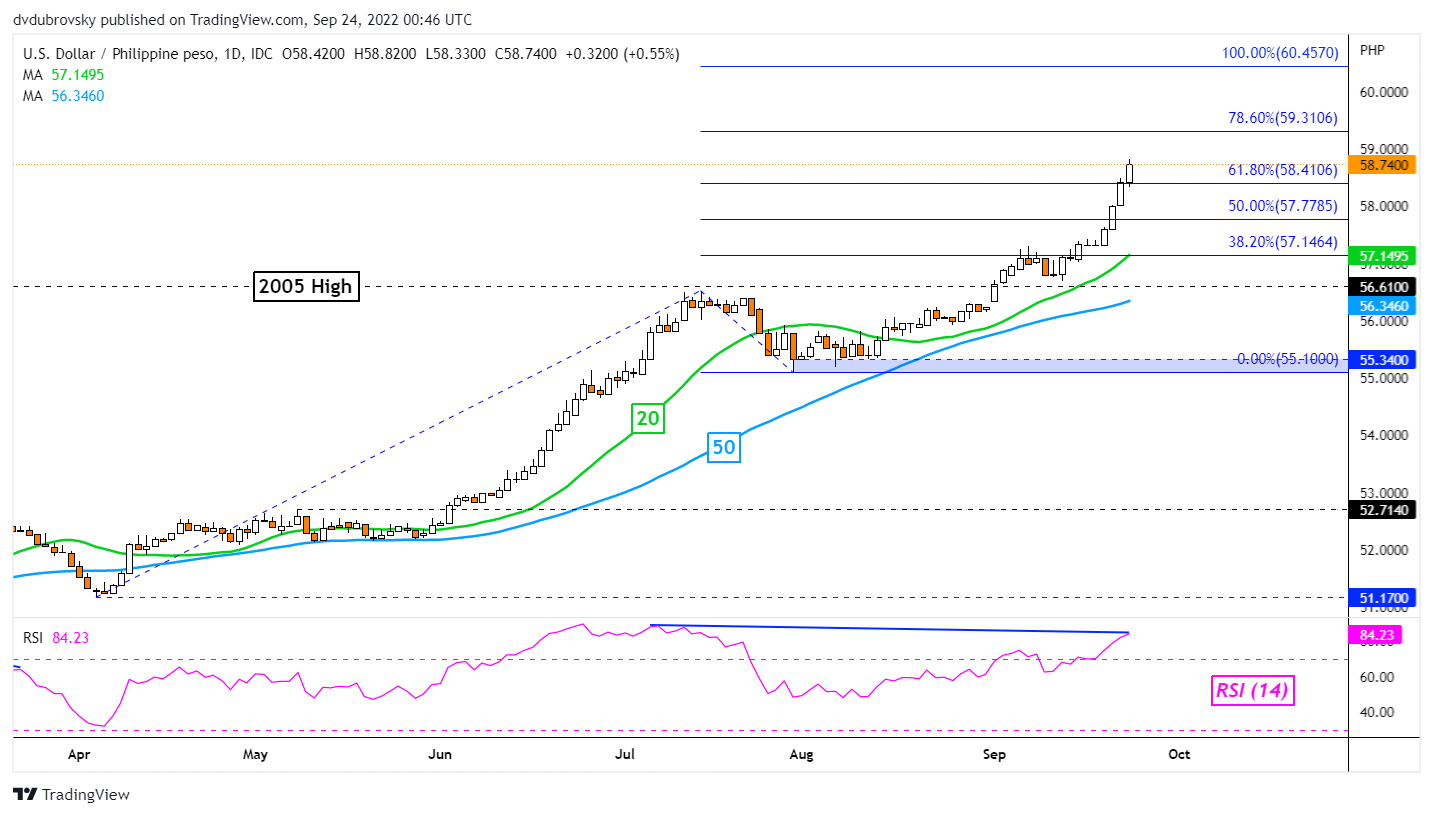

Philippine Peso Technical Outlook – Bearish

It was the same story for the Philippine Peso. USD/PHP soared 2.48% last week, the best performance for the US Dollar since November 2010. As such, prices continued to push above 2005 peaks. Prices broke above the 61.8% Fibonacci extension at 58.4106, exposing the 78.6% level at 59.3106. The latter is immediate resistance. Extending gains beyond that would open the door to facing the 100% level at 60.457. Negative RSI divergence is persisting. A turn lower would place the focus on the 20-day SMA as key support. The latter may reinstate the dominant upside focus.

USD/PHP Daily Chart

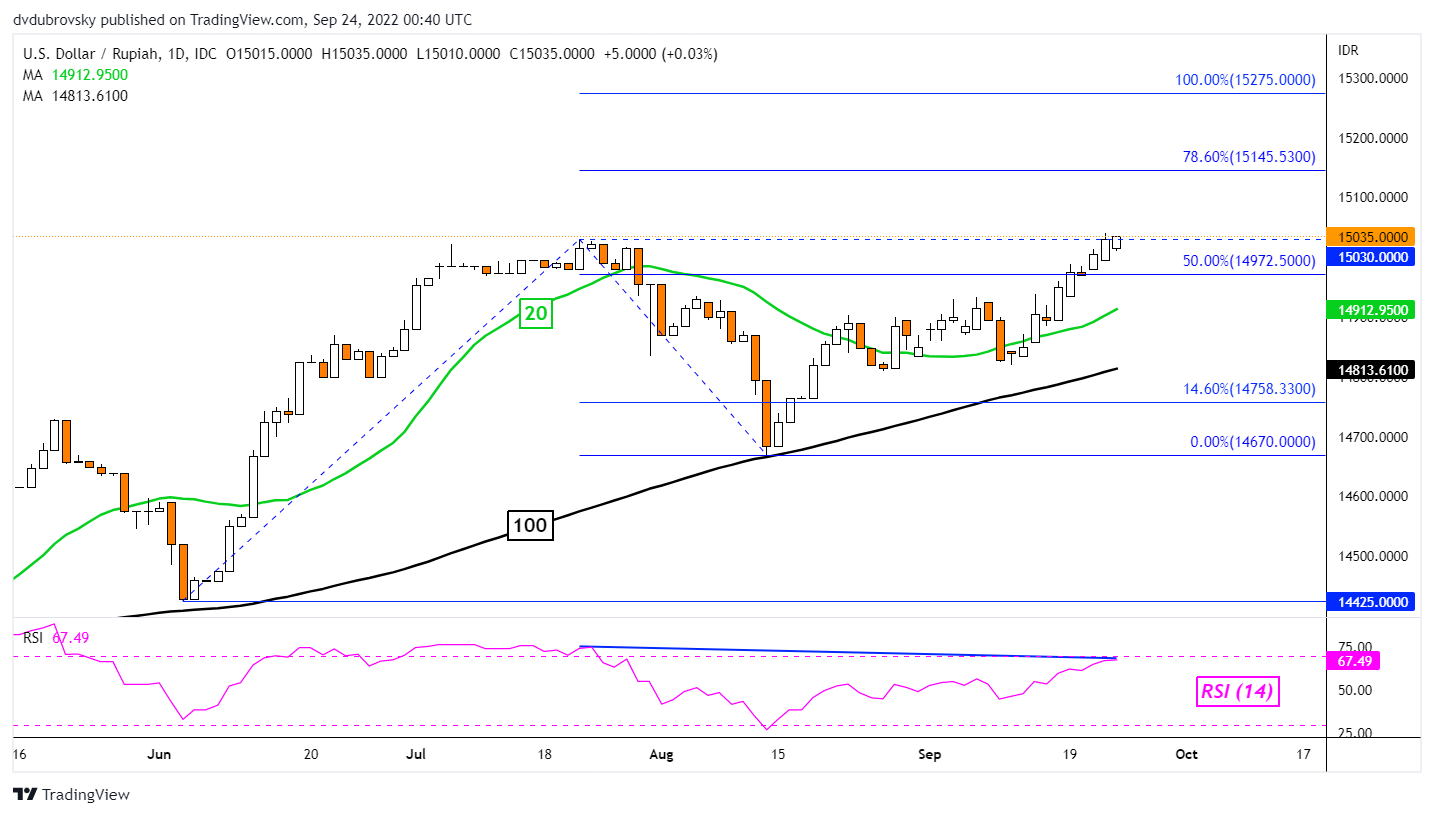

Indonesian Rupiah Technical Outlook – Neutral

The US Dollar performed relatively restrained against the Indonesian Rupiah. Nevertheless, USD/IDR aimed higher, closing above the July peak at 15030. Confirmation of the breakout was lacking at the time of last week’s close. Extending gains place the focus on the 78.6% Fibonacci extension at 15145.53. Negative RSI divergence does warn that a turn lower could be in store. In such a case, the 20-day SMA may hold as support, reinstating the upside focus.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

USD/IDR Daily Chart

--- Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or@ddubrovskyFXon Twitter