Shanghai Composite Index, Chinese Equities, SSEC - Technical Outlook:

- Chinese equities have run into stiff resistance.

- Chance of a pause/minor retreat in the Shanghai Composite Index.

- What are the key levels to watch?

SHANGHAI COMPOSITE INDEX TECHNICAL OUTLOOK - BULLISH

Chinese equities have run into stiff resistance suggesting that the nascent rally could be about to pause.

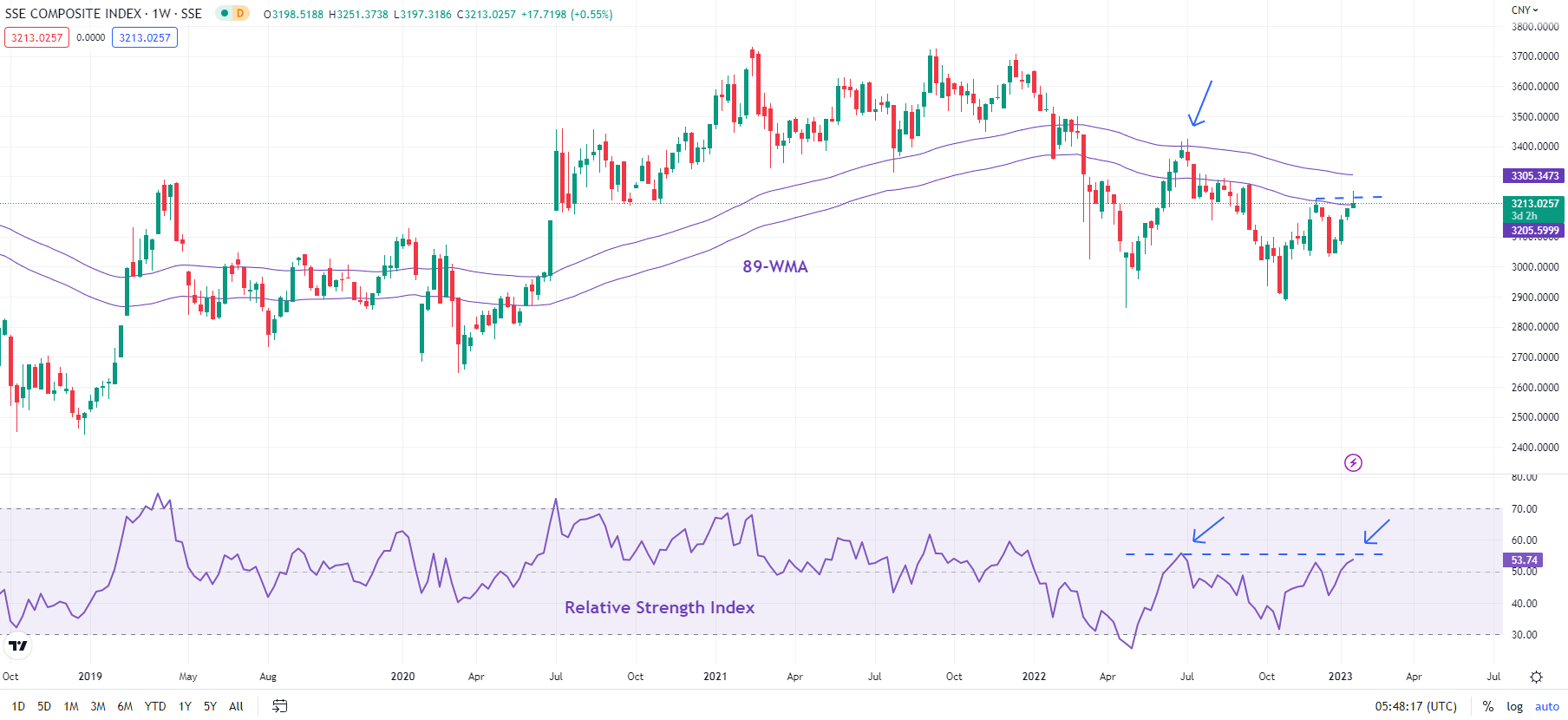

The Shanghai Composite Index has hit a converged resistance area: the December high of 3226, around the 200-day moving average and the 89-week moving average. Despite the 13% gains since October, the 14-week Relative Strength Index has failed to rise above 60 – a rise above this threshold is often a sign of strong upward momentum. Moreover, the index turned lower in the previous rally in July from near the shorter moving average and similar RSI levels (see Weekly chart).

Shanghai Composite Index Weekly Chart

Chart Created Using TradingView

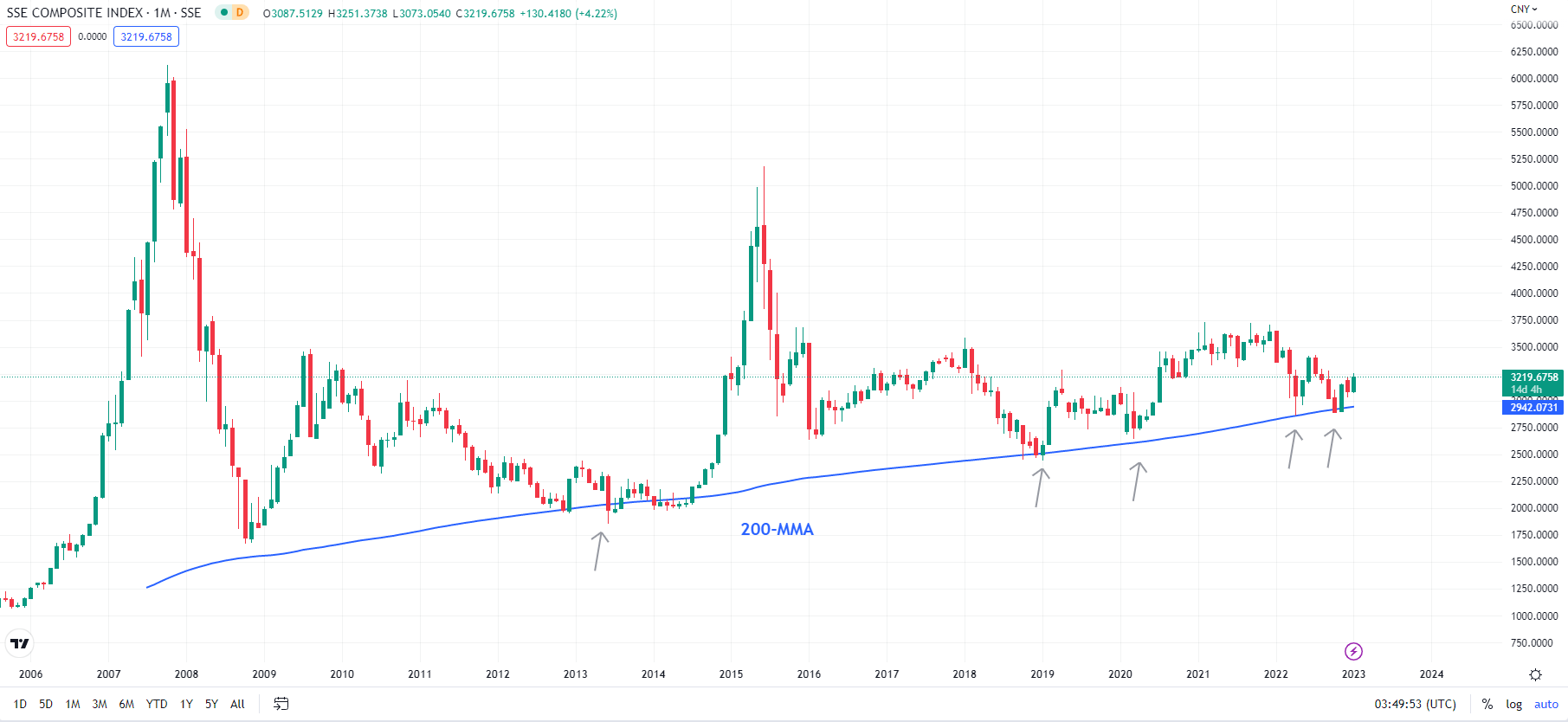

The index needs to clear both the moving averages decisively for the medium-term downward pressure to fade. The hold above crucial support on the 200-month moving average last year is an encouraging sign for bulls. However, the pause in the slide around a cushion is not enough – the index needs to clear significant barriers on the upside for any rebound to last.

Shanghai Composite Index Monthly Chart

Chart Created Using TradingView

Any break above the 3225-3300 could initially open the way toward the July high of 3425. Any break above 3425 would be a bullish signal, triggering a major double bottom (the April 2022 and the October 2022 lows), pointing to a potential rise toward 4000 in subsequent months. On the downside, the nascent rebound is likely to remain intact while the index holds above immediate support at the December low of 3032. Any break there would confirm that the short-term upward pressure had reversed.

Chinese equities were largely unmoved after data released this morning beat expectations, but economic growth slowed significantly last year amid strict COVID curbs and a slowdown in the property market. China’s reopening of its borders earlier this month has raised hopes of a revival in the economy this year. However, the abrupt end of its COVID curbs and the potential risk of spikes in infections mean that the growth trajectory could be bumpy.

--- Written by Manish Jaradi, Strategist for DailyFX.com