Article Summary: Framing price action helps a trader recognize high probability entry and exits. Framing is based on prior price action so while it cannot predict the future it can help build expectations so you know if the current room may be running out of steam or just beginning. There are a handful of ways to frame price action so you only need to decide which method works best for you.

Price can often feel subject to the rules of nature like gravity or inertia. Therefore, when price drops to a certain level, you can often notice a bounce at some point. Framing price charts with channels can help you see when price may react or bounce and when an appropriate entry or exit may appear.

There are many charts and trading strategies with price channels so treat it like a buffet. Choose only what you want and if something doesn’t suit you, leave it be for the next trader. Channels can also accomplish different things like helping you to pinpoint trend continuation entries or range bound reversals.

You’ll be introduced to 3 types of channels in the article. Hand drawn channels are the grade school version of channel trading but can be extremely effective in finding entries and exit. Donchian Channels help traders find breakouts and breakdowns by looking at price extremes over a set number of periods or days. Lastly, we’ll look at an advanced channel based on Median-Line analysis, called Andrews Pitchfork.

Learn Forex: Simple Channels Can Be Very Effective

Chart Created by Tyler Yell, CMT

Hand Drawn Channel

This is the best place to start for newer traders. Hand drawn channels are easy to understand and can be used in ranging or sideways markets with price reacting to support and resistance. Channels can also be used in a rising market like we see on the EURUSD chart above.

Learn Forex: The Line Tool Can Be Used To Draw Channel Tops And Bottoms

Chart Created by Tyler Yell, CMT

The key qualification for a channel is that price should touch at least two times but three or more is best. In a rising channel like we see above on EURUSD, the force is behind the buying pressure as we see with higher highs and higher lows so the high probability trading would have you buying near channel bottoms with stops below entry and outside of channel and selling near channel tops. Shorting at channel tops are not recommended because we’re in an uptrend.

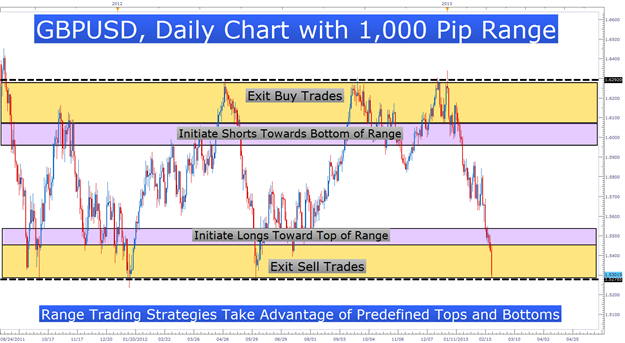

Learn Forex: Range Trading Allows You To Clearly Define Your Risk And Targets

Chart Created by Tyler Yell, CMT

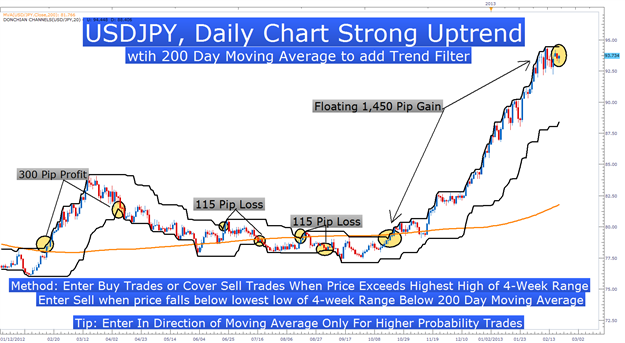

Donchian Channel Breakout Trading

Richard Donchian created a profoundly simple trend following strategy in the 1980s built on the concept of buying strength and selling weakness. Donchian Channels are considered a high probability breakout strategy that finds price exceeding the high or low over a user specified number of hours/days /weeks. This channel strategy works well in rising or falling markets but is best retired during range bound markets.

Learn Forex: This Simple Strategy Helps You Catch Big Moves And Limit Losses

Chart Created by Tyler Yell, CMT

Because few breakouts result in legitimate trends many traders will place a stop exit at the opposing channel. This limits risk and prevents you from holding onto a losing trade too long. Traders who aren’t comfortable with that wide of a stop are encouraged to reduce trade size or you can protect your trade by placing a stop utilizing Average True Range or with a stop in the middle of the channel which would be a 10-day low or high depending on trend direction.

Andrew’s Pitchfork – Median Line

Trading with the pitchfork is powerful once you understand where to find starting points for drawing the pattern. Pitchfork trading was developed by Dr. Alan Andrews based on the concept that price often returns to an average price overtime with swings away from the median line often returning until the trend switches directions. This pattern allows for tight risk and reasonable profit targets.

Learn Forex: Constructing The Pitchfork Is Simple And Built On Market Pivots

Chart Created by Tyler Yell, CMT

The argument that helps traders build strategies around the pitchfork is that 80% of the time in trending markets, prices will gravitate towards the rising or falling median line. The pitchfork’s foundation will be based on 3 swinging pivots in the markets (identified as A,B, &C on the chart). The starting swing (Point A) is the beginning of the median line and swing extreme points B and C around Point A bring you the pitchfork.

There are many helpful tools for finding the starting points A, B, & C but after a while you’ll be able to pin point the market swing starting points with your trader’s eye. You can use the Zig Zag indicator which helps you to determine the most important price changes and turns and draw your pitchfork from those points. Another option is to use daily or weekly fractals that show you price reversals to highlight turning points in the market.

The preferred target when trading the pitchfork is the middle line. However, in strong trending markets or ranging markets, you can target the opposing pitch fork. The stop is often placed outside of the pitchfork by the amount of 0.5 or 1 times Average True Range to allow the market to breathe within the trend.

Closing Thoughts

The key to this or any strategy is to find the one that works best for you. The end goal of whichever channel you use is to frame price action on your preferred time frame so that you can determine appropriate entries and exits. Regardless of the method you use, make sure to limit your risk by placing stops outside of the channel and using appropriate trade size for your account balance.

Happy Trading!

---Written by Tyler Yell, Trading Instructor

Interested In Our Analyst's Best Views On Major Markets? Check Out Our Free Trading Guides Here