Article Summary: Trading in the direction of the trend and buying low while selling high are mutually exclusive. Because we recommend you locate the direction of the trend and find a good entry, DailyFX has a new concept for you to consider. Buy the higher low and sell the lower high. This article will provide you with methods to do just that to prevent you from catching a falling knife.

If you’ve ever heard a trader say that price can’t possibly go any lower, chances are they haven’t been trading for long. That’s not meant to be harsh but simply to say, no trader knows the future. What traders can do is recognize that patterns tend to play out and repeat over and over again which can lead to higher probability entries.

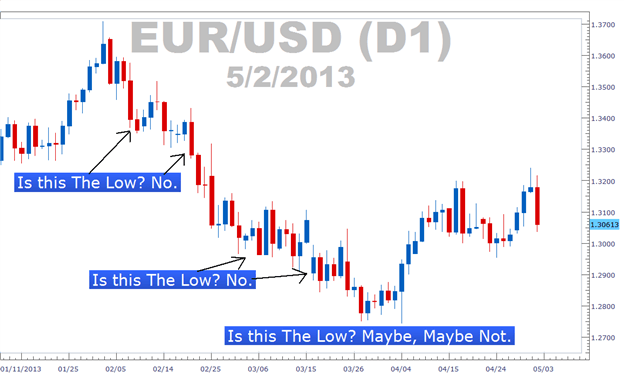

Learn Forex: Buy Low & Sell High Is Cute But Ineffective

Chart Created by Tyler Yell, CMT

One of the principles of every trader who enters an order, whether long or short is that they believe they’ve entered at a good price in relation to where they expect the market to go. One trader will be right and the other will be wrong if they entered at the same price with similar stops and limits. While there is no guarantee which trader will be profitable and which won’t, there are some things we can do to put the odds in our favor.

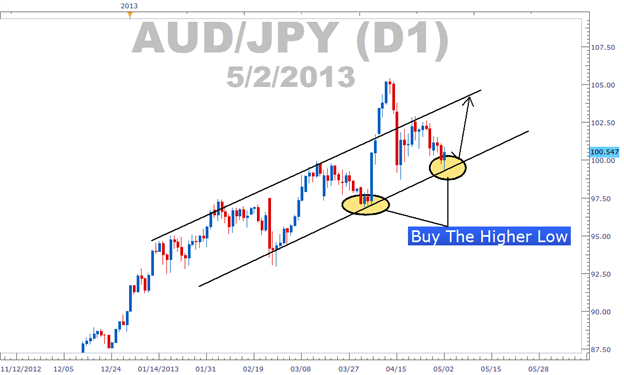

Learn Forex: Buy the Higher Low with Bullish Trend Lines or Rising Channels

Chart Created by Tyler Yell, CMT

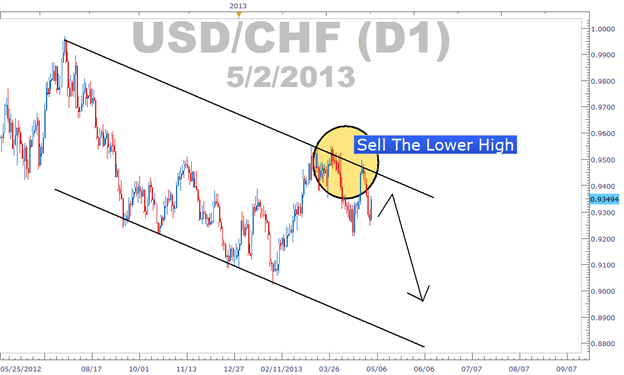

Learn Forex: Sell the Lower High with Bearish Trend Lines or Falling Channels

Chart Created by Tyler Yell, CMT

Methods to Help Prevent Buying a Low Before It Goes Lower

As stated at the beginning of the article, there is no crystal ball or Holy Grail. However,there are methodsthat you can use to stay on the likely right side of the big moves. The three methods we’re going to look at are pivot lines to identify support and resistance, RSI to understand directional strength, and trendlines or directional channels.

The purpose of these three methods is to help you avoid buying something that’s falling. On the other hand, selling something just because it’s rising can become a fool’s game as well. That’s why studying price action can give a big leg over investors or traders who feel price “can’t go any lower”, which has been the rallying cry of many losing trades.

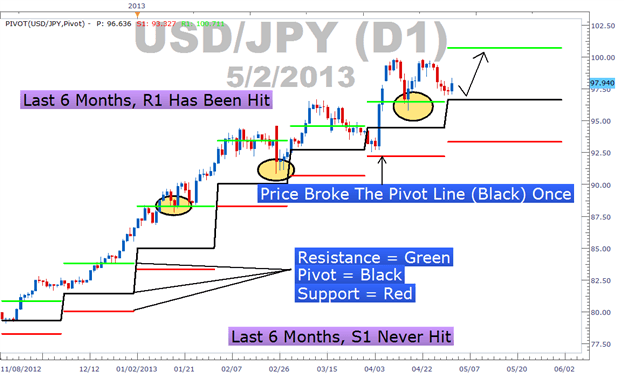

Pivot Lines for Support & Resistance

Pivot Lines are a leading indicator of sort. In short, Pivot Lines are a famous indicator to help you forecast likely future points of resistance and support to limit risk and find profit targets. Rising Pivot levels overtime can help you find a significant higher low to enter a buy trade or lower high to enter a sell trade on.

Learn Forex: Pivots Clearly Paint Dynamic Levels of Rising Support for Entries Zones

Chart Created by Tyler Yell, CMT

Knowing that the Holy Grail doesn’t exist, Pivots are a helpful way to get a feel for the directional bias. Combining pivots lines with candlestick analysis is a preferred method of many traders to find strong entries with the trend. A short cut for new traders looking at price action is to fade long wicks (highlighted above) against the trend as they likely are a rejection of a price test and often end up carrying back price in the direction of the trend.

Relative Strength Index (RSI) for Directional Strength

The Relative Strength Index is the utility knife of many traders. When the RSI crosses an extreme level and is making directional moves higher or lower, traders can look for strong entries that favor the RSI bias. One simple way to find a directional bias on RSI is to add a moving average or trendline to the RSI and find bounces off support or breakouts of the RSI for a high probability entry.

Learn Forex: RSI with Moving Average Added For Directional Bias

Chart Created by Trading Central

Rising or Falling Trendlines or Channels

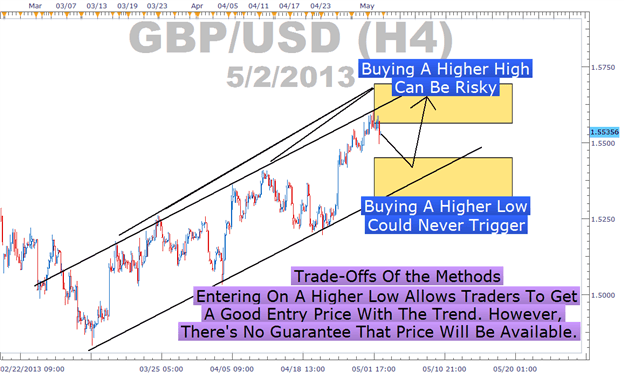

Trendlines and channels are nice and simple. The value of a trendline or channel is increased every time it is tested. When markets are moving higher a trendline is a form of support that can be used to identify buying opportunities. When markets are moving lower, a trendline is a form of resistance that can be used to identify selling opportunities.

The purpose of this article is to help you understand that buying low and selling high is not a given trading system. You may be buying something that’s about to go a lot lower or selling something before it skyrockets. Because price is the ultimate indicator, trendlines or channels can help you pinpoint a higher probability entry as opposed to a cheap entry which could end up costing you a lot if it continues to move against you.

Learn Forex: There Is No Guarantee you’ll get the Lower High You Want

Chart Created by Tyler Yell, CMT

Closing Thoughts

Finding a directional bias through the methods above can help you pinpoint entries. There is nothing wrong with buying a low or selling a high as long as it’s in the direction of the prevailing trend. Trading against the prevailing trend is often more trouble than it’s worth so we recommend identifying the trend and then entering on opportunities with the trend.

Happy Trading!

---Written by Tyler Yell, CMT.

Trading Instructor/ Currency Analyst

Market highs and lows can be difficult to navigate and require a plan such as the one described in the article. To understand what makes traders succeed with their strategies, check out the Top Trading Lessons guide that puts together some of the key lessons our analysts have learned over the years in the markets.