US Dollar and Gold Analysis and Charts

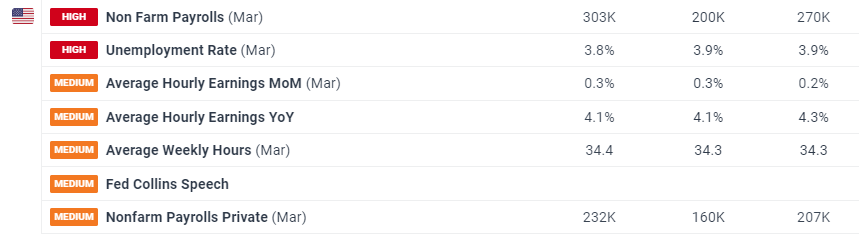

- US NFPs - 303k vs 200k expectations and a revised lower 270k February print.

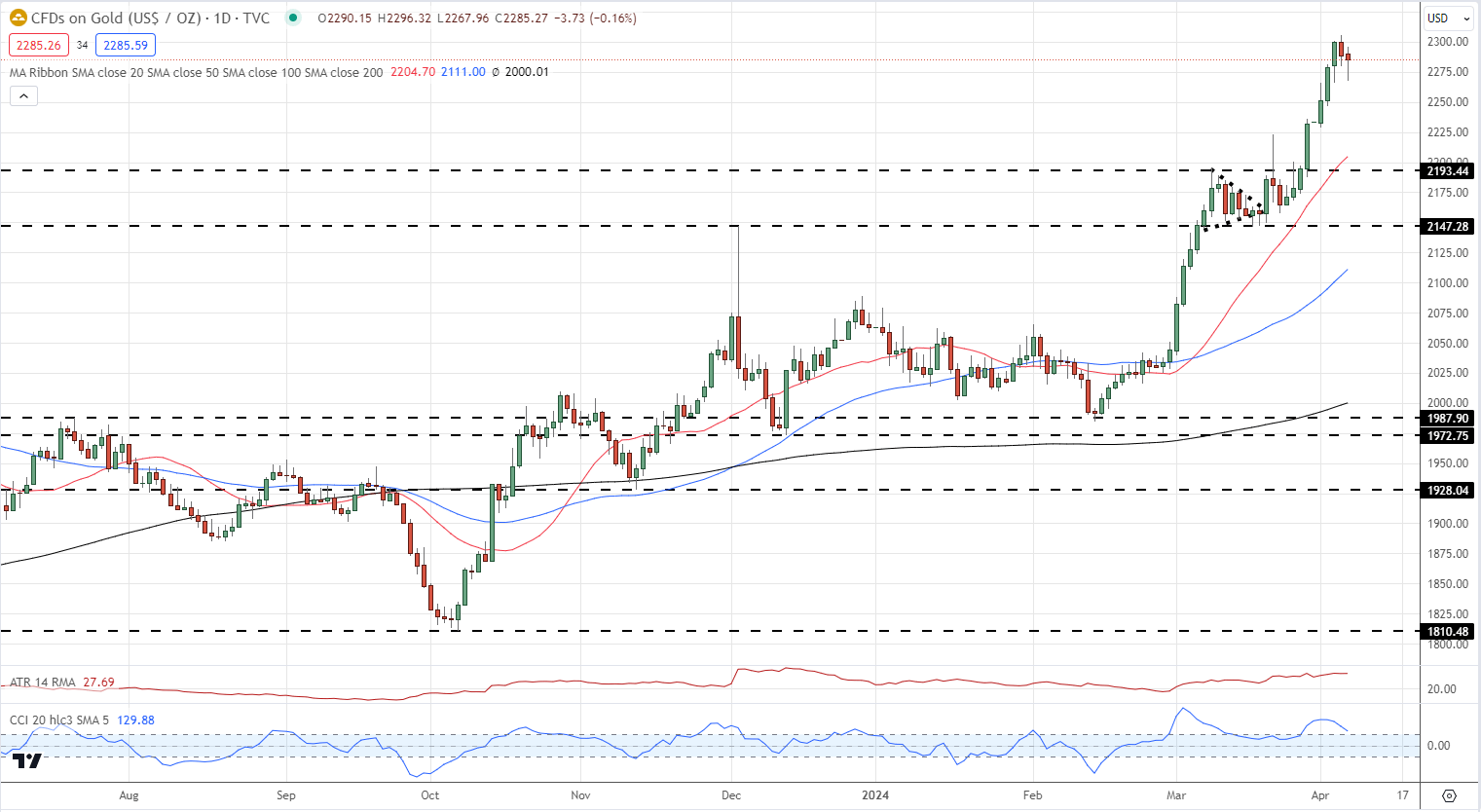

- Gold sheds $10/oz. post-release as the US dollar turns higher.

You can download our brand new Q2 US Dollar Forecast below:

For all major central bank meeting dates, see the DailyFX Central Bank Calendar

The latest Jobs Report (NFPs) shows the US labor market in rude health with 303k new jobs added in March, trouncing forecasts of 200k. The unemployment rate slipped 0.1% lower to 3.8%, while average hourly earnings m/m met forecasts of 0.3%. Nonfarm private payrolls also beat forecasts, 232k compared to 160k.

For all economic data releases and events see the DailyFX Economic Calendar

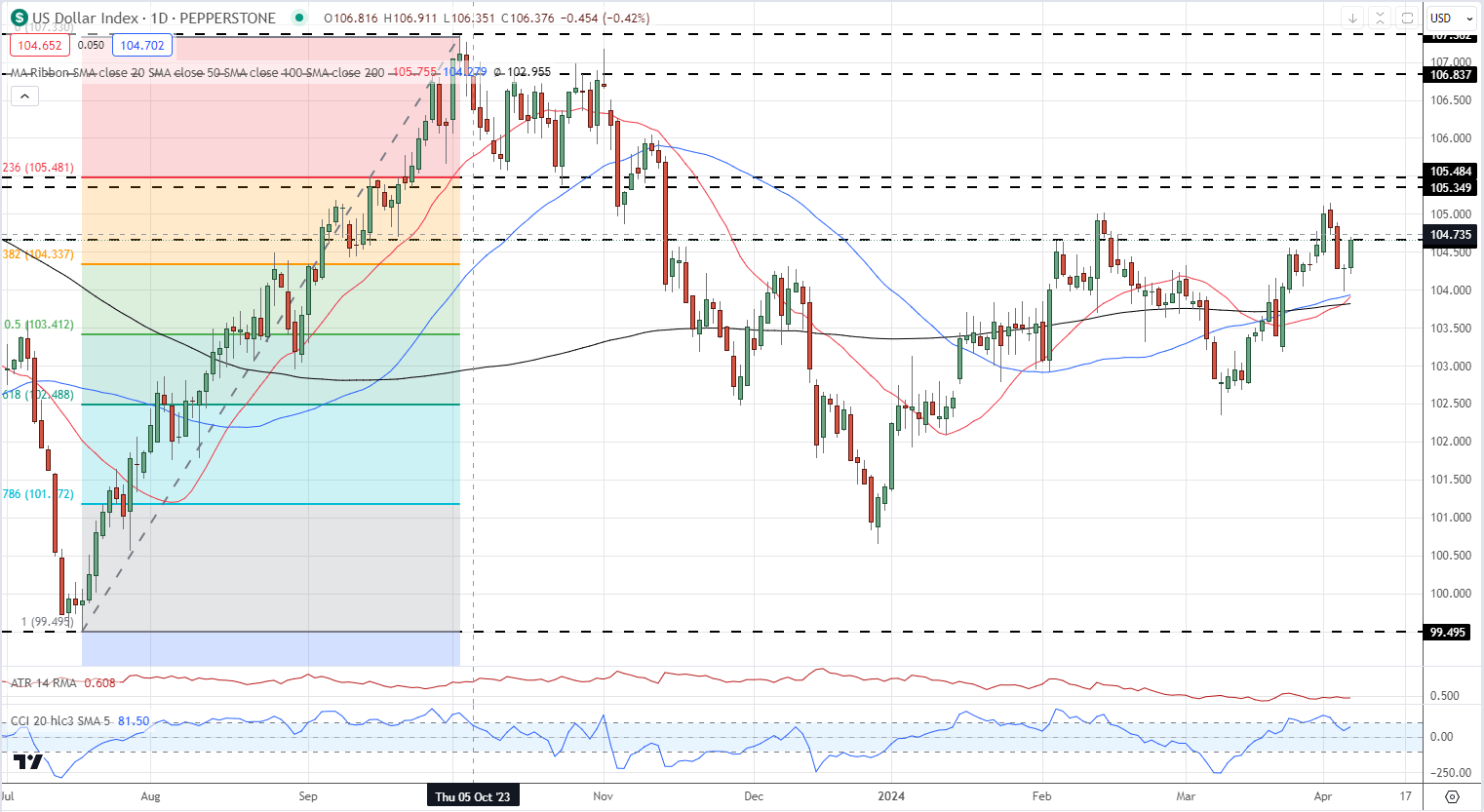

The US dollar index added 30 ticks after the release, continuing Thursday’s late move higher after Federal Reserve member Neel Kashkari openly queried if rate cuts were appropriate this year. Today’s strong labor report will further stoke fears that inflation may become stickier than expected, meaning US rates will be left on hold for longer. Market rate cut probabilities were trimmed slightly after the NFP release with the June meeting now seen as just 56/44 in favour of a 25 basis point cut.

US Dollar Index Daily Chart

Gold’s recent rally stalled post-release with a haven still supporting the precious metal as Israel and Iran continue to warn of further military action.

Gold Daily Price Chart

All Charts via TradingView

Retail trader data shows 43.87% of Gold traders are net-long with the ratio of traders short to long at 1.28 to 1.The number of traders net-long is 1.06% higher than yesterday and 13.69% higher from last week, while the number of traders net-short is 5.61% lower than yesterday and 8.50% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests Gold prices may continue to rise.

| Change in | Longs | Shorts | OI |

| Daily | 0% | 5% | 2% |

| Weekly | -7% | 3% | -3% |

What are your views on the US Dollar – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.