US Dollar, DXY, USD, GBP/USD, Fed, Crude Oil, OPEC+, Gold, - Talking Points

- The US Dollar eased slightly today after solid gains overnight

- APAC equities were mixed while commodities rose on a weaker USD

- A number of Fed speakers appear likely to spruik the hawkish later today

The US Dollar softened through the Asian session today after a solid rally in the aftermath of Federal Reserve speakers spelling out the plan for interest rate rises.

GBP/USD even managed a small uptick despite the rating agency Fitch sounding the alarm bell and downgrading the outlook for the UK to negative.

Earlier this week, the market had built up hopes for an end to the aggressive tightening stance of the Fed. They have been kiboshed by several Fed speakers, most notably San Francisco Fed President Mary Daly.

She has been busy over the last few days making sure that the market is ready for another large hike at the next Federal Open Market Committee (FOMC) meeting in early November.

So far this week, she has referred to inflation as ‘corrosive’, ‘toxic’ and ‘problematic’ and that the pain that she is hearing from people is on the inflation side, not on the jobs front.

The market is pricing in a 75 basis point hike and the 1-year Treasury yield is again approaching 4.20%.

The OPEC+ cut to oil production by 2 million barrels per day has been digested by the market with the WTI futures contract near US$ 89 bbl while the Brent contract is around US$ 93.50 bbl at the time of going to print.

Gold nudged slightly higher, trading above US$ 1,720 an ounce. APAC equites were mixed after Wall Street closed slightly lower. Japan was up, Hong Kong was down and Australia was flat while China is still on holiday.

Futures are pointing toward a positive day for European and US stock indices. The ECB meeting minutes from their September gathering will released later and the US will see some jobs data. There are a number of Fed speakers crossing the wires today as well.

The full economic calendar can be viewed here.

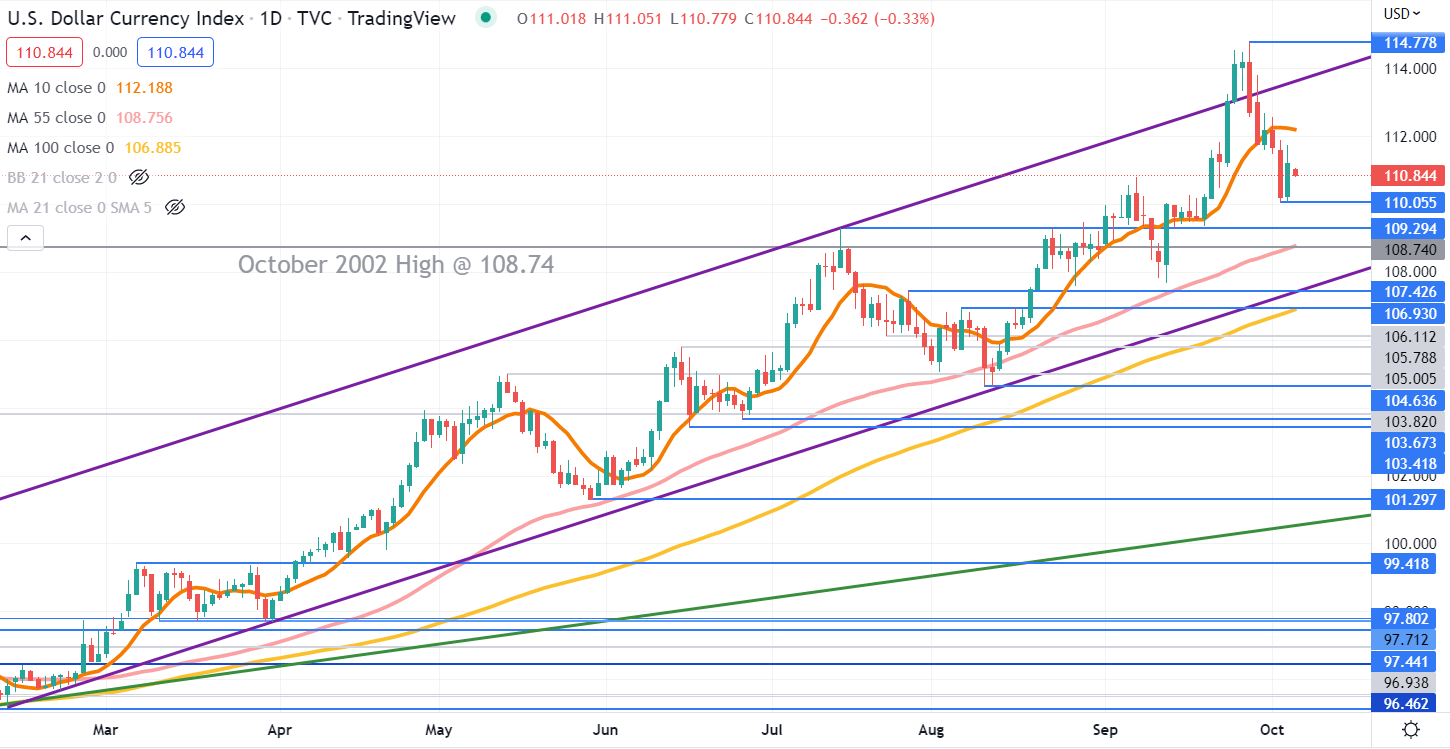

USD (DXY) INDEX TECHNICAL ANALYSIS

The US Dollar remains in an ascending trend channel despite the recent pullback.

While it is below the 10-day simple moving average (SMA) it remains above the 55- and 100-day SMAs which may suggest the underlying bullish momentum may evolve further while short term momentum might be stalling.

Support could be at the recent low of 110.05 or the break point of 109.30. On the topside, resistance be at the previous peak of 114.78 or at the 10-day SMA, currently dissecting at 112.19.

--- Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter