US Dollar, DXY, CPI Preview – Market Update:

- US Dollar on course for another weekly pullback so far

- All eyes on CPI data Thursday, will core inflation slow?

- DXY shows early signs of a brewing broader reversal

The US Dollar (DXY Dollar Index) is heading for a loss this week so far ahead of the highly-anticipated Consumer Price Index (CPI) report. If losses are sustained, the -0.3% drop could be the worst 5-day performance since the middle of July. Meanwhile, things are looking increasingly bearish on the daily chart. Let us take a look at how the currency is shaping up ahead of the inflation report.

On Thursday, US headline inflation is seen weakening to 3.6% y/y in September from 3.7% y/y in August. This is known as disinflation. Disinflation is a period where prices are still rising but at a slower pace compared to prior. This should not be confused with deflation (falling prices). Core CPI, which excludes volatile food and energy costs (underlying inflation), is seen dropping to 4.1% y/y from 4.3% prior.

The Federal Reserve is probably more interested in the latter. It should be noted that from my fourth-quarter outlook, the lag effect of slowing rental property prices will likely continue making its way into core CPI. As such, this might continue pressuring core inflation lower in the coming months, which is what I am expecting from this report on Thursday.

Such an outcome would likely support recent cautious commentary coming from the Federal Reserve, which has been adding slight downward pressure to Treasury yields. In turn, that has been pushing the US Dollar lower, particularly as stock markets rise again. This results in less demand for safety, which works against the haven-linked currency.

US Dollar Technical Analysis

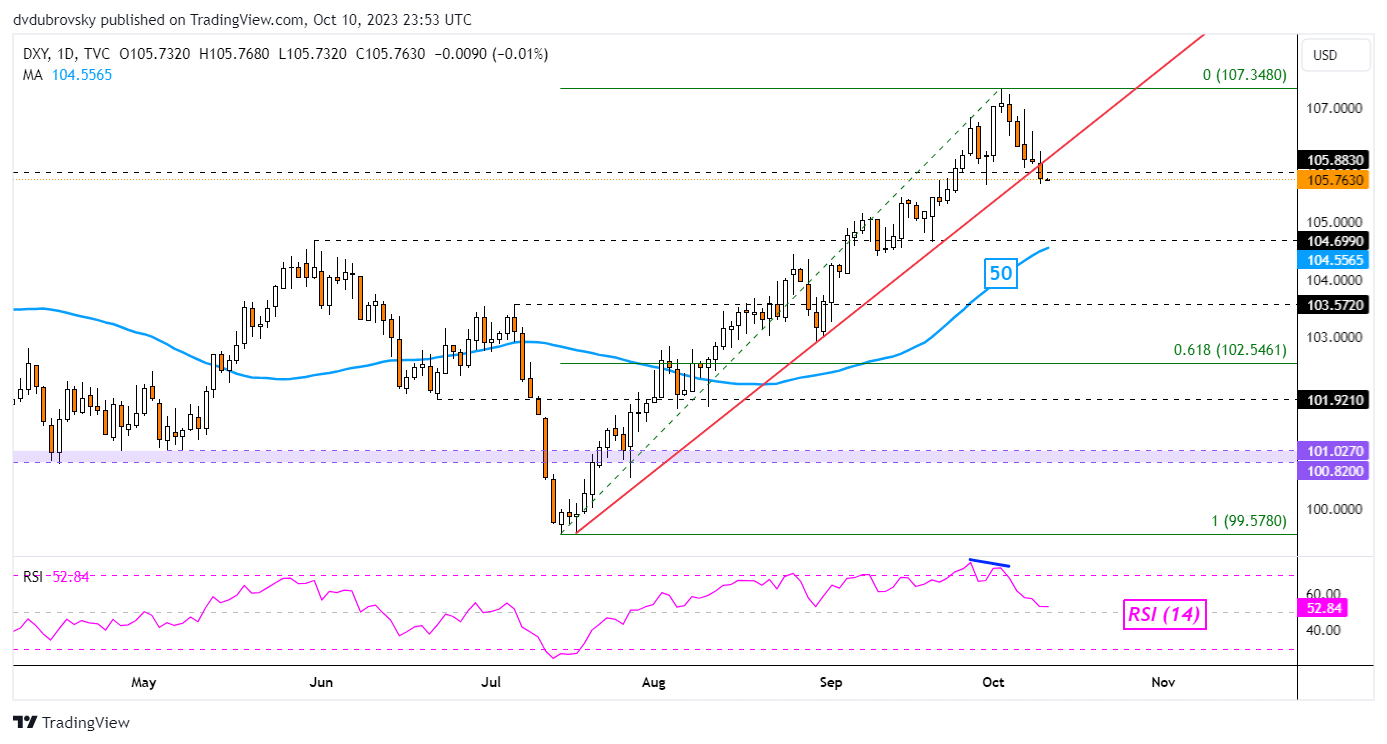

Taking a look at the DXY daily chart below, we can see that the currency broke under a key rising trendline from July. While confirmation is lacking, this could be an early indication of an impending reversal. This also follows negative RSI divergence, showing that upside momentum was fading leading into the turn lower. From here, key support is the 104.69 inflection point below.

DXY Daily Chart

Chart Created in TradingView

--- Written by Daniel Dubrovsky, Contributing Senior Strategist for DailyFX.com