Dollar, NZD/USD, RBNZ Rate Decision – Asia Pacific Market Open

- S&P 500 gains as US Dollar weakens after soft economic data

- All eyes are on the New Zealand Dollar and RBNZ rate decision

- Asia-Pacific stock markets may follow Wall Street’s upbeat day

Asia-Pacific Market Briefing – Soft Data Highlights Slowing Inflation

Sentiment noticeably improved on Tuesday in Wall Street. The S&P 500, Dow Jones and Nasdaq 100 rallied about 1.2%, 1.1% and 1.3%, respectively. For the S&P 500, this meant the best day in just under two weeks. Because of the risk-on tone, the haven-linked US Dollar was punished as it sank against its major peers. The sentiment-linked New Zealand and Australian Dollars performed well.

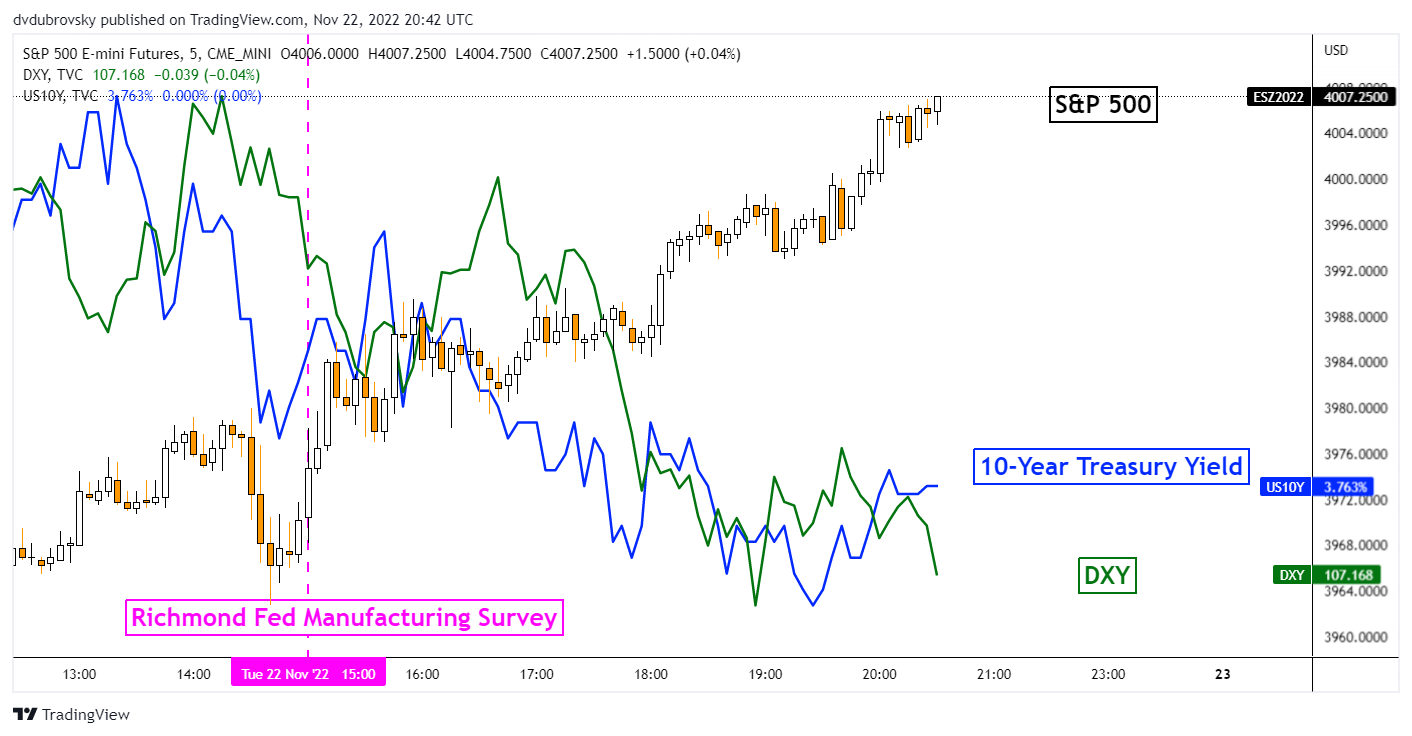

Looking at the chart below, we can see that risk appetite was inspired quite greatly around the time of the Richmond Fed Manufacturing Index data release. The figure surprised at -9 versus -8 expected, trimming from -10 in October. Looking at the details of the data, the prices paid and wages segments eased, further underscoring the slowing inflation story.

Treasury yields weakened across the curve, likely a sign of traders easing hawkish Federal Reserve interest rate hike expectations for next year. Somewhat surprisingly, despite the decline in the Greenback and bond yields, anti-fiat gold prices fell in the aftermath of the data. It seems traders focused more on picking up equities as Fed officials continue to underscore the slowing rate hike narrative.

S&P 500, US Dollar, Treasury Yields on Tuesday

Wednesday’s Asia Pacific Trading Session – Eyes on RBNZ, Positive Sentiment

All eyes will be on the New Zealand Dollar during Wednesday’s Asia-Pacific trading session. That is because the Reserve Bank of New Zealand’s monetary policy announcement will cross the wires. A jumbo 75-basis point rate hike to 4.25% from 3.50% is widely expected. This follows higher-than-anticipated local inflation and still-tight labor market conditions.

The central bank will also release new economic forecasts. If the central bank signals it will continue to tighten aggressively, especially amid slowing hikes elsewhere, NZD/USD could rally up a storm. Speaking of that, Wall Street’s rosy tone may open the door for a continuation in risk appetite. That may bode well for indices such as the Nikkei 225 and ASX 200.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

S&P 500 Technical Analysis

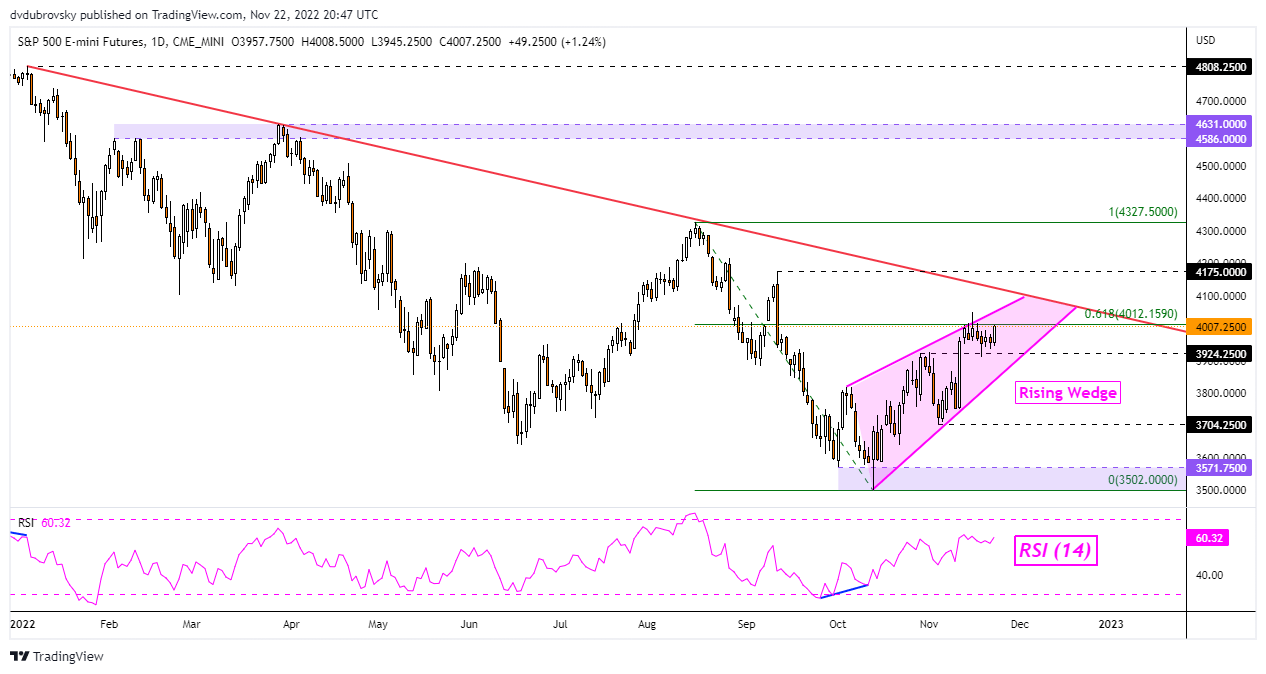

The S&P 500’s rally brought the index back to testing the 61.8% Fibonacci retracement level at 4012. Back in early November, the index attempted to breach this key point without luck, leaving behind upper wicks. As such, further upside confirmation is likely needed to argue that the uptrend since October may resume. Prices are still trading within a Rising Wedge chart formation, which can have bearish implications down the road.

S&P 500 Futures Daily Chart

--- Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

To contact Daniel, follow him on Twitter:@ddubrovskyFX