NZD/USD, AUD/NZD, EUR/NZD - Outlook:

- NZD/USD is holding above channel support, but there is no sign of reversal of the downtrend.

- AUD/NZD remains well within its recently established range; EUR/NZD’s downside could be limited.

- What is the outlook for NZD/USD, EUR/NZD, and AUD/NZD?

NZD/USD: Holding the above channel support

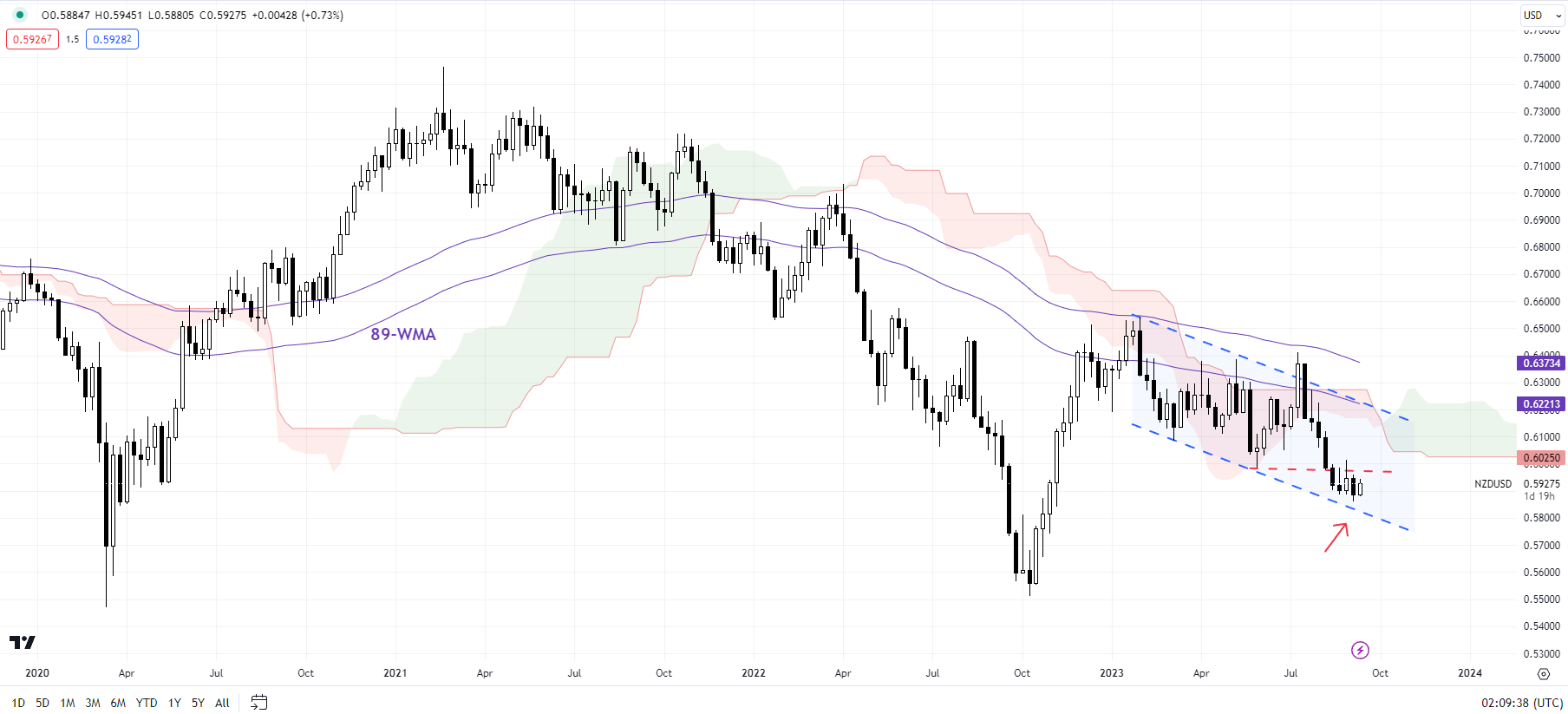

NZD/USD’s fall in August below key support at the August low of 0.5985 keeps the medium-term term bias down even as it tries to hold above the lower edge of a downtrend channel since early 2023. This follows a failed attempt in July to clear past stiff resistance at the April high of 0.6375, coinciding with the 89-week moving average.

NZD/USD Weekly Chart

Chart Created Using TradingView

Unless NZD/USD rises above the early September high of 0.6015, the broader bias remains bearish. A break above 0.6015 could initially open the way toward 0.6100 initially. For the 2023 downtrend to reverse the pair, at minimum, would need to regain the July high of 0.6410. Only a crack above the February high of 0.6540 would trigger a reversal of the multi-week downtrend.

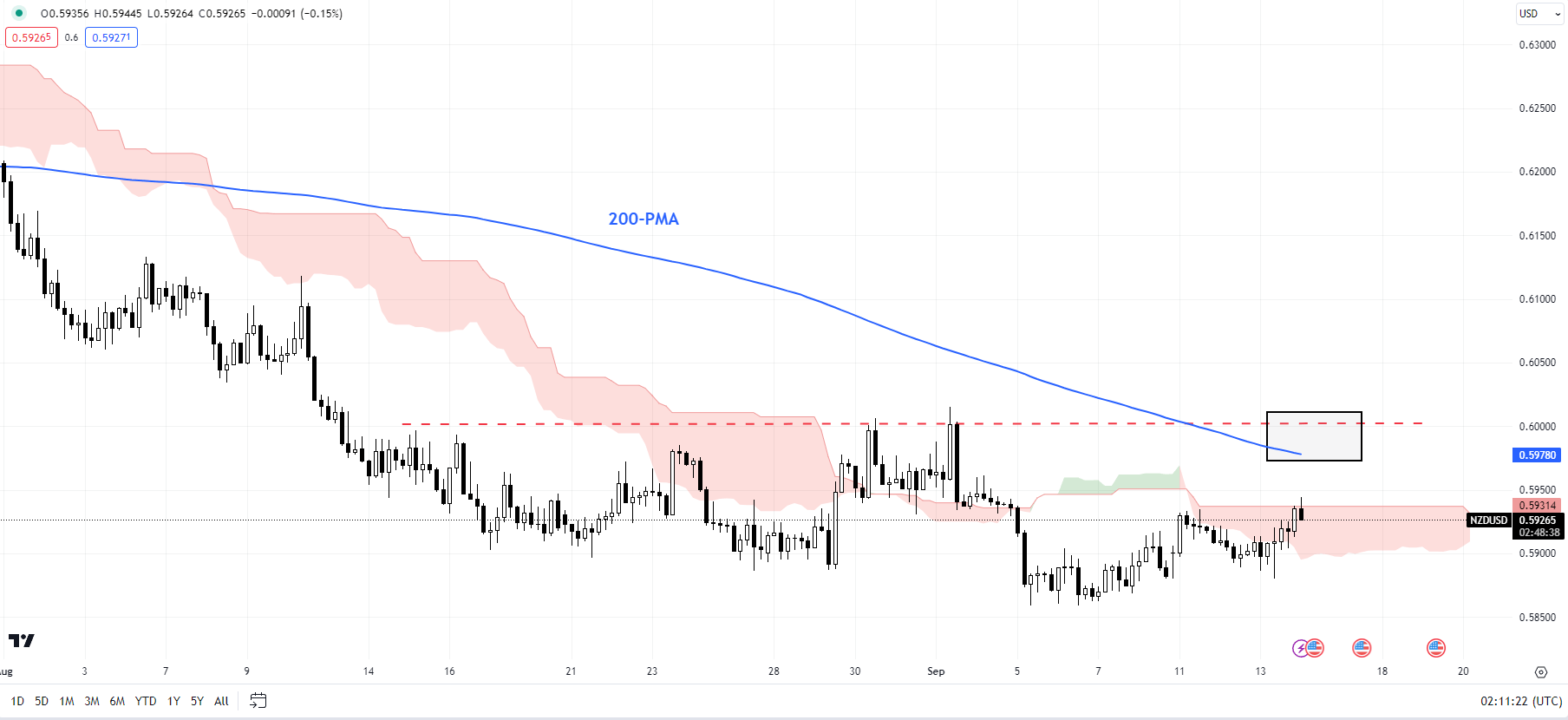

NZD/USD 240-Minute Chart

Chart Created Using TradingView

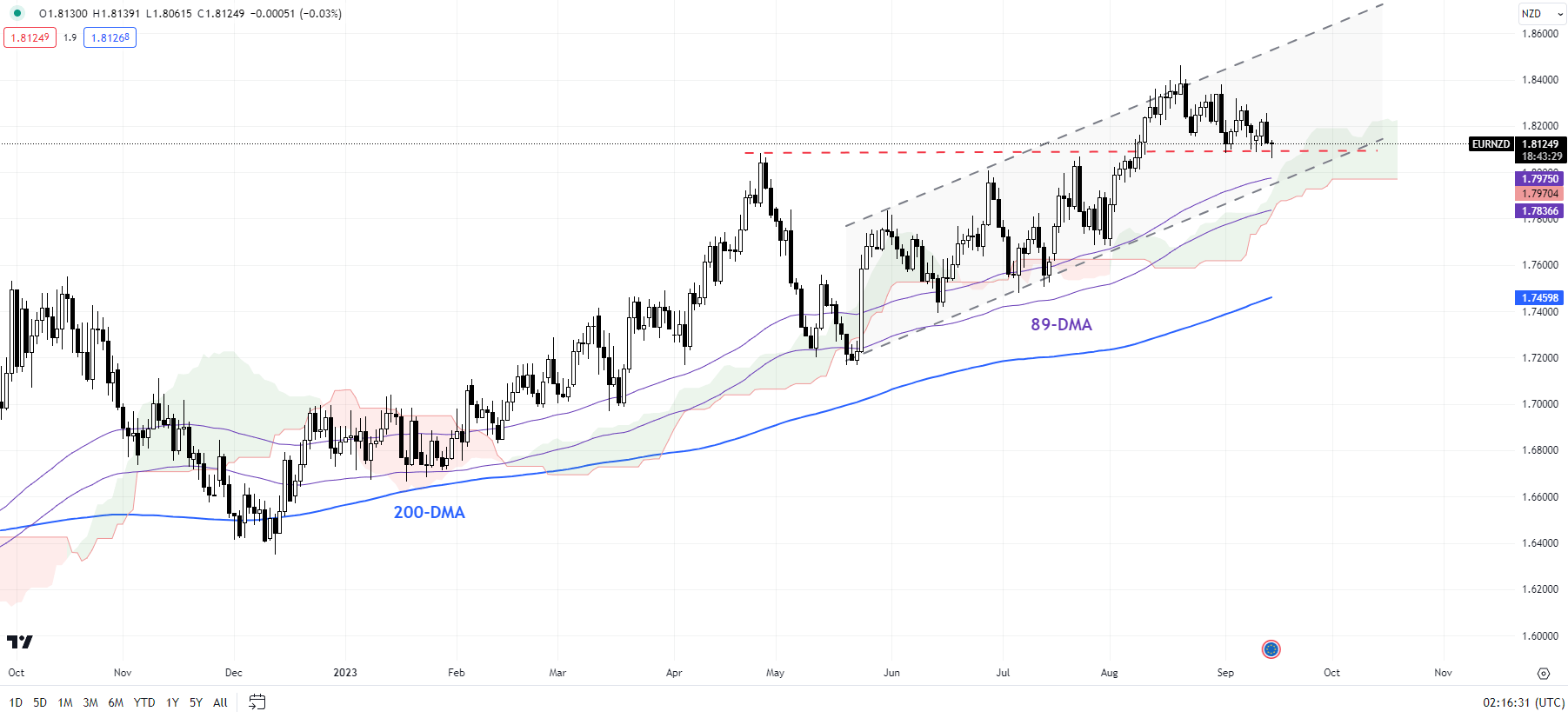

EUR/NZD: Further downside could be limited

EUR/NZD has pulled back from stiff resistance at the top edge of a rising channel since May. The retreat by itself isn’t enough to suggest the broader bullish trajectory is reversing. Indeed, the higher-highs-higher-lows sequence in recent months reinforces the uptrend.

EUR/NZD Daily Chart

Chart Created Using TradingView

Immediate support is at the April high of 1.8080. Stronger support isn’t too far from 1.7825, coming in on the 89-day moving average, coinciding with the lower edge of the Ichimoku cloud on the daily charts. The last time the cross was below the converged support was in 2022, suggesting that further downside in the cross could be limited.

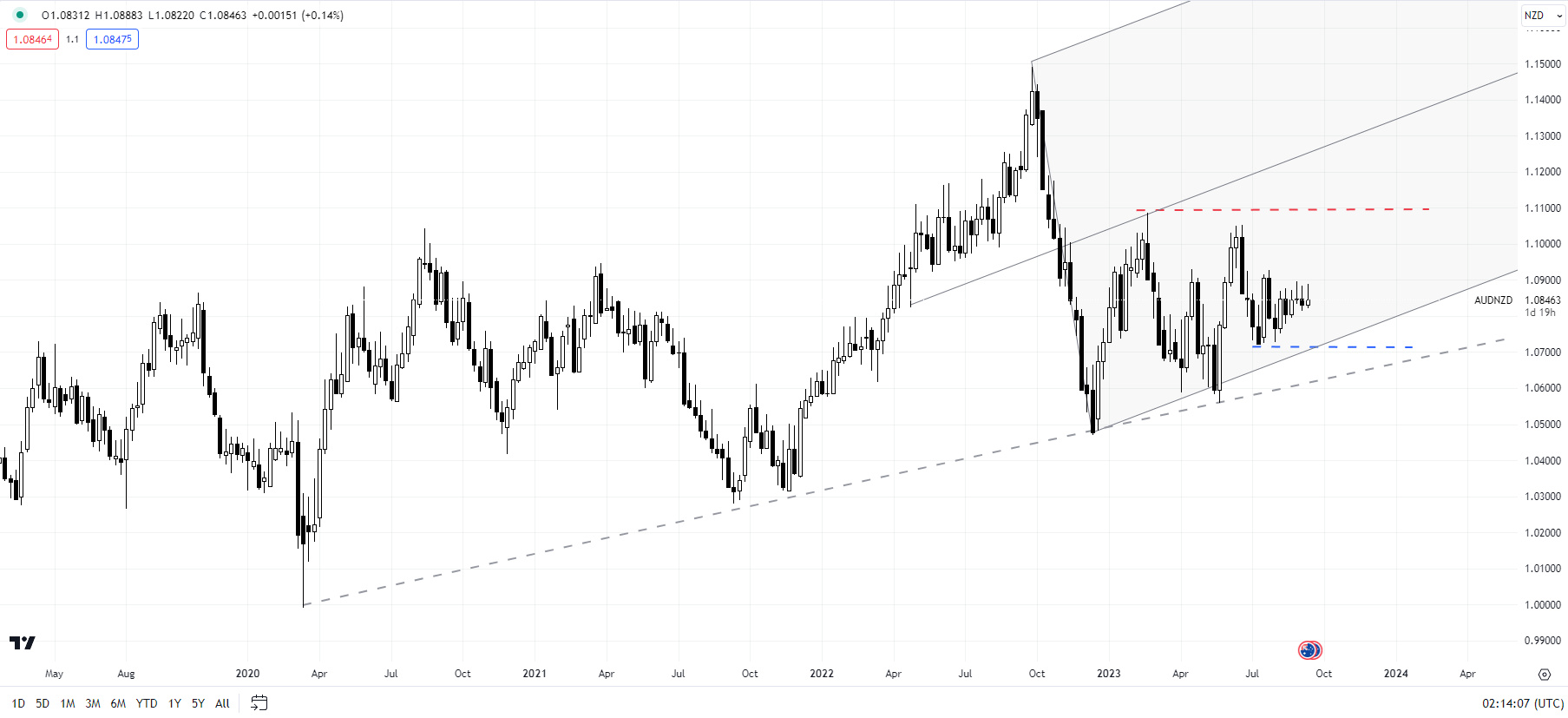

AUD/NZD Weekly Chart

Chart Created Using TradingView

AUD/NZD: Boxed in a range

Not much of a change in AUD/NZD in recent weeks, with the cross continuing to trade sideways, but well within the lower edge of a rising pitchfork channel from last year. The broader range established is 1.05-1.11, but most recently the range has narrowed to 1.07-1.09. A break above 1.11 or a break below 1.05 is needed for AUD/NZD to start trending.

--- Written by Manish Jaradi, Strategist for DailyFX.com

--- Contact and follow Jaradi on Twitter: @JaradiManish