Nasdaq 100 – Talking Points

- Nasdaq 100 eases from premarket highs following robust rally

- Netflix results come into focus as tech earnings kick off

- Short squeeze or actionable rally? Only time will tell

Stocks have given back a large portion of overnight gains as market volatility continues to remain elevated. Nasdaq 100 futures rallied roughly 9% off of last Thursday’s intraday low, culminating in a premarket peak today of 11431.75. Markets continue to oscillate as we head into the corporate earnings season. Bank earnings have largely been impressive, which sets the table for tech earnings over the coming weeks. High multiple tech stocks have been slaughtered this year as interest rates have soared, but there may be some respite should earnings paint a rosy picture.

Market participants will likely be looking ahead to Netflix earnings which are slated for after the closing bell. Subscriber growth will be under the market microscope like it always is, while commentary on the subscription that includes ads will also be top of mind. Tech companies have started to cut back following an impressive 2-year run during the Covid-19 pandemic, with many slashing headcount and cutting capex as recession fears grow. Weakness in results and/or guidance could take the Nasdaq 100 lower over coming sessions, undoing this robust rally of the lows.

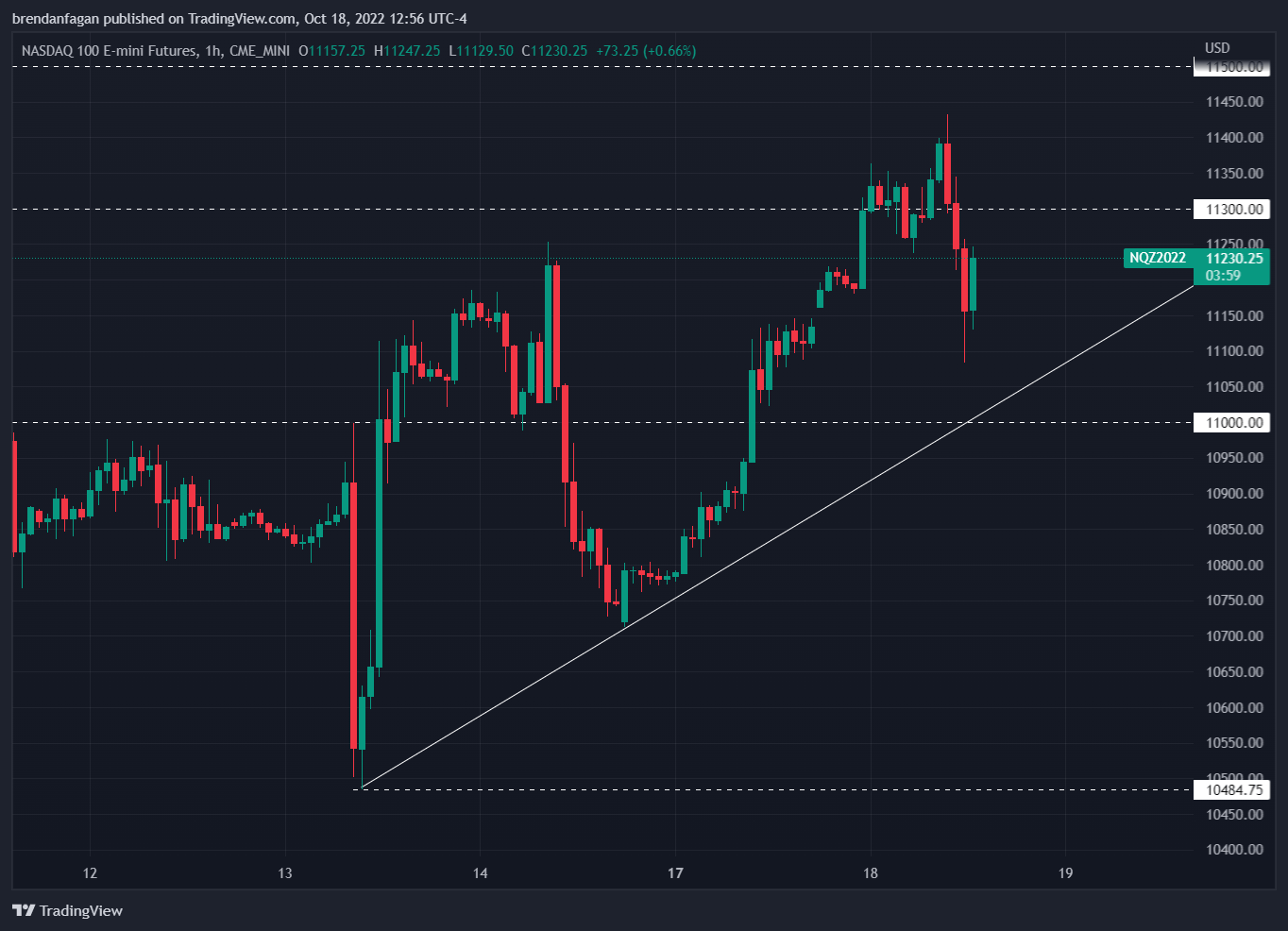

Nasdaq 100 Futures 1 Hour Chart

Chart created with TradingView

Following a sharp rally out of the 10484 area on Thursday, NQ staged yet another strong rally during the overnight session. Price briefly traded through 11400 before cooling after the opening bell in New York. The overnight advance cooled sharply, as sellers took price below 11100. Since those session lows were minted, price has rallied more than 1% into the 11200 zone ahead of key earnings after the bell.

NQ appears to be benefitting from a lighter-than-usual US economic calendar, with few data points on offer to “spook” equities. It remains to be seen whether this rally has any legs, or if it is just short covering and hedges coming off the books following last week’s CPI print. If ascending trendline support continues to hold, NQ may look to make an advance into the 11700 area that marks the monthly high. Should FAANG earnings disappoint, it may just be a matter of sessions before fresh YTD lows print. On any strong move to the downside, pre-Covid highs around 9763 may come into view.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

RESOURCES FOR FOREX TRADERS

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

--- Written by Brendan Fagan

To contact Brendan, use the comments section below or @BrendanFaganFX on Twitter