Japanese Yen (USD/JPY) Analysis

- Markets look-ahead to April for possible rate hike despite economic contraction

- CoT report shows sharp rise in yen shorts despite FX intervention warnings

- USD/JPY tentatively hovers around the 150 mark

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

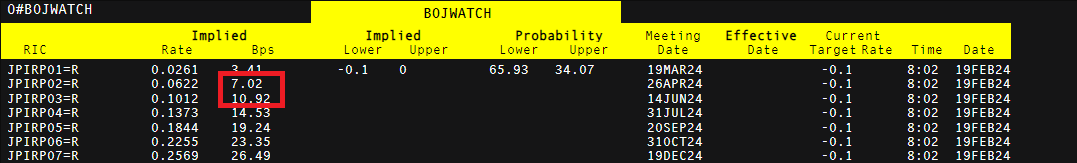

Markets Still Eye April for Potential Rate Hike

Markets have not been deterred by the fact that Japan has entered into a recession, still indicating a high probability that the Bank of Japan will vote to hike interest rates by 0.1% to exit its long-standing negative interest rate policy.

Source: Refinitiv

The Bank’s preconditions for the historic hike involve a “virtuous relationship” between wages and prices. Inflation remains above the 2% target for well over a year now but has dropped in the last two prints, questioning whether price pressures will be able to remain above the 2% target in a sustainable manner.

Wage negotiations are currently underway, with the process supposedly coming to an end in mid-March. This forms the basis of why markets are looking ahead to the April meeting for that all important hike.

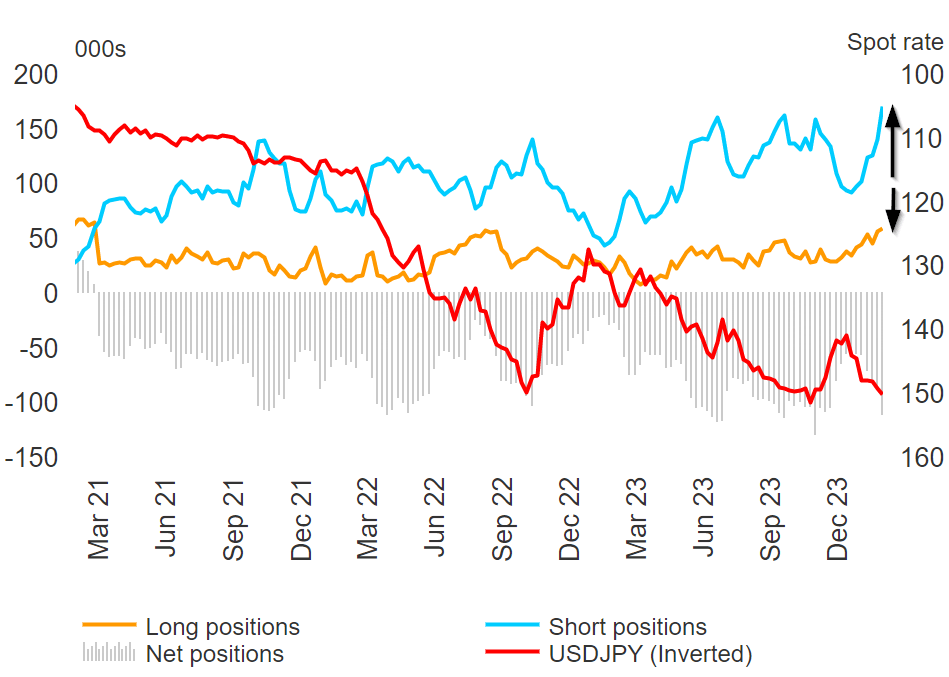

CoT Report Shows Sharp Rise in Yen Shorts Despite FX Intervention Warning

The latest CoT data reveals an accumulation of yen short positions which goes against the warnings communicated last week by Japan’s top currency official Kanda and the Deputy Governor of the Bank of Japan, Shun’ichi Suzuki. Both officials expressed their displeasure in sharp volatile FX moves (yen depreciation) with Mr Kanda going as far as to even mention FX intervention as a possible solution.

Positioning via Commitment of Traders Report (includes data up to 13 Feb)

Source: TradingView, prepared by Richard Snow

See how client sentiment can inform trend trading strategies. Download your guide to the contrarian indicator below:

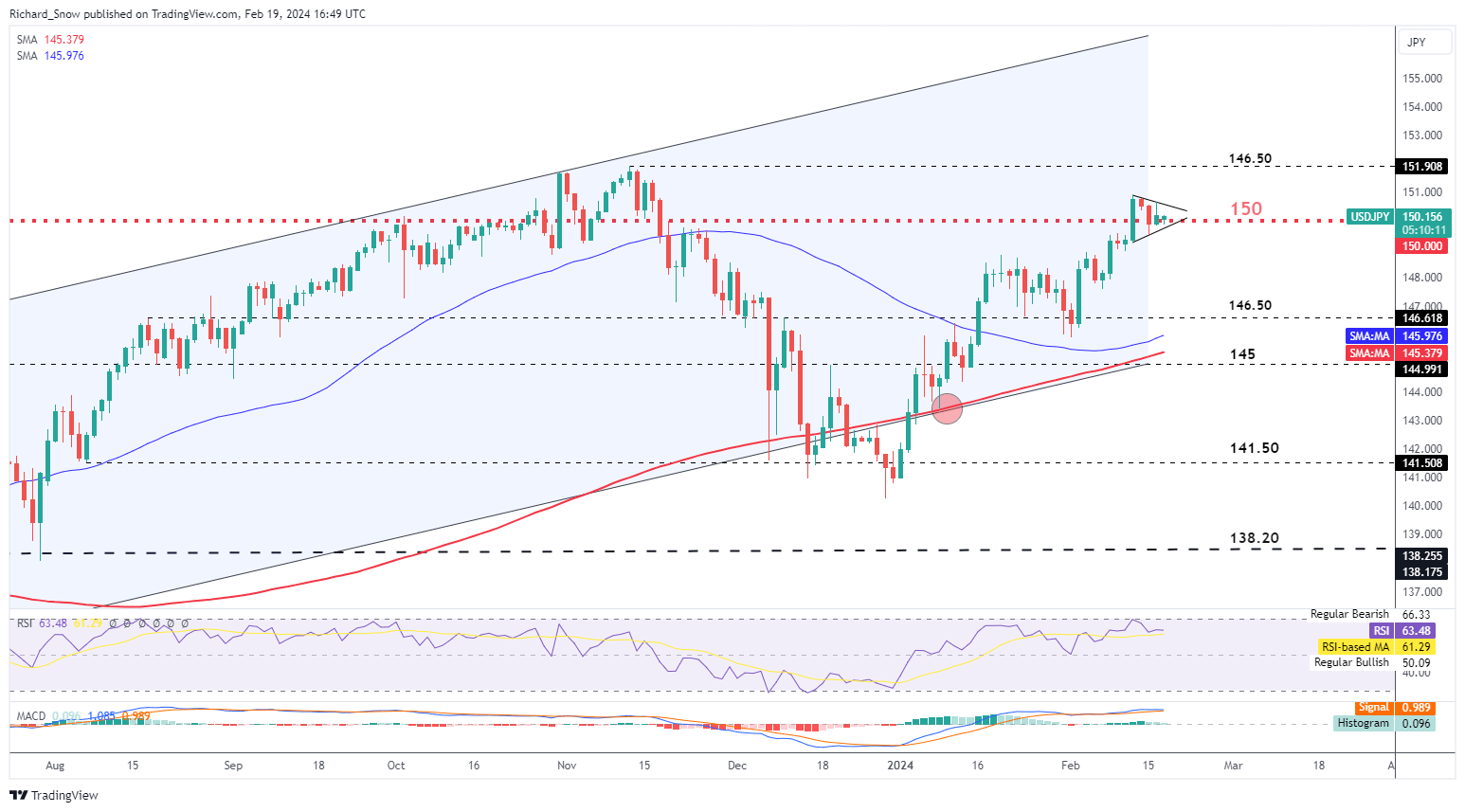

USD/JPY Tentatively Hovers Around the 150 Mark

USD/JPY hangs on to the 150 handle despite the FX intervention warnings. In fact, price action is forming a pennant-like shape which suggests a bullish continuation under typical market conditions. It can be argued that with the potential threat of intervention, moves to the upside attract a poor risk to reward ratio as previous instances of FX intervention have moved the yen around 500 pips – with the majority of that being to the downside.

If bulls are able to move prices towards 146.50 – this could potentially draw the attention from the finance ministry, leading to an enquiry of FX quotes from banks. This has been the case in the past, right before selling dollars and buying yen in large quantities. Support is at 146.50 while resistance appears at the recent swing high of 150.88 followed by 146.50.

USD/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

Understand the nuances of the Japanese yen and US dollar and how this informs USD/JPY movement:

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX