XAU/USD, DXY PRICE FORECAST:

- Gold (XAU/USD) Rallies Above $2000/oz but the Move Proves Short-Lived as the DXY Recovers.

- Dollar Index (DXY) Advanced as Well in Light of Another Positive Data Release.

- IG Client Sentiment Shows that Retail Traders are Overwhelmingly Long on Gold.

- To Learn More About Price Action, Chart Patterns and Moving Averages, Check out the DailyFX Education Section.

MOST READ: S&P 500 and Gold (XAU/USD) Take Diverging Paths Ahead of a Raft of Data Releases

Gold prices fell to a low of around $1990/oz in the Asian session before a bounce in the European session has resulted in the precious metal regaining the $2000/oz handle. There is however quite a bit of selling pressure above the $2000/oz handle as the Dollar Index (DXY) also looks to be staging a US session recovery.

Supercharge your trading prowess with an in-depth analysis of gold's outlook, offering insights from both fundamental and technical viewpoints. Claim your free Q4 trading guide now!

US DATA, FOMC MEETING AND MIDDLE EAST TENSION

US data continues to go form strength to strength with today's Consumer Confidence number beating estimates of 100 with a print of 102.6 in October. The September print was revised higher from 103 to 104.3, a further sign of the improvement in the outlook of consumers despite some recent challenges. The only concern from the data is the 1-year consumer inflation expectations which remains elevated at 5.9% with the 4-year inflation expectation number coming in at 5.9% as well. This is concerning for the Fed and market participants a his would hint that the Fed may need to do more and could explain in part the resurgence in the US Dollar Index (DXY).

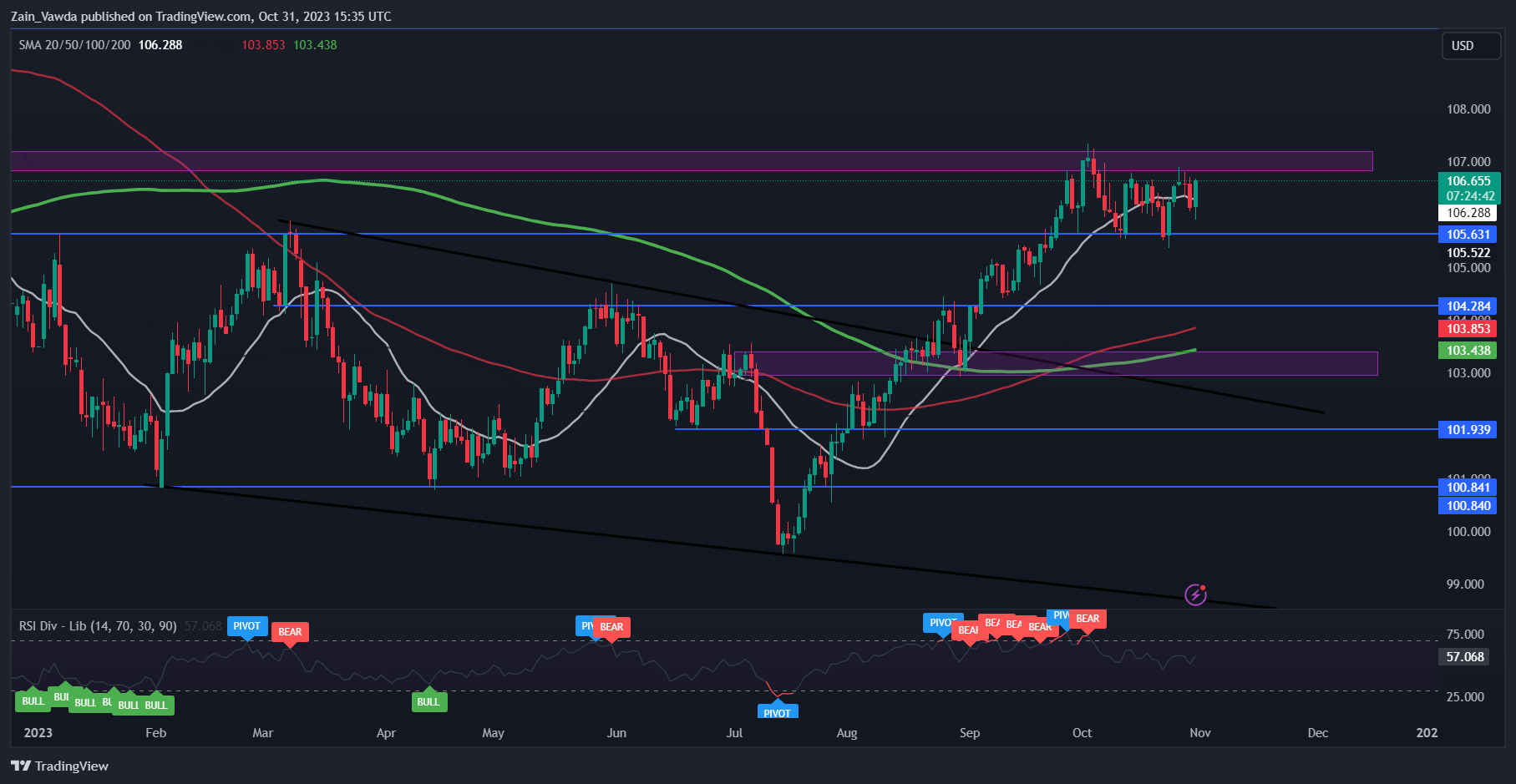

The FOMC meeting tomorrow is expected to result in a pause from the Fed tomorrow but given another round of solid data will Fed Chair Powell err on the Hawkish side? Comments around the door is open for another hike may not be hawkish enough for the DXY bulls to extend the recent rally beyond the 107.00 mark. The language from the Fed Chair will be of utmost importance at tomorrow's meeting and could stoke volatility as the rate decision is unlikely to do that.

US Dollar Index, Daily Chart

Source: TradingView, Created by Zain Vawda

Looking at the Middle East situation and we are seeing a step up in attacks on US bases in the region while Israel conducted airstrikes on Hezbollah targets in Lebanon overnight. This could stoke tensions further and see safe-haven appeal return. This continues to drive markets and in particular Gold and can thus not be ignored.

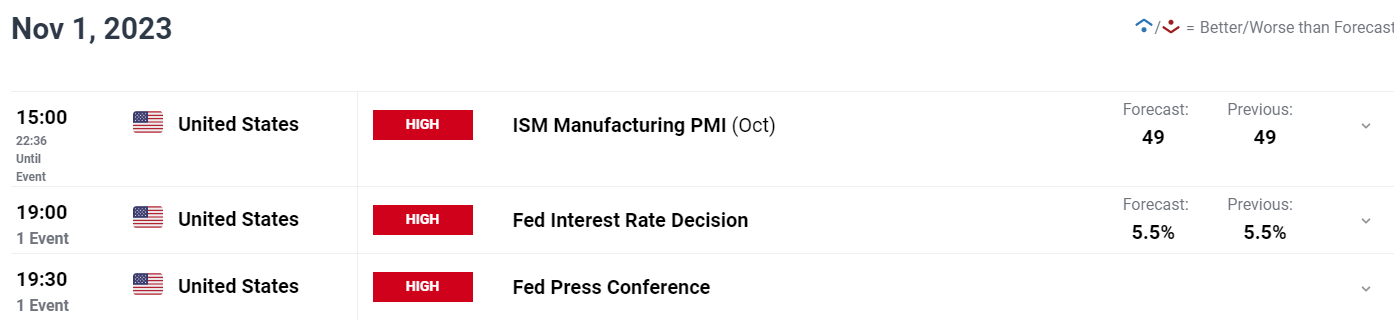

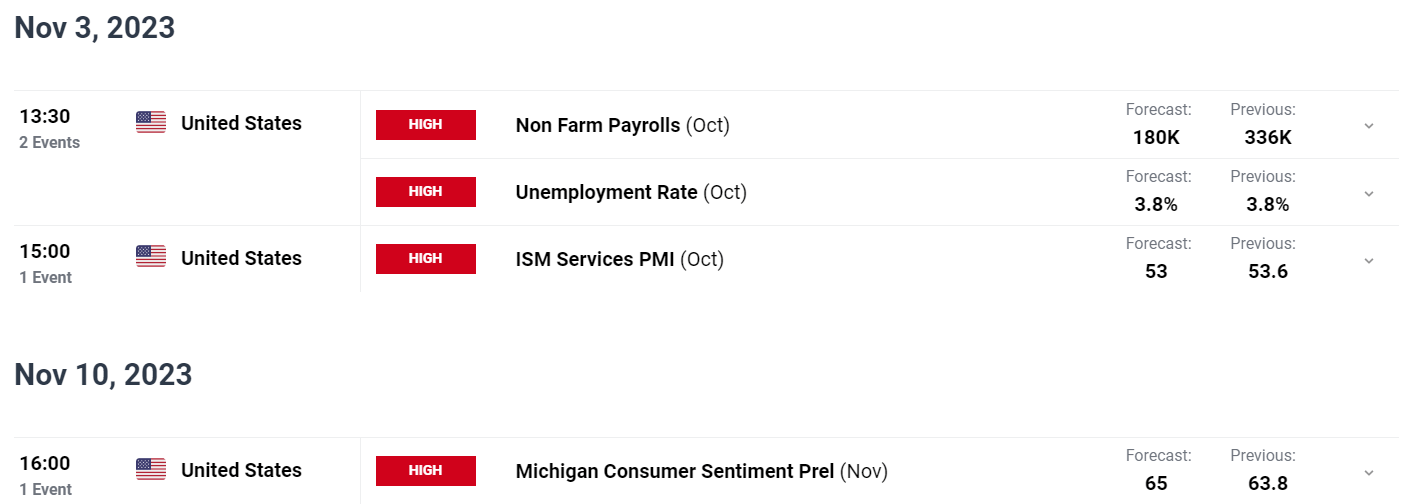

RISK EVENTS AHEAD

The rest of the week brings some high impact data from the US with the FOMC meeting tomorrow evening, but before that we do also have manufacturing PMI data. Friday could prove to be more volatile as we have the NFP print as well as Services PMI data which is always massive for the US as it remains primarily a serviced driven economy.

For all market-moving economic releases and events, see the DailyFX Calendar

TECHNICAL OUTLOOK

GOLD

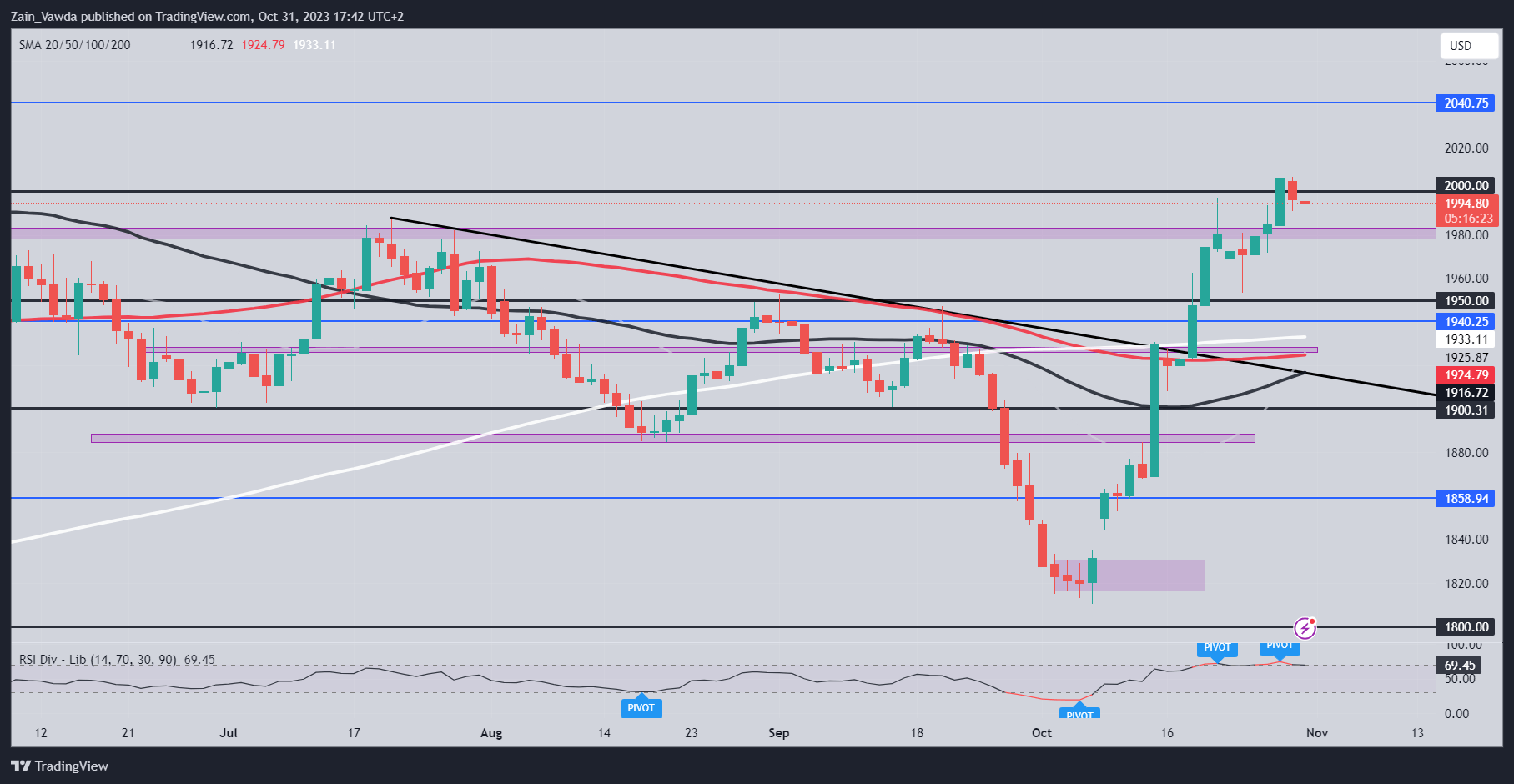

Form a technical perspective, Gold has struggled above the $2000 this week with today no different. The precious metal is failing to find acceptance above the level an extended rally to the upside as tension erupted in the Middle East.

Looking ahead of tomorrow's FOMC meeting and we could see the precious metal remain rangebound ahead of the meeting. The range between $1980 and $2020 may remain intact as the precious metal looks for a catalyst to renew its bullish vigor.

Key Levels to Keep an Eye On:

Resistance levels:

- 2000

- 2007

- 2020

Support levels:

- 1990

- 1980

- 1969

Gold (XAU/USD) Daily Chart – October 31, 2023

Source: TradingView, Chart Prepared by Zain Vawda

IG CLIENT SENTIMENT

Taking a quick look at the IG Client Sentiment, Retail Traders are Overwhelmingly Long on Gold with 60% of retail traders holding Long positions. Given the Contrarian View to Crowd Sentiment Adopted Here at DailyFX, is this a sign that Gold may continue to fall?

For a more in-depth look at GOLD client sentiment and changes in long and short positioning download the free guide below.

| Change in | Longs | Shorts | OI |

| Daily | 5% | -8% | -1% |

| Weekly | 9% | -14% | -2% |

Written by: Zain Vawda, Markets Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda