GOLD AND SILVER OUTLOOK

- Gold and silver prices end the week with a bang, boosted by rising geopolitical tensions in the Middle East following the Hamas terrorist attacks in Israel

- News of a possible ground invasion of the Gaza Strip by Israeli troops put investors on edge, increasing appetite for defensive assets

- This article discusses XAU/USD and XAG/USD key technical levels worth watching in the coming trading sessions

Most Read: Market Q4 Outlook - Gold, Oil, Stocks, US Dollar, Euro, Pound, Yen at Tipping Point

Gold (XAU/USD) and silver (XAG/USD) were wounded after September U.S. inflation beat consensus estimates and sparked a surge in U.S. Treasury yields, but managed to stage a remarkable turnaround on Friday, rallying about 3.2% and 4.0% respectively on risk-off mood, brought on by escalating geopolitical tensions in the Middle East.

The financial world has been on edge following the Hamas terrorist attacks in Israel, but a full-fledged flight to safety hasn't yet been observed. However, sentiment has begun to deteriorate after Israeli Prime Minister Benjamin Netanyahu warned civilians in Gaza to begin evacuating the northern part of the enclave ahead of an invasion.

While the situation is in a state of flux and subject to change, some traders believe that a possible Israeli incursion into the Gaza Strip, designed to secure the coastal territory and disrupt Hamas operational facilities, could backfire. Such a move could unintentionally trigger more violence by potentially drawing other nations into the conflict, ultimately prolonging instability in the region.

Eager to gain insights into gold's future trajectory and the upcoming market drivers for volatility? Discover the answers in our complimentary Q4 trading guide. Download it for free now!

Gold and, to a lesser extent, silver, tend to perform well during periods of market uncertainty and widespread anxiety. With tensions in the Middle East on the upswing, both metals are likely to remain well-supported in the days and weeks ahead, especially if Israel initiates a ground operation as part of its response to last weekend's events.

Although the interest rate environment continues to present challenges for precious metals, it wouldn’t be surprising for investors to temporarily ignore these dynamics in favor of an increased focus on the geopolitical landscape, which at times enhances the premium on safe-haven assets. With that any mind, any escalation of the ongoing conflict should be positive for gold and silver.

Acquire the knowledge needed for maintaining trading consistency. Grab your "How to Trade Gold" guide for invaluable insights and tips!

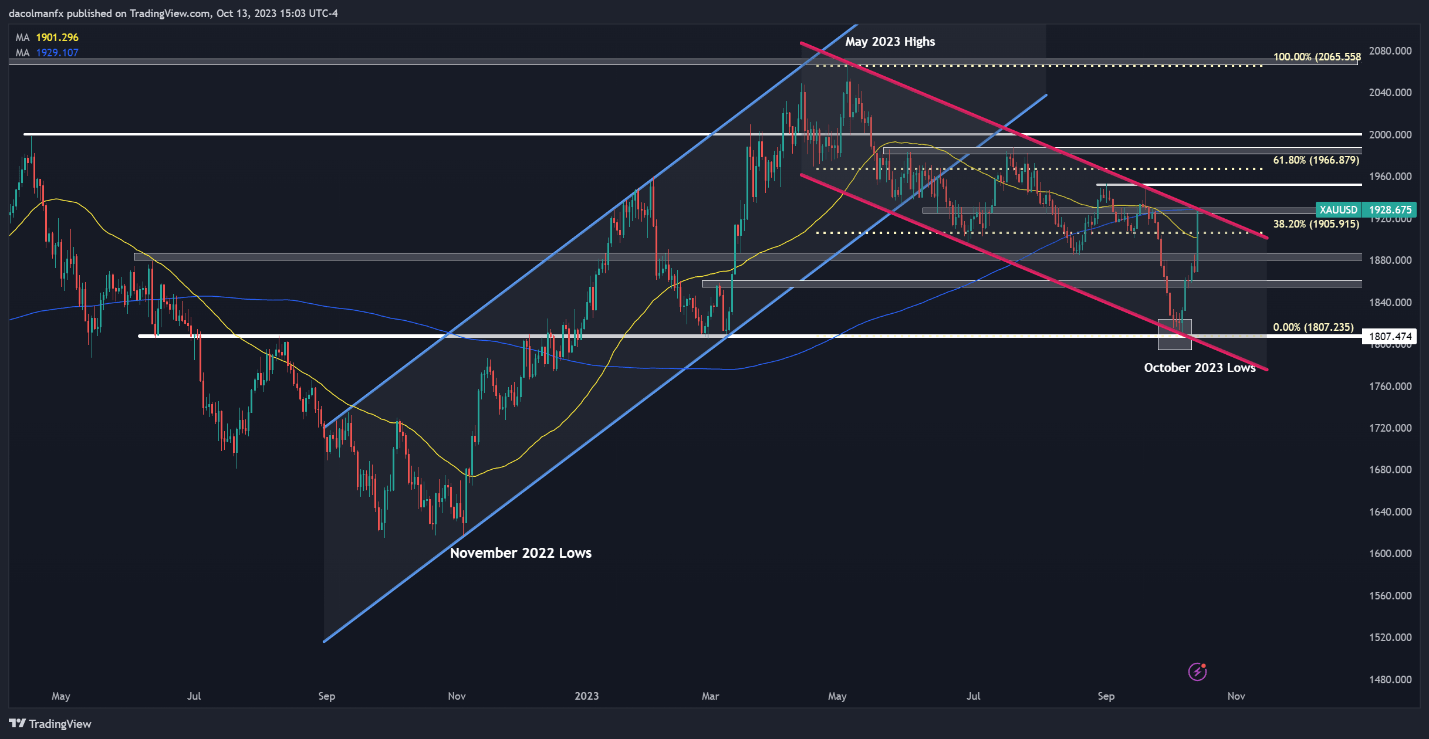

GOLD PRICE TECHNICAL ANALYSIS

Gold rallied on Friday, approaching channel resistance and the 200-day simple moving average around the $1,930 area. It is not yet certain that XAU/USD will be able to overcome this technical barrier on a sustained basis, but in case it does so decisively, we could see a push towards $1,950. On further strength, the crosshairs will be fixed on $1,967, the 61.8% Fibonacci retracement of the May/October decline.

On the flip side, if sellers return and spark a bearish reversal from current levels, initial support rests around the 50-day simple moving average. Further down the line, the next area of interest is located near $1,890. While XAU/USD could find support in this zone on a pullback, a breakdown could pave the way for a descent toward the $1,860 mark.

GOLD PRICE TECHNICAL CHART

Gold Price Chart Creating Using TradingView

Wondering how retail positioning can shape silver prices? Our sentiment guide provides the answers you seek—don't miss out, download it now!

| Change in | Longs | Shorts | OI |

| Daily | 2% | 1% | 2% |

| Weekly | 7% | 0% | 6% |

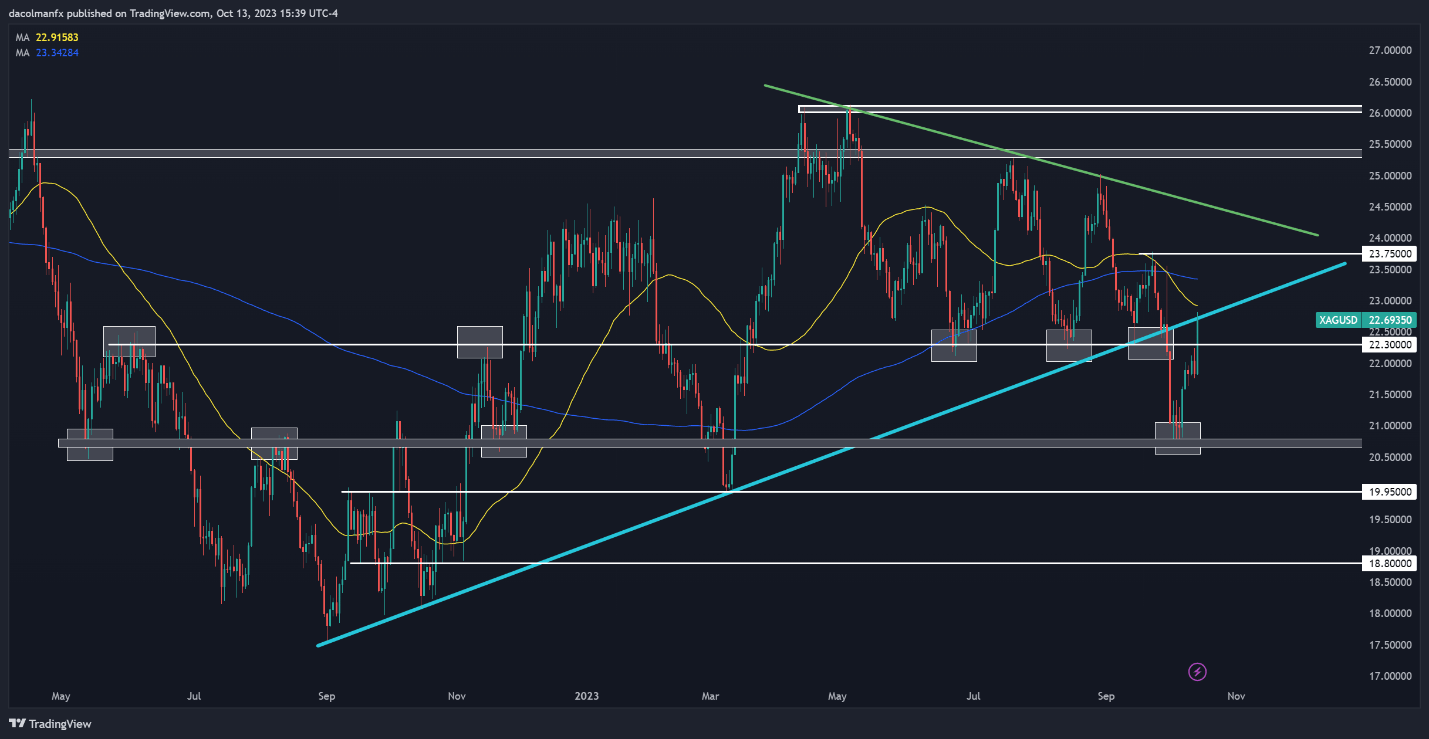

SILVER PRICE TECHNICAL ANALYSIS

Silver also registered strong gains on Friday on the back of geopolitical tensions in the Middle East, surging towards trendline resistance at $22.75, but failing to clear this technical ceiling. It is important to watch how prices react in this area next week, but there are two possible scenarios worth considering: a breakout or a bearish rejection.

In the event that XAG/USD breaks out on the upside, buyers could become emboldened to challenge the 50- and 200-day moving averages. On further strength, we could see a move towards $23.75, the September 22 swing high. Conversely, if sellers regain the upper hand and spark a pullback, the first area of support to consider is situated at $22.30. Below that, the focus shifts to $20.70.

SILVER PRICE FORECAST