OIL PRICE FORECAST:

- Oil Rally Pauses as Caution Takes Hold of Market Participants.

- Chinas Recovery Eyeing a New Bout of Stimulus Which Should Put it on Course for its 5% Growth Target in 2023.

- IG Client Sentiment Hints at the Current Indecision and Caution Regarding the Next Move in Oil Prices.

- To Learn More About Price Action, Chart Patterns and Moving Averages, Check out the DailyFX Education Section.

Most Read: What is OPEC and What is Their Role in Global Markets?

Oil prices have continued their impressive rally this week on the back of Chinese stimulus hopes and a tighter market boosting prices to levels last seen mid-April. This morning did bring a slight pullback however ahead of an expected rate hike by the US Federal Reserve as well which could reignite the volatility many market participants have been yearning for.

CHINESE STIMULUS AND FOMC MEETING

Market participants were buoyed yesterday by the potential for further stimulus from the Chinese government which will likely ensure the GDP growth target of 5% in 2023 will be met. I have reiterated over the past few weeks but despite an uneven recovery China has still been purchasing oil at a rapid pace as they look to build up their stockpiles. Despite the uncertain recovery the demand for oil remained high with adding 950,000 bpd to inventories, an increase of 28% from the 740,000 bpd during the entirety of 2022. The uneven recovery from China this year has had a slight knock-on effect on some economies while denting overall market sentiment as well. Markets will now wait for any announcements detailing the stimulus package as well as the support measures for the highly publicized and scrutinized property sector.

This morning also brough rumors that Russia may be on course to significantly increase oil loadings for export from September. Russia have been cutting exports through the last 3 months with August expected to see a decline 100-200k bpd from July levels before recording a strong rebound in September. This could partially explain the slight pullback in oil prices this morning.

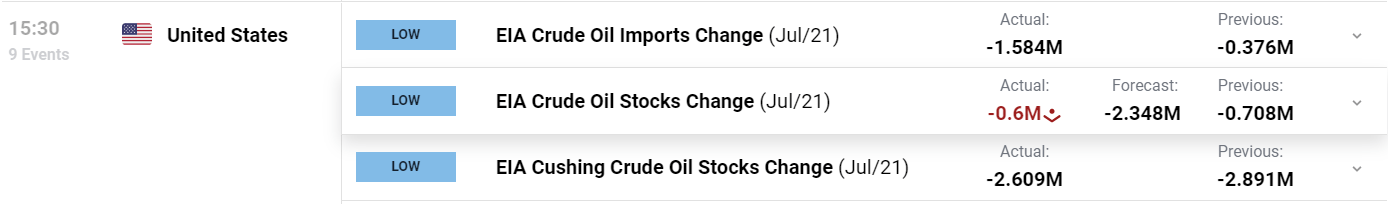

EIA data was released a short while ago indicating another decline by around 0.600 million barrels in the week to July 21st, below market expectations for a 2.348-million-barrel draw.

For all market-moving economic releases and events, see the DailyFX Calendar

I am aware it may be tiresome to continually mention tonight’s FOMC meeting so I will be brief. Fed Chair Powell remains the key player heading into the meeting today given that markets have largely priced in a 25bps hike. All eyes will be focused on the message Powell chooses to convey with a dovish likely to help WTI push back above the $80 a barrel mark.

TECHNICAL OUTLOOK AND FINAL THOUGHTS

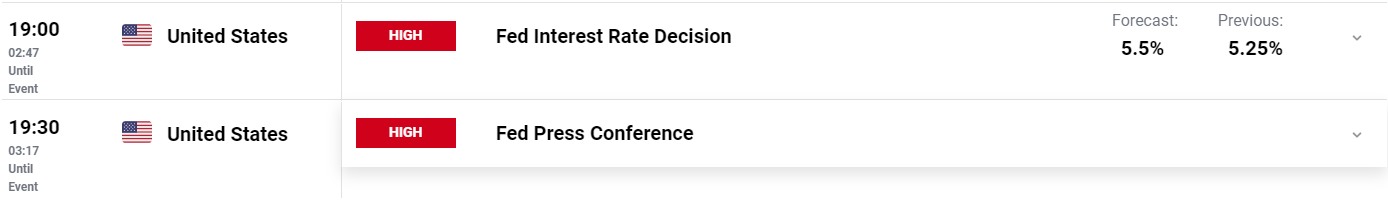

From a technical perspective both WTI and Brent finished last week strong before continuing higher this week. Resistance has been found at the previous gap higher in oil prices in early April when OPEC announced production cuts.

WTI in particular remains confined to the rising wedge pattern for now and could be in for a short-term retracement with the 14-day RSI entering overbought territory yesterday. Any move today will hinge on the outcome of the Fed decision.

WTI Crude Oil Daily Chart – July 26, 2023

Source: TradingView

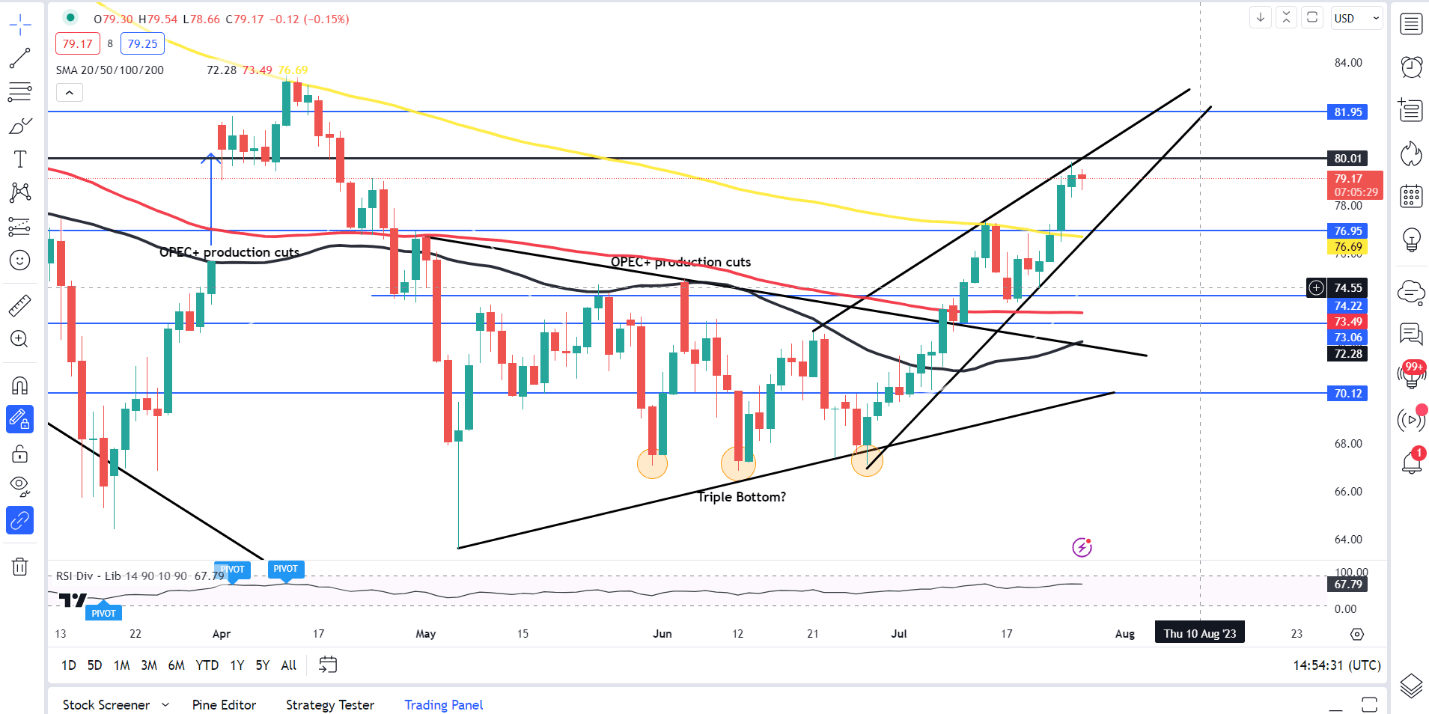

Something which caught my attention is that both WTI and Brent are trading back above the 200-day MA for the first time since August 2022, which in all fairness was short-lived. Any retracement from here may find it a tough challenge to break below the 200-day MA at the first time of asking and could help keep oil prices supported.

Brent Oil Daily Chart – July 26, 2023

Source: TradingView

Key Levels to Keep an Eye on:

Support Levels:

- 81.80 (200-day MA)

- 80.30

- 78.80 (20-day MA)

Resistance Levels:

- 83.50

- 85.00

- 87.00

IG CLIENT SENTIMENT DATA- OIL US CRUDE

IGCSshows retail traders are currently FLAT on WTI Oil, with 50% of traders currently holding LONG/SHORT positions. At DailyFX we typically take a contrarian view to crowd sentiment, and the fact that traders are FLAT highlights the caution and indecision market participants have heading into the FOMC meeting later.

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda