KEY POINTS:

- EUR/USD at 6-Month Highs as Dollar Index Slide Continues.

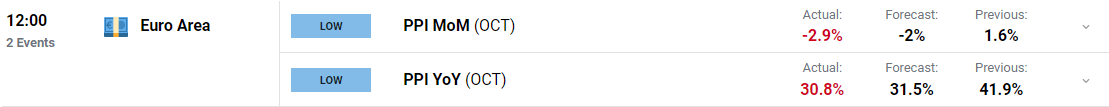

- Euro Area PPI Data Beats Estimates.

- Fed Funds Peak Rate Expectations Decline to 4.9% Compared to 5.25% a Month Ago.

- To Learn More About Price Action, Chart Patterns and Moving Averages, Check out the DailyFX Education Section.

EUR/USD FUNDAMENTAL BACKDROP

EUR/USD consolidates above the psychological 1.0500 level ahead of the NFP report out later today. The Euro is currently trading at 6-month highs to the greenback around 1.0540 as the dollar index continues to slide.

European data released yesterday did little to justify the Euros recent rally against the greenback as German retail sales missed estimates while the S&P PMI numbers from both Germany and the Euro area remain in contraction territory. This morning brought some positive news as the Euro areas producer price inflation (PPI) slowed significantly in October beating estimates. However, the report did indicate inflationary pressures in Europe remain high coupled with a weakening economic outlook which suggest there is a need to continue raising interest rates. European Central Bank President Christine Lagarde has continued her hawkish rhetoric this week keeping the door open for a potential 75bps hike at the ECBs December meeting.

For all market-moving economic releases and events, see the DailyFX Calendar

The dollar index continues its slide as Fed Chair Powell’s dovish rhetoric was backed up by a fall in US core PCE data. The PCE data came in at 6% YoY in October down from 6.3% print in September and added further pressure on the dollar. Markets have clearly bought into a Fed slowdown and a bearish dollar theme seems to be gaining traction. This is reflected by a drop in the Fed funds peak rate which has dropped from 5.25% a month ago to around 4.90% (at the time of writing). All eyes will now be fixed on the NFP report out later today with consensus around the 200k mark. A miss to the downside is likely to keep the US dollar under pressure while an upside beat may not be enough to bring dollar bulls back to the table. A precarious position for the dollar, one we haven’t seen for the majority of 2022.

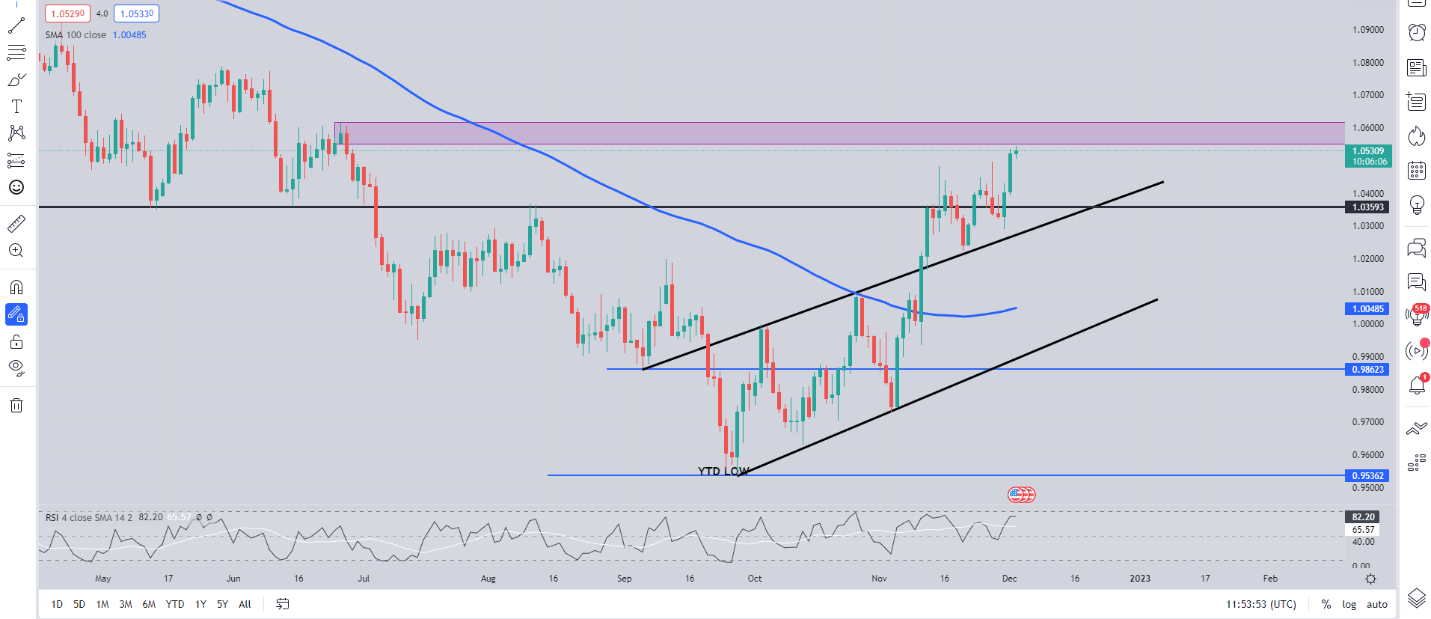

From a technical perspective, EUR/USD finally recorded a daily candle close above the key 1.0500 level. The next area of resistance rests around the 1.0600 which could be reached should the NFP print come in lower than expected. The RSI is in overbought territory and any push lower for the pair could see a retest of resistance turned support around the 1.0500 level. A break below this level brings key support around the 1.0420 area into play.

EURUSD Daily Chart – December 2, 2022

Source: TradingView

IG CLIENT SENTIMENT: BULLISH

IGCSshows retail traders are SHORTon EUR/USD, with 60% of traders currently holding short positions. At DailyFX we typically take a contrarian view to crowd sentiment, and the fact that traders are SHORT suggests EUR/USD prices may continue to rise.

Written by: Zain Vawda, Markets Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda