KEY POINTS:

- EUR/USD Prints Highest Daily Candle Close Since June, Further Upside May prove Elusive.

- US Dollar Index Posts Second Successive Day of Losses.

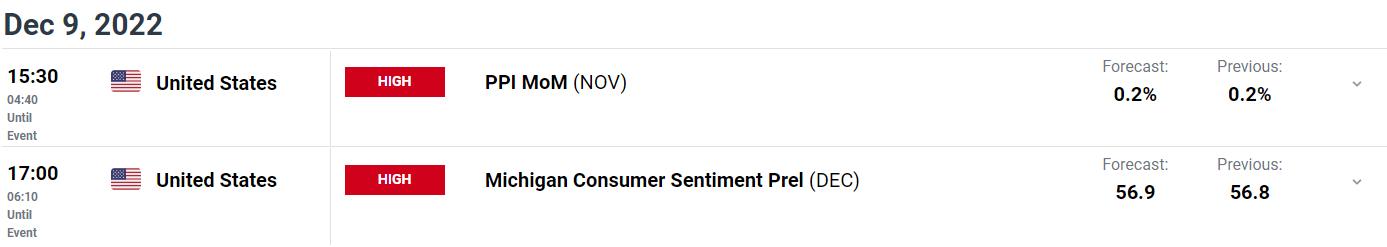

- Positive US PPI and University of Michigan Data Could Provide Dollar with Support

- To Learn More About Price Action, Chart Patterns and Moving Averages, Check out the DailyFX Education Section.

EUR/USD FUNDAMENTAL BACKDROP

EUR/USD continues its grind higher in early European trade as key US data events lie ahead. It has been a rather mixed week for EUR/USD with two days of losses followed by two days of gains ahead of the todays US data and next week’s Central Bank meetings.

The dollar index continued its decline yesterday keeping the Euro bulls on the front foot allowing EUR/USD to record its highest daily close since June 24. The dollar has a tendency for weakness in December while the slight improvement in sentiment yesterday has seen haven demand fade.

There has been comments this week from some ECB members discussing the possibility of further rate hikes with markets now pricing around 55bps of tightening at next week’s ECB meeting. ECB policymaker Gabriel Makhlouf wouldn’t rule out a 75bps hike for December while stating that a 50bps hike likely means more will follow. Comments out from ECB policymaker Francois Villeroy this morning warning that a recession cannot be ruled out failed to have any notable impact on the Euro. The ECB also released data yesterday from a consumer survey which put inflation expectations at 5.4% over the next 12 months.

Later in the day attention turns to the US economic calendar as we await the US PPI as well as University of Michigan data. A positive data print could offer some support for the dollar while a weaker print could push EUR/USD above the 1.06000 marker.

For all market-moving economic releases and events, see the DailyFX Calendar

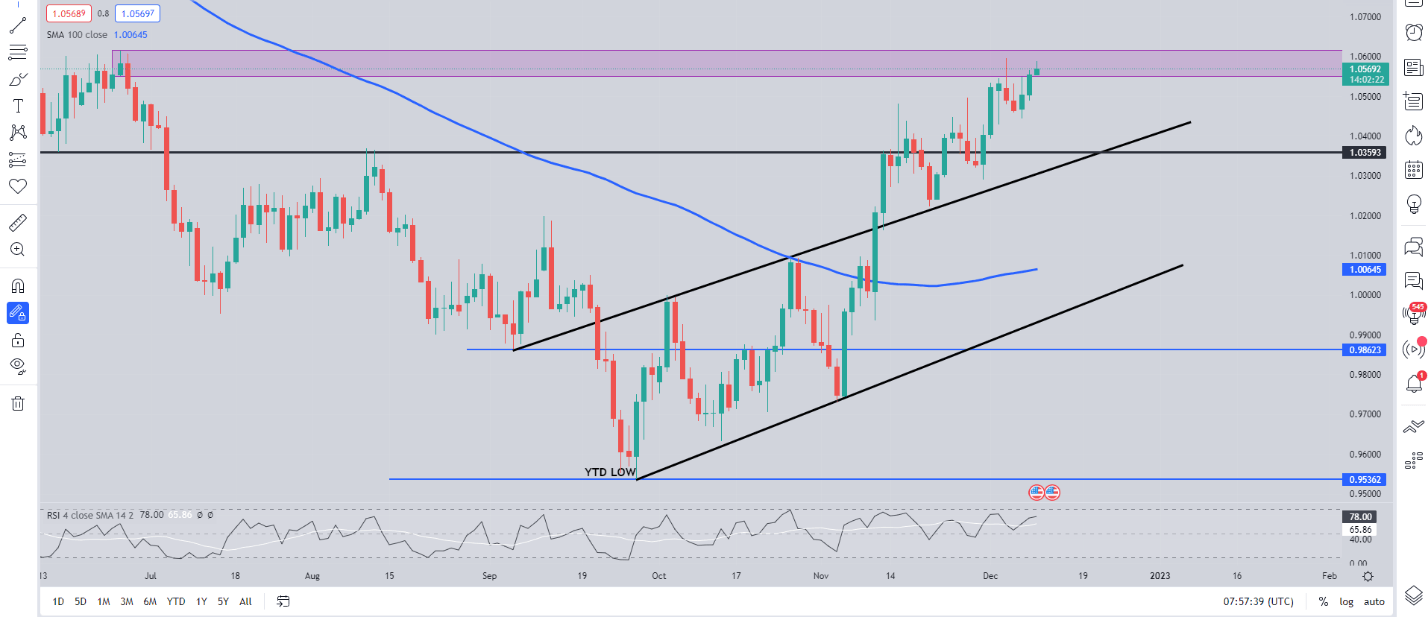

From a technical perspective, EUR/USD continues to print higher highs and higher lows on the daily timeframe while attempting to break above the 1.06000 level for the second time this week. Given the massive data events next week buyers may look too sure up positions ahead of the US data later today which could push EUR/USD lower before the release. Alternatively, should we see a push above 1,06000 we could see selling pressure return pushing the pair back below with 1.0550 providing immediate support. A weekly candle close sub 1.05300 will see the weekly timeframe print a doji candlestick close and could see the pair face renewed selling pressure heading into next week.

EURUSD Daily Chart – December 9, 2022

Source: TradingView

IG CLIENT SENTIMENT: BULLISH

IGCS shows retail traders are SHORT on EUR/USD, with 62% of traders currently holding short positions. Client sentiment is often viewed as a contrarian indicator Therefore with traders SHORT, this suggests EUR/USD prices may continue to rise.

Written by: Zain Vawda, Markets Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda