POUND STERLING ANALYSIS & TALKING POINTS

- Fears around rising US interest rates smashes global risk sentiment.

- All eyes shift to upcoming US labor data and Beige book.

- Falling wedge quashed, where to next?

GBP/USD FUNDAMENTAL BACKDROP

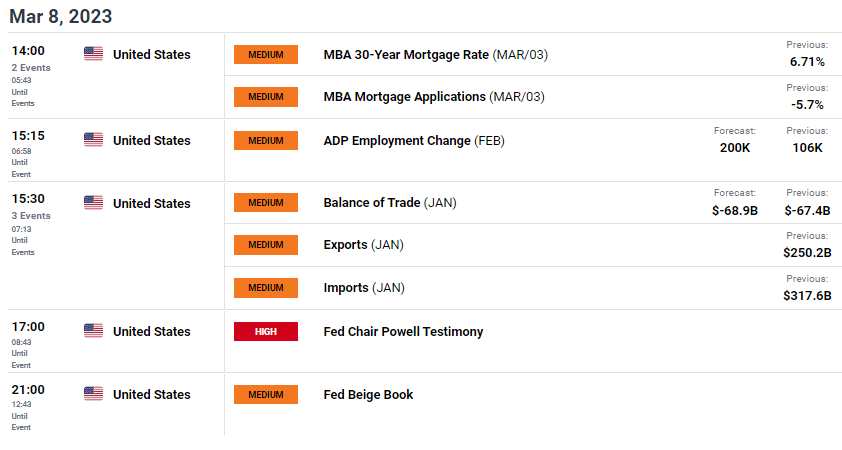

The pound is reacting negatively to the more aggressive guidance given by Fed Chair Jerome Powell during his testimony in front of the Senate Banking Committee yesterday. Naturally, the USD found support against all major currencies including GBP. Although there was some positive UK economic data yesterday (housing and retail sales), the scale of the dollar move outweighed any upside. Today, the US theme will continue to dominate the trading session and markets are keenly awaiting the ADP report (see economic calendar below) for February as well as the Fed Beige book that summarizes current economic conditions by filtering data from each District. Expectations for the ADP employment change is favoring a higher print which will only heighten the comments made from Fed Chair Jerome Powell yesterday and reiterate the tight labor market conditions in the US. Day 2 of Mr. Powell’s testimony is unlikely to touch on monetary policy issues hence the focus on ADP and the Beige book.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

GBP/USD ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

From a UK perspective, there are no noteworthy economic data ahead of Friday’s GDP release.

Consequence of yesterday’s testimony:

- Higher interest rate forecast for 2023.

- Terminal rate up to 5.655% (at the time of writing).

- Greater chance of a 50bps rate hike in the March meeting.

- Upcoming US inflation and Non-Farm Payrolls (NFP) data could cool down expectations if they miss forecasts and may give cable some upside support.

TECHNICAL ANALYSIS

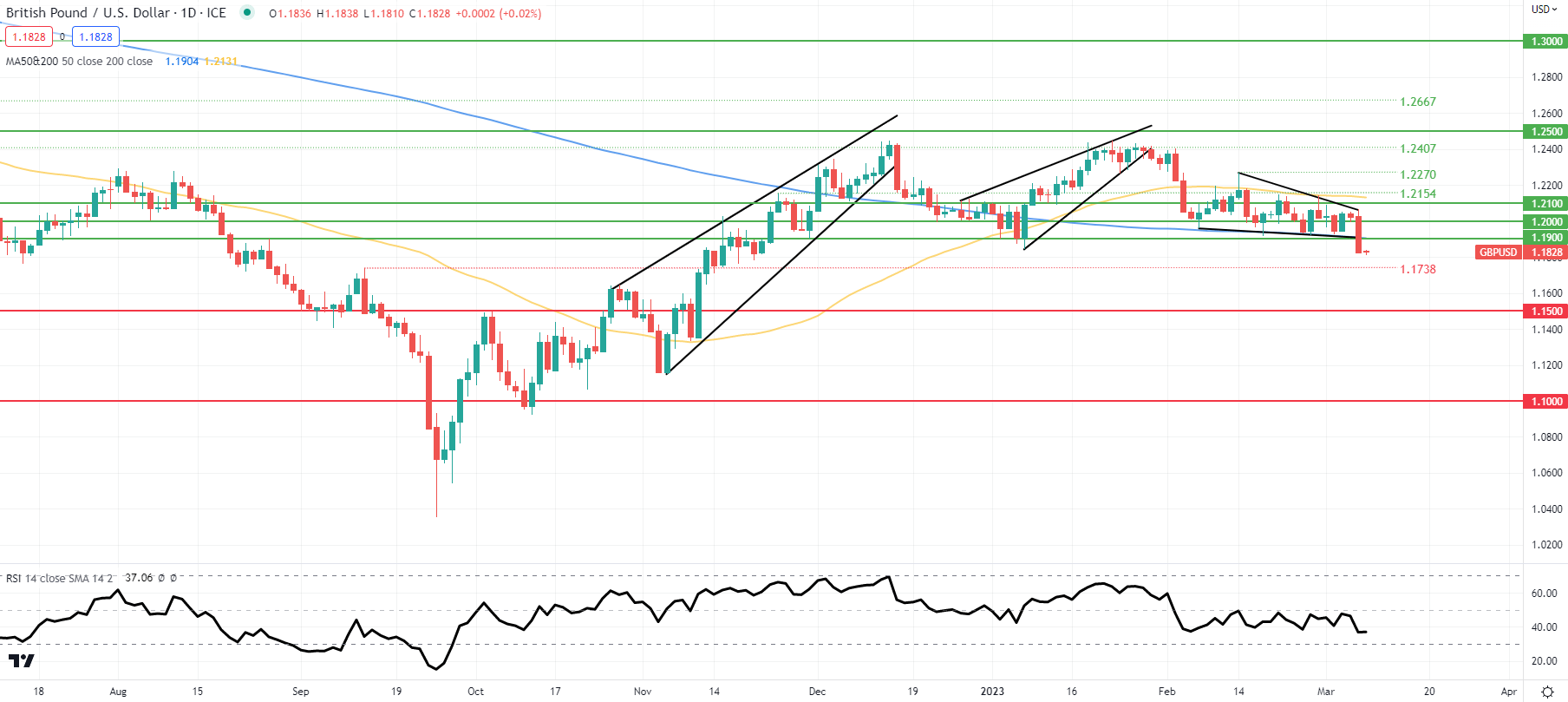

GBP/USD DAILY CHART

Chart prepared by Warren Venketas, IG

The daily GBP/USD chart above has price action in limbo around yesterdays close awaiting further fundamental data. After blasting below the 1.1900 psychological level, 200-day (blue) SMA and wedge support; likely invalidating the falling wedge chart pattern (black), bears now eye the 1.1738 swing high (now support). According to the Relative Strength Index (RSI), the pair has more room to fall before entering oversold territory but remains highly dependent on incoming data.

Key resistance levels:

- 1.2000

- 1.1900/200-day SMA

Key support levels:

- 1.1738

- 1.1500

BEARISH IG CLIENT SENTIMENT

IG Client Sentiment Data (IGCS) shows retail traders are currently LONG on GBP/USD, with 72% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment resulting in a short-term upside disposition.

Contact and followWarrenon Twitter:@WVenketas