AUD/USD ANALYSIS & TALKING POINTS

- US debt ceiling discussions will lead the way this week.

- China’s LPR remains steady as growth potential comes into question.

- Fed speakers in focus for today.

- AUD/USD consolidates as external factors dictate terms.

AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP

The Australian dollar looks to be facing another challenging week after US factors weighed on the pro-growth AUD. Beginning late on Friday, Treasury Secretary Janet Yellen addressed bank CEO’s and stated there may be a need for additional mergers due to the slew of bank failures seen over the last few months. This dampened risk sentiment leaving the AUD on the backfoot against the US dollar. Market caution gained traction over the weekend as optimism around the US debt ceiling was quickly dispelled when President Joe Biden mentioned that the demands from Republicans were ‘unacceptable’. President Biden and House of Representatives Speaker Kevin McCarthy will hash it out once more later today as time runs out.

That being said, Fed Chair Jerome Powell relayed a rather dovish statement last week which was largely lost in the debt ceiling shadow, hinting that the Fed may pause their hiking cycle. In summary, the week should be dominated by debt ceiling negotiations but Fed monetary policy should be a close second.

Earlier this morning China kept its 1 and 5-year Loan Prime Rates (LPR) unchanged. The increasing interest rate differential between the US and China has weighed on the Yuan and the PBoC’s desire to cut rates (as a stimulus measure) to meet their 5% GDP growth target. Commodity prices (Australian specific exports) have weakened thus exacerbating downside for the Aussie dollar.

Foundational Trading Knowledge

Commodities Trading

Recommended by Warren Venketas

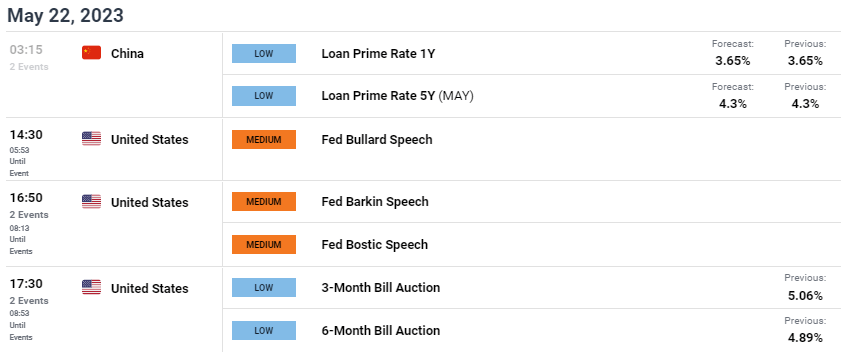

The day ahead will be led by Fed speakers (see economic calendar below) and it will be interesting to see how the scheduled officials react to Fed Chair Powell’s recent comments.

ECONOMIC CALENDAR

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

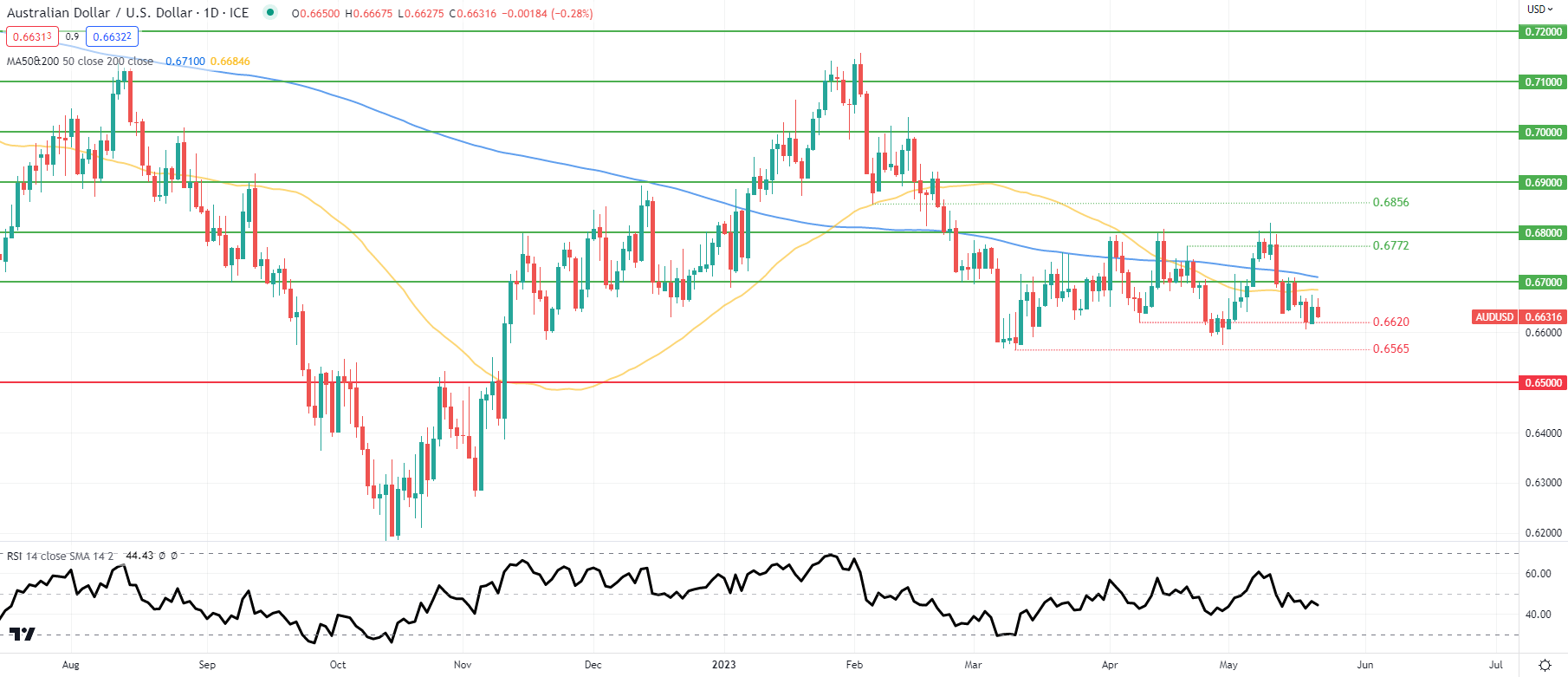

AUD/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Daily AUD/USD price action reveals recent uncertainty in global markets as the pair fluctuates between the 0.6600 and 0.6800 psychological levels. The Relative Strength Index (RSI) further reiterates investor skepticism due to fundamental ambiguity. This week may be a ‘wait and see’ mindset from traders awaiting external cues.

Key resistance levels:

- 200-day MA (blue)

- 0.6700

- 50-day MA (yellow)

Key support levels:

- 0.6620

- 0.6565

- 0.6500

IG CLIENT SENTIMENT DATA: BULLISH

IGCS shows retail traders are currently LONG on AUD/USD, with 73% of traders currently holding long positions. At DailyFX we typically take a contrarian view to crowd sentiment resulting but due to recent changes in long and short positioning, we arrive at a short-term upside disposition.

Contact and followWarrenon Twitter:@WVenketas