AUD/USD ANALYSIS & TALKING POINTS

- Another hike by RBA could be backed post-CPI later this week.

- China crucial to commodity outlook for Australia.

- Golden cross may lead to additional AUD upside to come; 0.7000 under threat.

AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

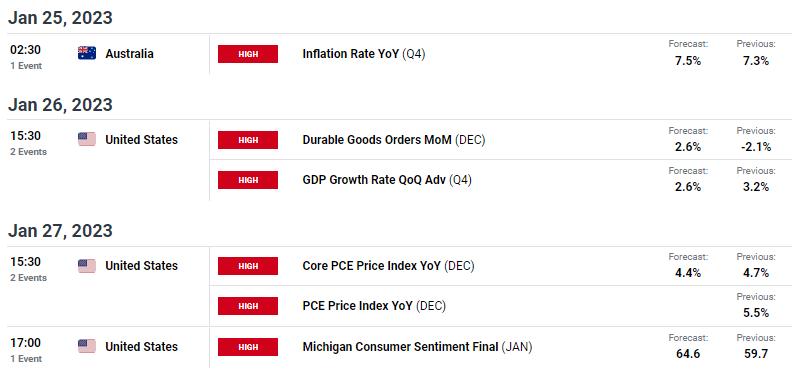

The pro-growth Australian dollar did not react to rising COVID death statistics released on Saturday by the Chinese Centre for Disease Control and Prevention showing markets focus on the upcoming Australian CPI report on Wednesday and a weaker USD – see economic calendar below. Estimates point to a 0.2% increase from the prior read and could throw a spanner in the works considering the Australian economy could be pushed into a recession should the Reserve Bank of Australia (RBA) hike rates again. Taking into account softening housing prices and lower consumer demand, another hike will hurt and already wounded Australian consumer. The week rounds off with high impact U.S. data which should shift AUD/USD price movement over to dollar-based factors.

ECONOMIC CALENDAR

Source: DailyFX economic calendar

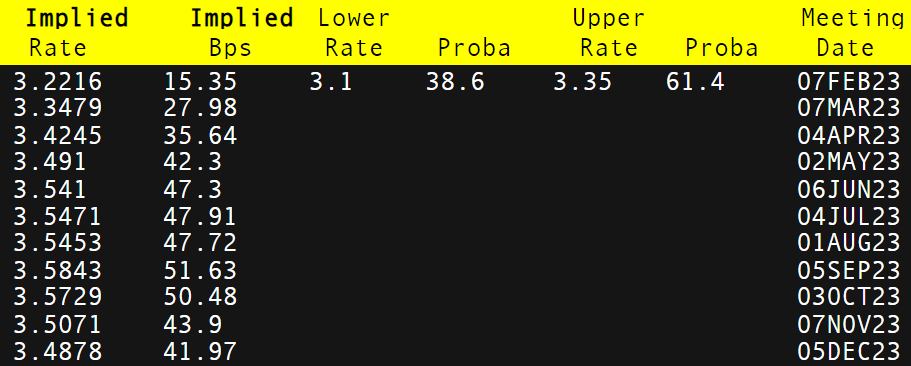

The RBA has not ruled out another interest rate hike for the February meeting as mentioned in their previous minutes and with money market (refer to table below) pricing divided between no change and a 25bps increment, Wednesday’s inflation print could result in more clarity. On a positive note for the Aussie dollar, commodity prices are projected to remain elevated throughout 2023 largely based on a China re-opening and coal exports to European countries who now look to hedge their exposure to Russian energy sources.

RBA INTEREST RATE PROBABILITIES

Source: Refinitiv

TECHNICAL ANALYSIS

Introduction to Technical Analysis

Moving Averages

Recommended by Warren Venketas

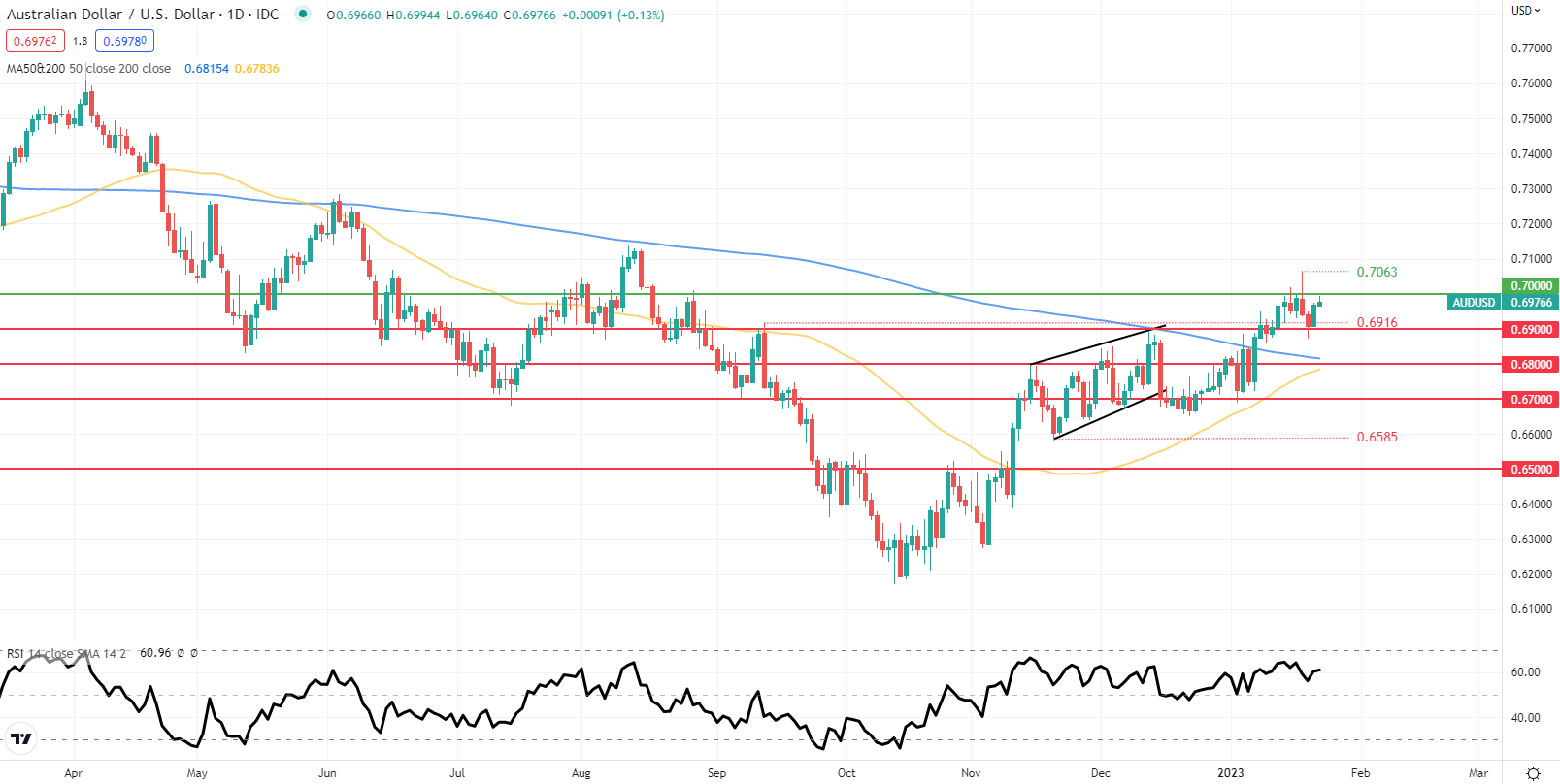

AUD/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Daily AUD/USD price action has bears defending the 0.7000 psychological resistance handle this morning which has been tested three times since last week Monday. It may only be a matter of time before there is a confirmed daily candle close above this level that could lead to a leg higher. A possible golden cross (50-day MA crosses above 200-day MA) could establish this move higher and is definitely a market I will be monitoring closely over the coming week.

Key resistance levels:

- 0.7063

- 0.7000

Key support levels:

- 0.6916

- 0.6900

IG CLIENT SENTIMENT DATA: CAUTIOUS

IGCS shows retail traders are currently SHORT on AUD/USD, with 52% of traders currently holding short positions. At DailyFX we typically take a contrarian view to crowd sentiment; however, due to recent changes in long and short positioning we arrive at a short-term mixed bias.

Contact and followWarrenon Twitter:@WVenketas