AUD/USD ANALYSIS & TALKING POINTS

- China’s COVID woes weigh heavily on the Australian dollar.

- AUD/USD sandwiched between psychological levels.

AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP

The pro-growth Australian dollar has been dancing to the tune of global factors of recent with no key Australian specific data to speak of. A China re-opening was initially met with cheer by global markets giving a boost to the commodity complex and risk assets in general however, rising COVID cases have inundated local Chinese hospitals, increasing the level of concern about a positive re-open.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

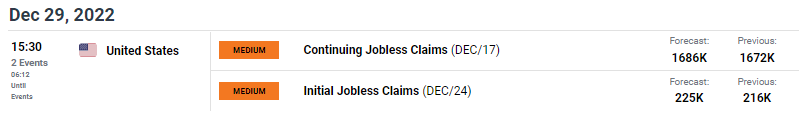

From a USD perspective labour data is scheduled later today (see economic calendar below) and should give us another data point to include in what has been an extremely resilient and tight jobs environment. Although expectations are slightly weaker than the prior read, should actual data come in line with these projections, the impact on dollar crosses should be minimal considering the changes are minor.

ECONOMIC CALENDAR

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

Introduction to Technical Analysis

Candlestick Patterns

Recommended by Warren Venketas

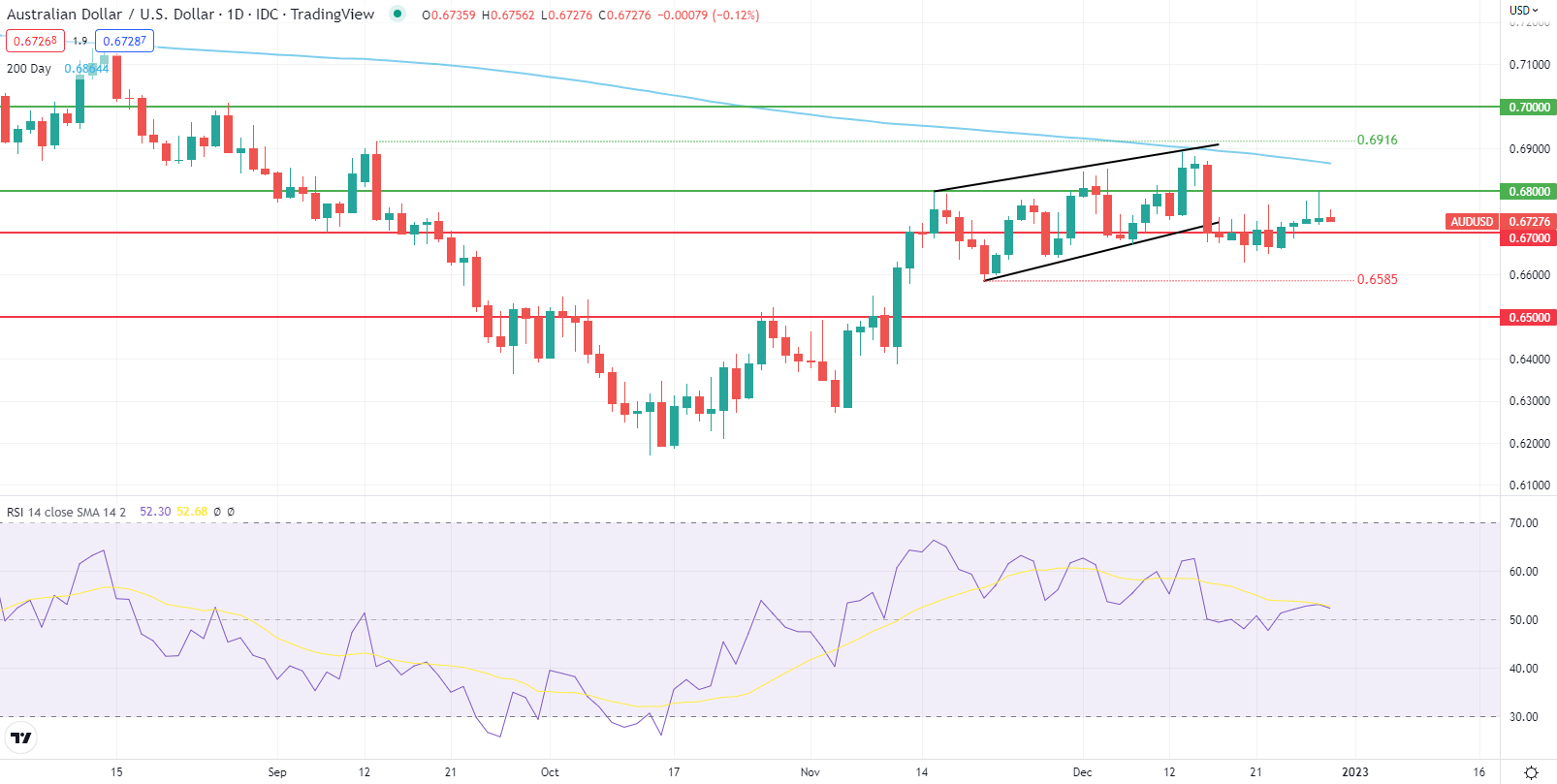

AUD/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Daily AUD/USD price action shows a long upper wick candle close yesterday at the key psychological 0.6800 resistance level and may lead to short-term downside to come. The Relative Strength Index (RSI) echoes the fundamental sentiments of caution around China and a move towards 0.6800 or below 0.6700 are on the cards awaiting a catalyst likely coming in early 2023 as liquidity beefs up.

Key resistance levels:

- 200-day SMA (blue)

- 0.6800

Key support levels:

- 0.6700

- 0.6585

IG CLIENT SENTIMENT DATA: MIXED

IGCS shows retail traders are currently LONG on AUD/USD, with 55% of traders currently holding long positions. At DailyFX we typically take a contrarian view to crowd sentiment but recent changes in long and short positioning result in a short-term cautious bias.

Contact and followWarrenon Twitter:@WVenketas