AUD/USD ANALYSIS & TALKING POINTS

- Chinese growth forecasts limit AUD upside today.

- Markets await RBA and Fed guidance tomorrow.

- AUD/USD in limbo, awaiting catalyst.

AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP

The Australian dollar gave up some of its gains this Monday morning after China’s National People’s Congress (NPC) delivered a more conservative outlook for 2023 GDP. Forecasts now point to 5% as opposed to the anticipated 5.5-6% range which may be disappointing for commodity export heavy nations like Australia but the lower base could allow for the greater chance of an upside surprise.

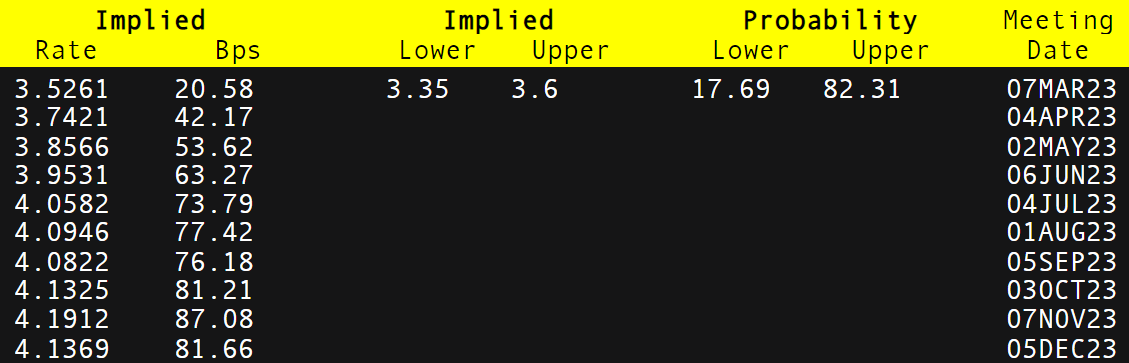

Looking ahead, the Reserve Bank of Australia (RBA) will be in focus tomorrow morning (see economic calendar below) with their interest rate decision. Consensus is for another 25bps increment which will be the 10th consecutive rate hike by the central bank. This could see the Aussie dollar find some support against the U.S. dollar ahead of Fed Chair Jerome Powell’s testimony later in the day. Mr. Powell will be under the spotlight as market participants look to uncover any possible clues as to the Fed’s March meeting and whether there is a chance of a reversion to 50bps or not as money market pricing currently exhibits indecision at roughly 30bps.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

RBA INTEREST RATE PROBABILITIES

Source: Refinitiv

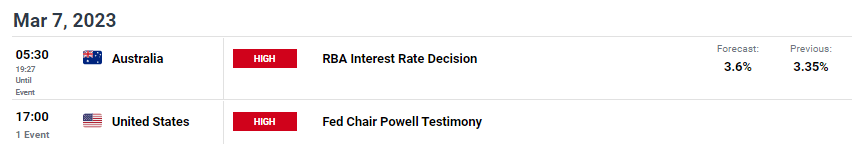

ECONOMIC CALENDAR

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

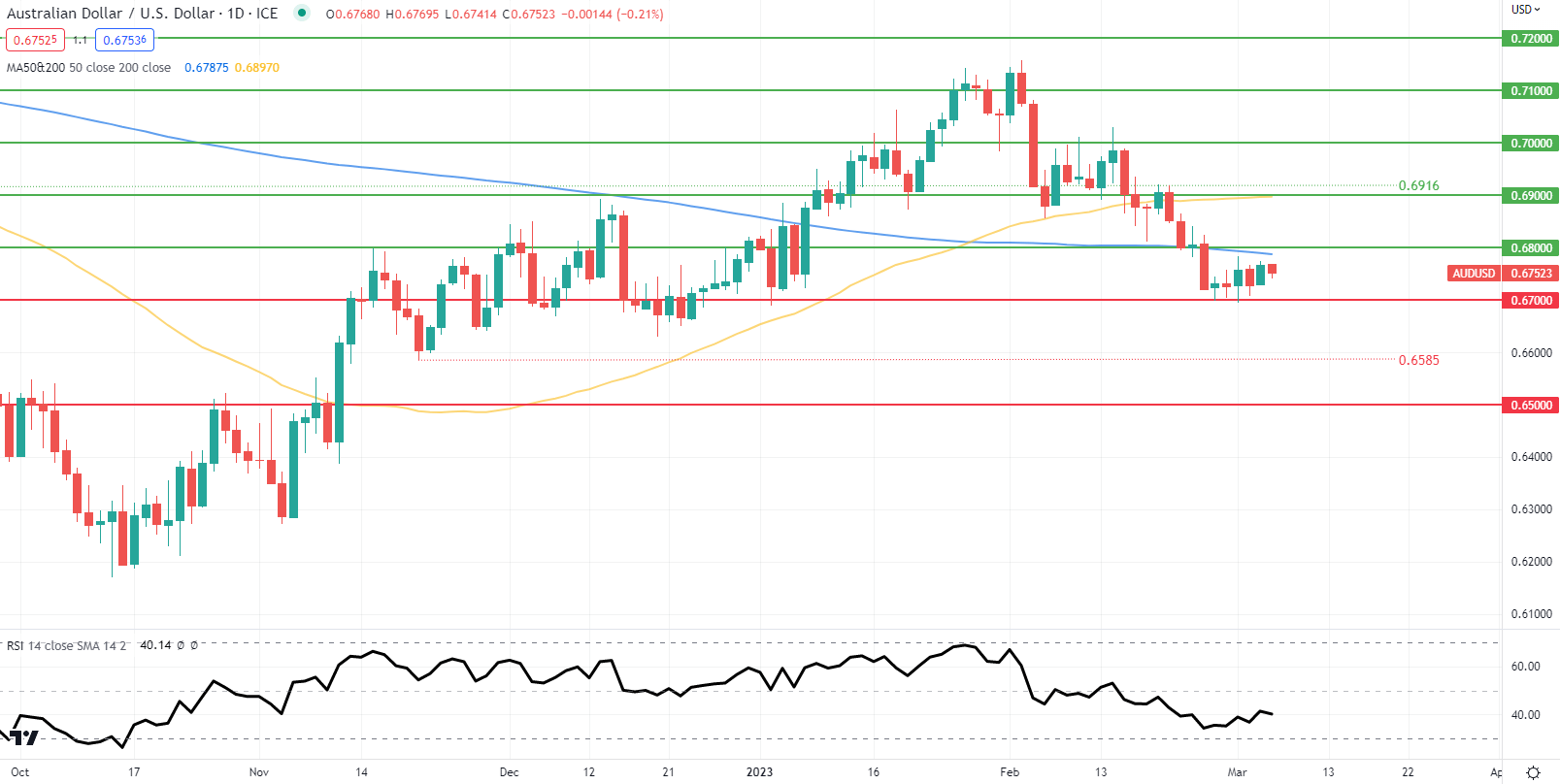

AUD/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Daily AUD/USD price action remains below the 200-day SMA (blue) resistance zone but tomorrow’s fundamental data could see a re-test. A candle close above may point to some short-term bullish backing from a technical analysis standpoint; however, a breach below the 0.6700 psychological support handle could open up further room for bears to extend the downside rally. Although the Relative Strength Index (RSI) is below the 50 level, there is still capacity to push further into oversold territory. Today’s price action should be quite subdued with no high impact data expected likely remaining between the 0.6700 - 0.6800 range.

Key resistance levels:

- 0.6900/50-day SMA

- 0.6800

- 200-day SMA

Key support levels:

- 0.6700

- 0.6585

IG CLIENT SENTIMENT DATA: MIXED

IGCS shows retail traders are currently LONG on AUD/USD, with 70% of traders currently holding long positions. At DailyFX we typically take a contrarian view to crowd sentiment but due to recent changes in long and short positioning we arrive at a short-term cautious bias.

Contact and followWarrenon Twitter:@WVenketas