Euro Price Setups (EUR/GBP, EUR/USD, EUR/JPY)

- EUR/GBP: Downtrend continues as markets price in 6.5% terminal rate for BoE

- EUR/USD: Falling wedge suggests further upside to come

- EUR/JPY: Japanese yen attempts to claw back losses on favourable wage rises

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Euro Fundamental Data Fails to Impress

The economic situation in Europe continues to deteriorate as the latest data points: Eurozone retail sales and German construction PMIs disappoint. Retail sales in the Eurozone during the month of June was flat despite forecasts of a modest 0.2% improvement while German construction PMI moved sizeably lower during the same period. One standout was the German industrial orders which improved 6.4% month on month in May despite a forecasted figure of 1% expected. Looking closer into the data a lot of the increase was due to large-scale orders of ships, spacecraft and military vehicles with the rest of the sector languishing behind.

EUR/GBP: Downtrend continues as markets price in 6.5% terminal rate for the BoE

Rates markets now envision that the Bank of England (BoE) will be forced to hike interest rates to a mammoth 6.5% in an attempt to bring down relentless, widespread price pressures in Britain. Such an upward revision is likely to keep the pound supported versus its G7 peers, it may not necessarily contribute to strong sterling moves. UK households are still grappling with the cost-of-living squeeze even though energy prices have turned lower. Broader price pressures are being experienced and now the major concern for many homeowners is their increasing mortgage repayments.

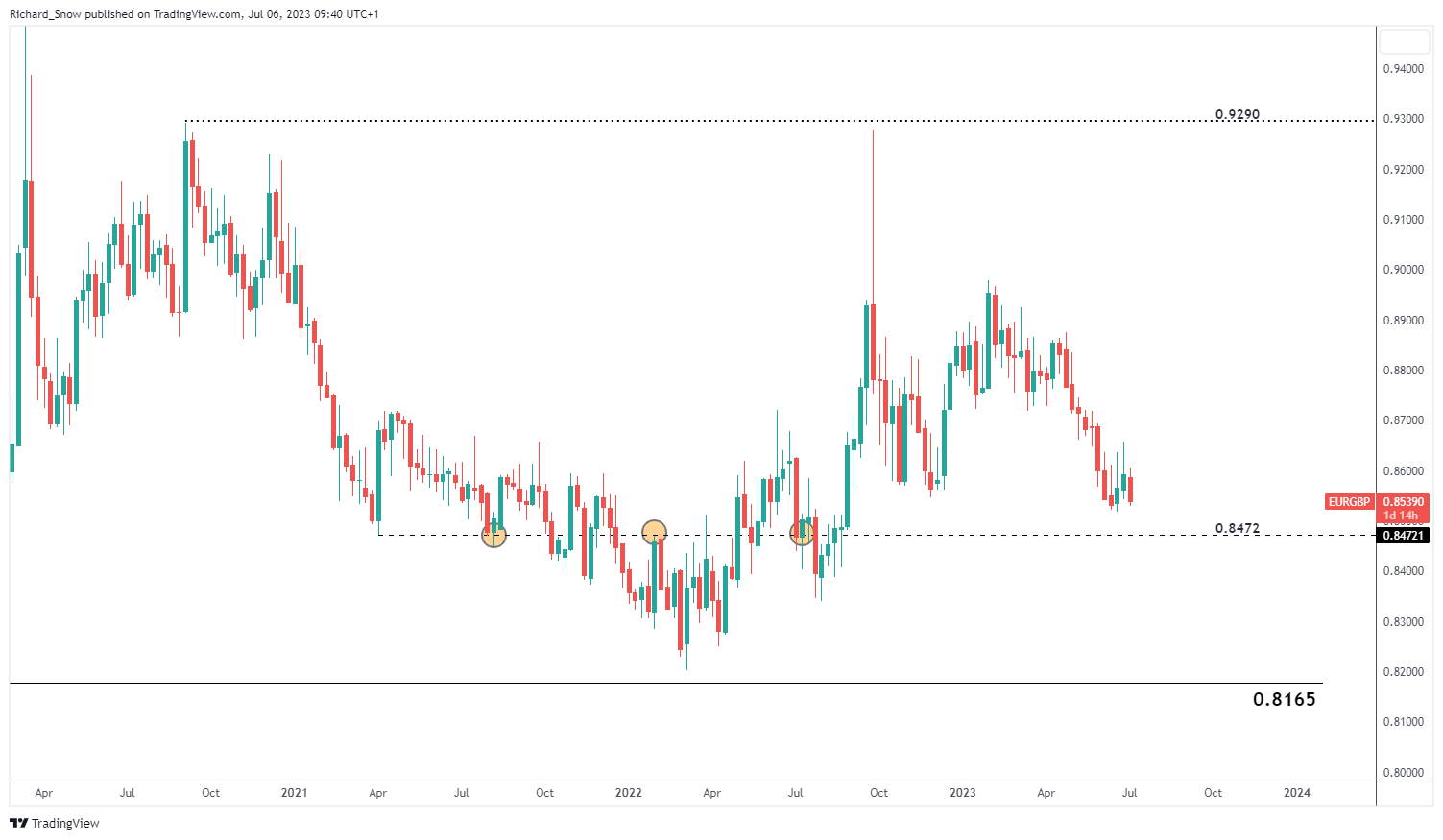

The weekly chart shows the general downtrend in the pair, which has seen a bullish pullback that has now succumbed to the greater, longer-term downtrend. Should price action continue trading lower from here, 0.8472 becomes the next level of support, having provided a pivot point multiple times in the past.

EUR/GBP Weekly Chart

Source: TradingView, prepared by Richard Snow

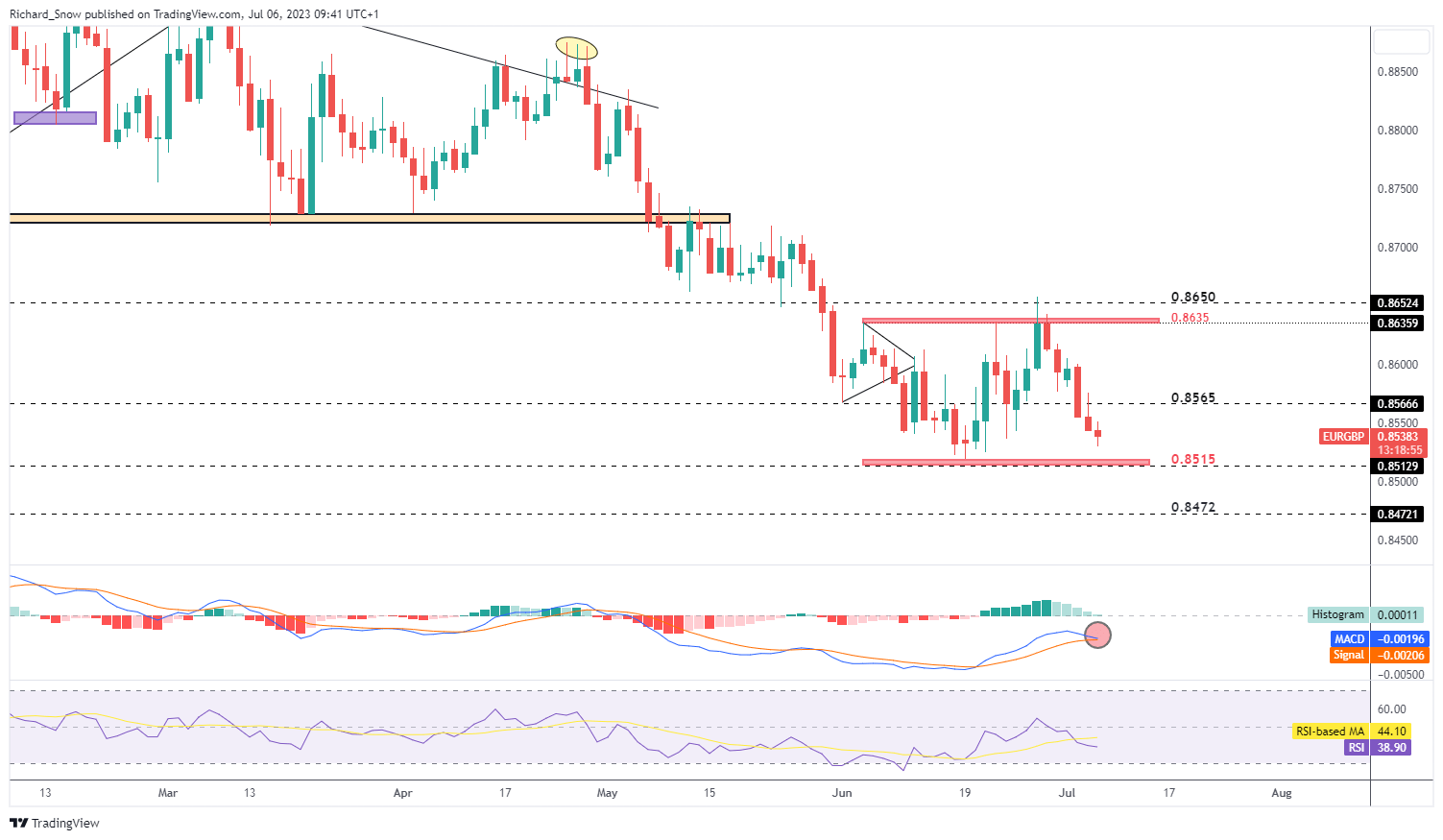

The daily chart reveals a continuation of the range-bound behavior of EUR/GBP. Prices have been broadly contained within the 0.8515 to 0.8635 range, with breaches of the range only being observed on an intraday basis.

After testing and respecting 0.8635, prices have sold off rather consistently, now heading towards 0.8515 again. The MACD is on the verge of a bearish crossover – a signal that momentum is soon to be favouring the downside once more although keep in mind this is a lagging indicator.

A break below 0.8515 could see an immediate retest of the very same level, as resistance this time, before a bearish continuation gathers more credence. Thereafter, 0.8472 appears as the nearest and most relevant level of support. With 0.8515 acting as a tripwire for bearish continuation, it can also prove too much for bears to handle. In that case, a bounce off support would naturally look to 0.8565 as a possible pullback zone.

EUR/GBP Daily Chart

Source: TradingView, prepared by Richard Snow

EUR/USD: Falling Wedge Suggests Potential Upside to Come

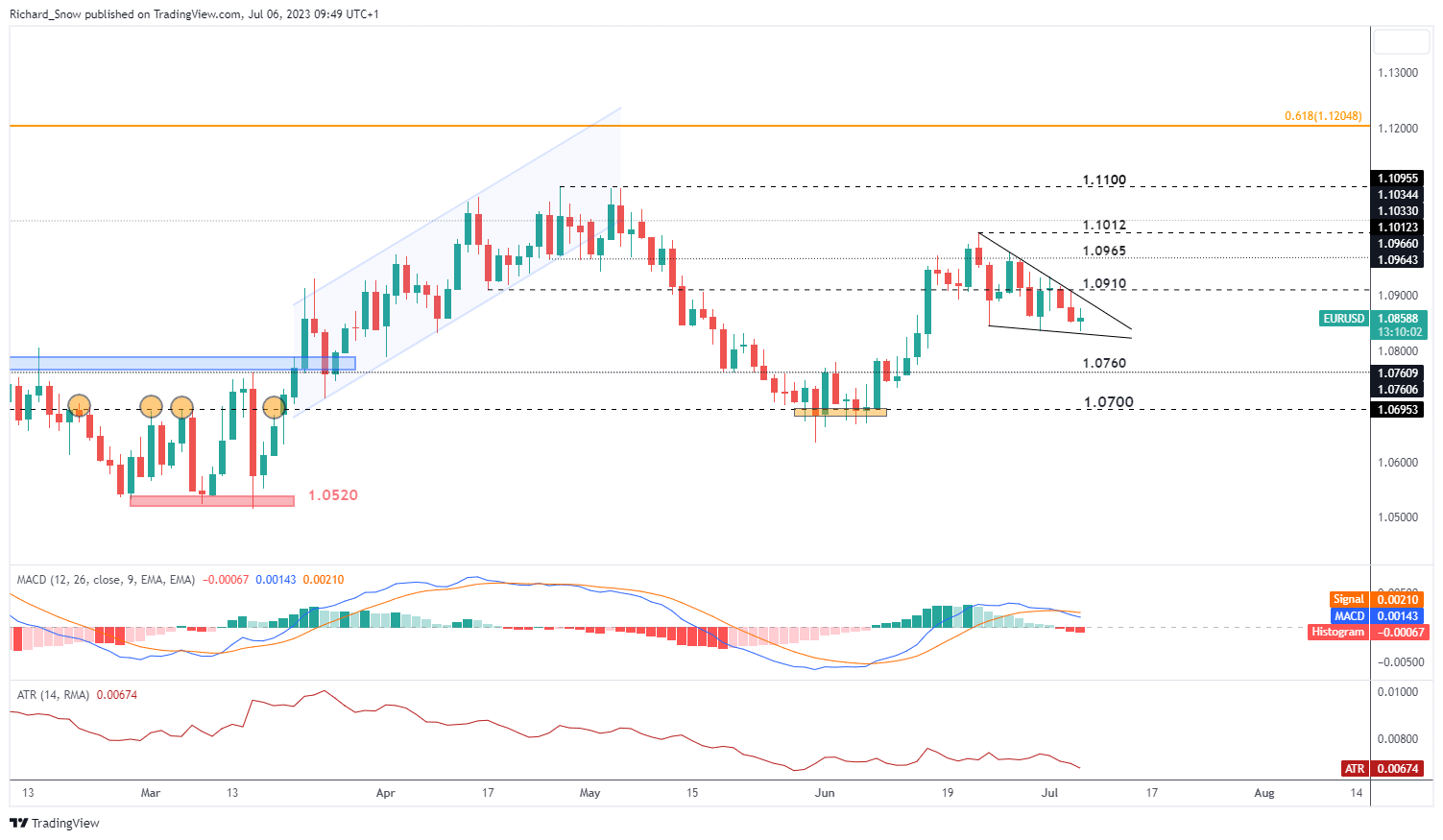

EUR/USD has a rather wavy feel to it, rising and falling in succession as the US and Europe continue to target inflation. However, while the US is seeing positive signs on the part of the economy, Europe appears to be heading in the opposite direction – making sustained rate hikes a much harder sell.

Germany is in a technical recession, even if only just, and manufacturing data drags the rest of Europe lower with it. ECB officials are hoping that reduced economic activity can help bring down core inflation, easing the pressure on the Governing Council to keep hiking into weakness. If markets smell blood in the water, they are likely to hold back on ambitious rate hike expectations, which could see a weaker euro as a result.

The falling wedge suggests the euro hasn’t thrown in the towel and could still see an upside breakout. Levels to watch from here include: the downward sloping trendline resistance and the 1.0910 level which coincides with the April 2023 swing low. Given that the Fed remains of the opinion rates have further to rise, an opinion also held by the ECB, a discernable lack of direction could continue to plague the pair. A bullish impulse would need to breach 1.0965 on the way to 1.1012 for validity, while downside scenarios would need to take into account trendline support and a move below 1.0760 with a daily hold.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

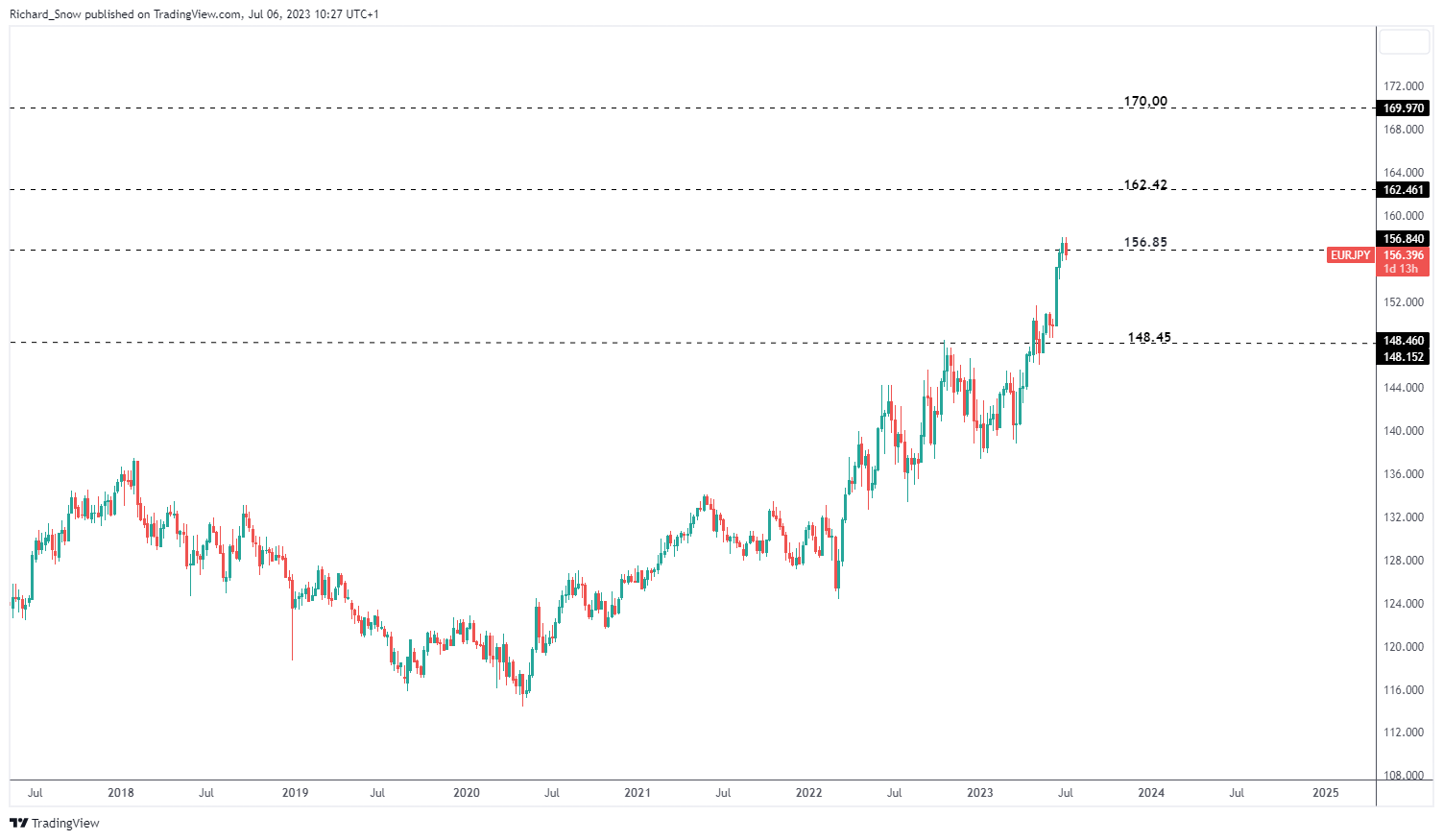

EUR/JPY: The Japanese Yen Attempts to Claw Back Losses

The Japanese yen appears desperate to reclaim some of the consistent losses across G7 FX peers after the Bank of Japan’s (BoJ’s) supportive policy opens the currency up to depreciation. The carry trade has regained popularity as major central banks widen interest rate differentials.

Encouraging wage data in Japan suggested that not only are wages going up, but that the increases are widespread across large and small businesses. Data from Rengo – an umbrella labor union – average wages within the small and medium enterprise (SME) sector rose marginally lower than the wider job market. Rising wages and longer lasting inflation could see the Bank normalize monetary policy but that appears only likely to even be discussed in 2024.

EUR/JPY Weekly Chart

Source: TradingView, prepared by Richard Snow

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX