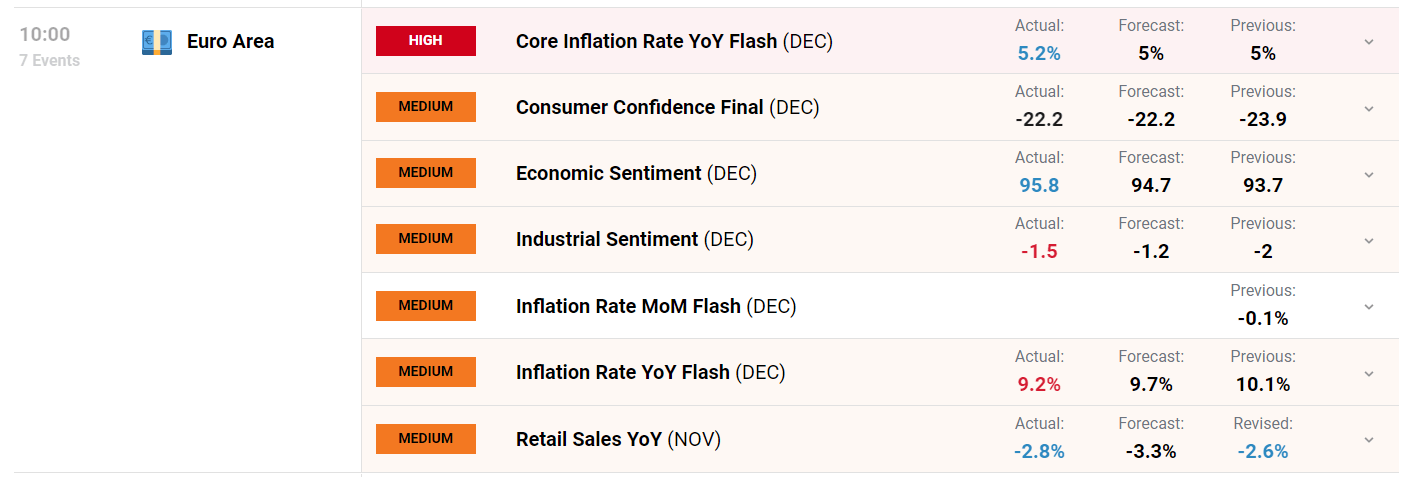

EU Inflation (HICP) Prints Another Lower Figure

- EU headline inflation (estimate) drops from 10.1% to 9.2% YoY

- Core inflation rises from 5% to 5.2% YoY suggesting widespread price pressures remain

- Latvia retains the prize for hottest inflation (20.7%) while Spain has the lowest rate (5.6%)

Customize and filter live economic data via our DailyFX economic calendar

Massive Drop in Energy Prices Helps Cool Euro Inflation – Widespread Price Pressures Remain

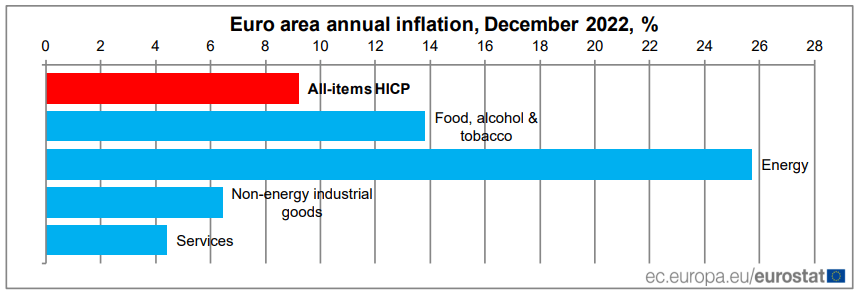

Unsurprisingly, drastically lower energy prices in the eurozone have helped ease the headline measure of inflation where there has been an improvement year on year and month on month – highlighting the trend of lower prices for the EU consumer. While still the biggest contributor to the overall index, energy price increases have come down from 41.5% in October to 25.7% in December according to the estimate. What is noticeable is that price pressure in non-energy or food items trends higher, suggesting that inflation remains fairly widespread.

Source: Eurostat, prepared by Richard Snow

Immediate Market Reaction

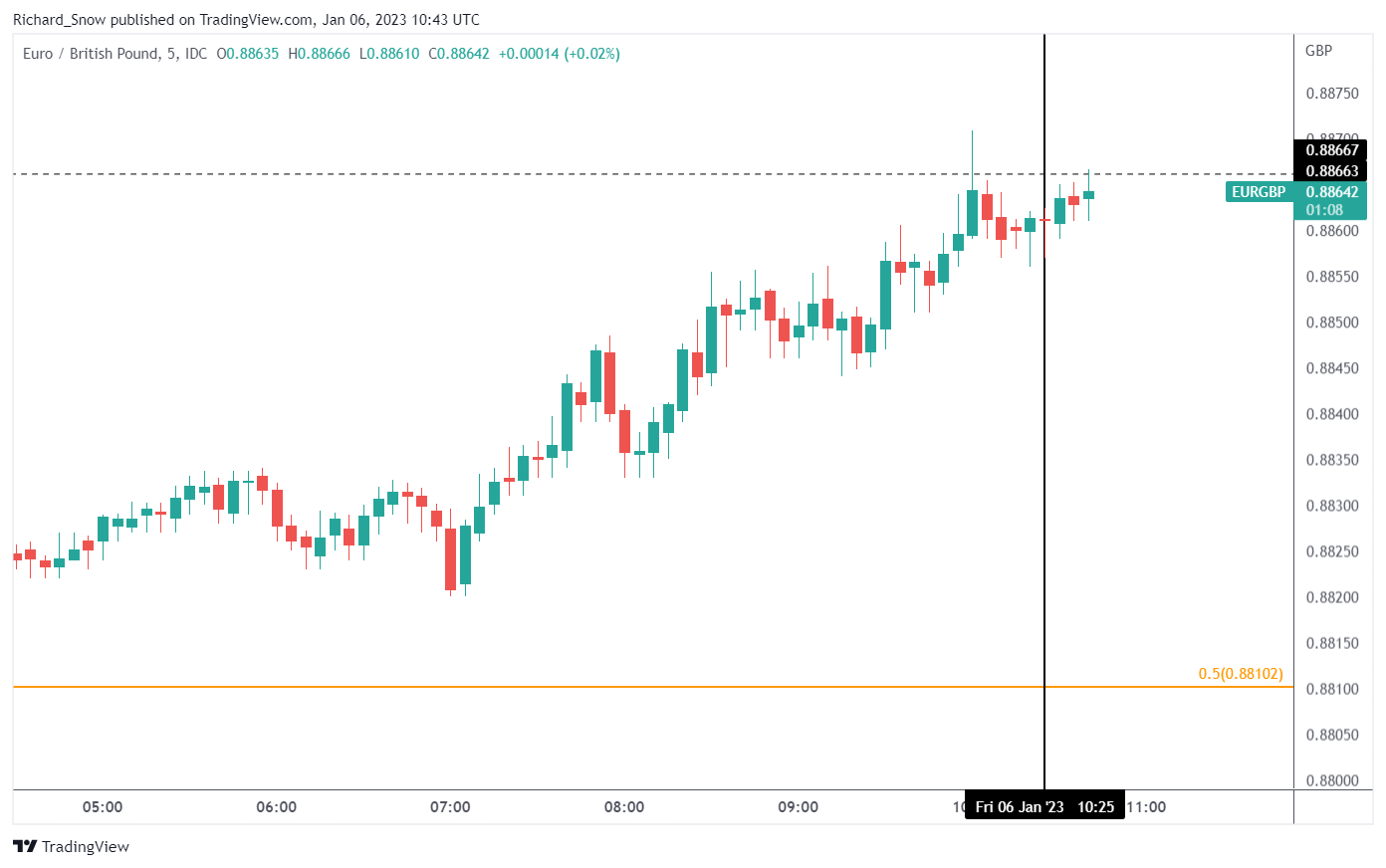

Euro reaction has been very slight, which is understandable ahead of US non-farm payroll data due later today. The consistent grind higher in EUR/GBP however, highlights a rather important level for the pair (0.8867) when viewed on the daily chart – the October 2022 high and the level that met a fair amount of resistance at the end of December. Traders ought to watch this level with interest as fundamental drivers pick up later today and into next week when the U.S. release their consumer inflation report.

EUR/GBP 5-Minute Chart

Source: TradingView, prepared by Richard Snow

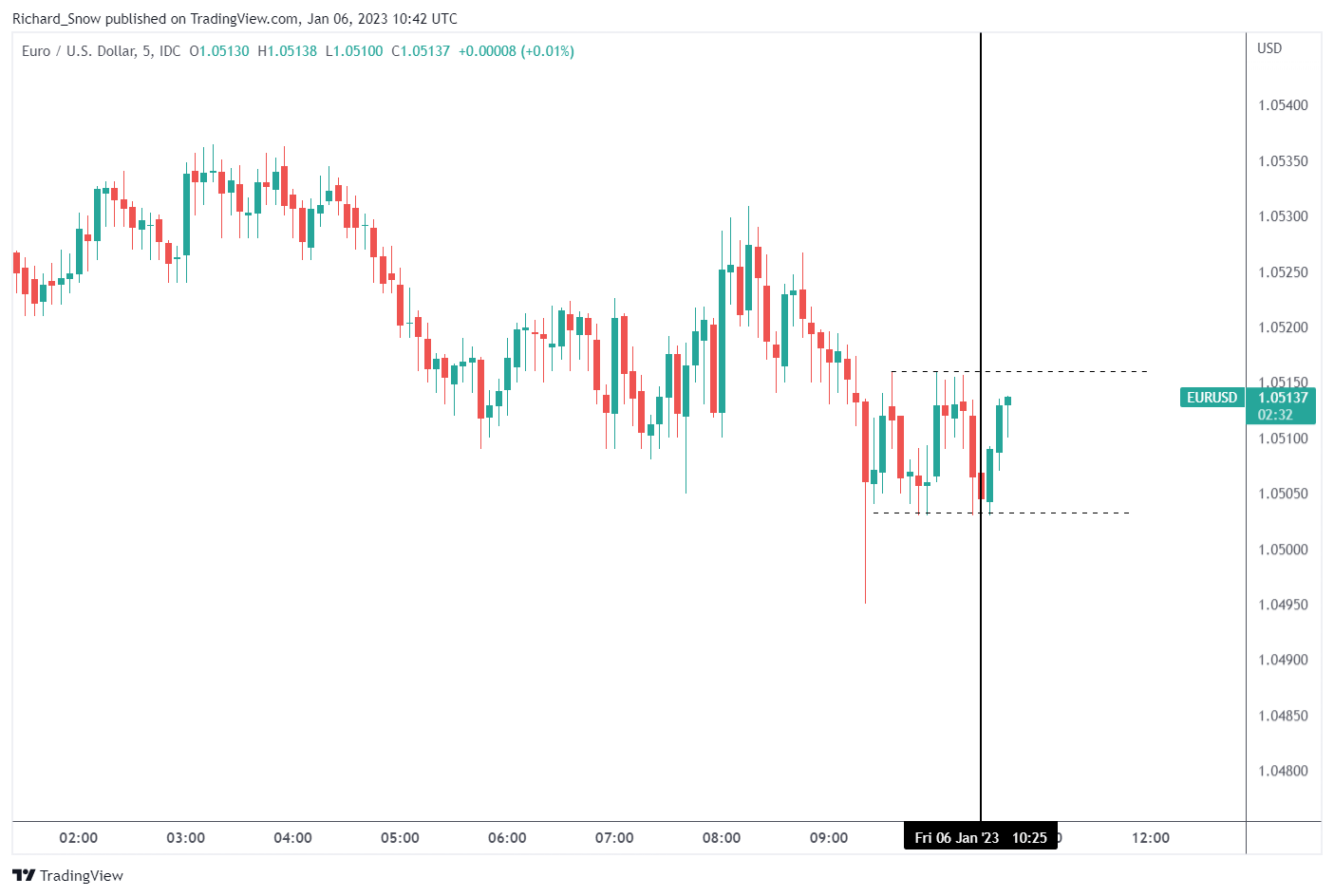

The EUR/USD pair rose slightly but continues within the very short-term range that developed ahead of the data. Focus shifts to NFP and US services PMI data later today.

EUR/USD 5-Minute Chart

Source: TradingView, prepared by Richard Snow

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX