Crude Oil, WTI, Contango, Risk Aversion – Asia Pacific Market Open

- Crude oil prices crushed as futures market entered contango Friday

- Cautious risk aversion on Wall Street sets sour tone for Asia trade

- WTI Ascending Triangle breakout continues to gather momentum

Asia-Pacific Market Briefing

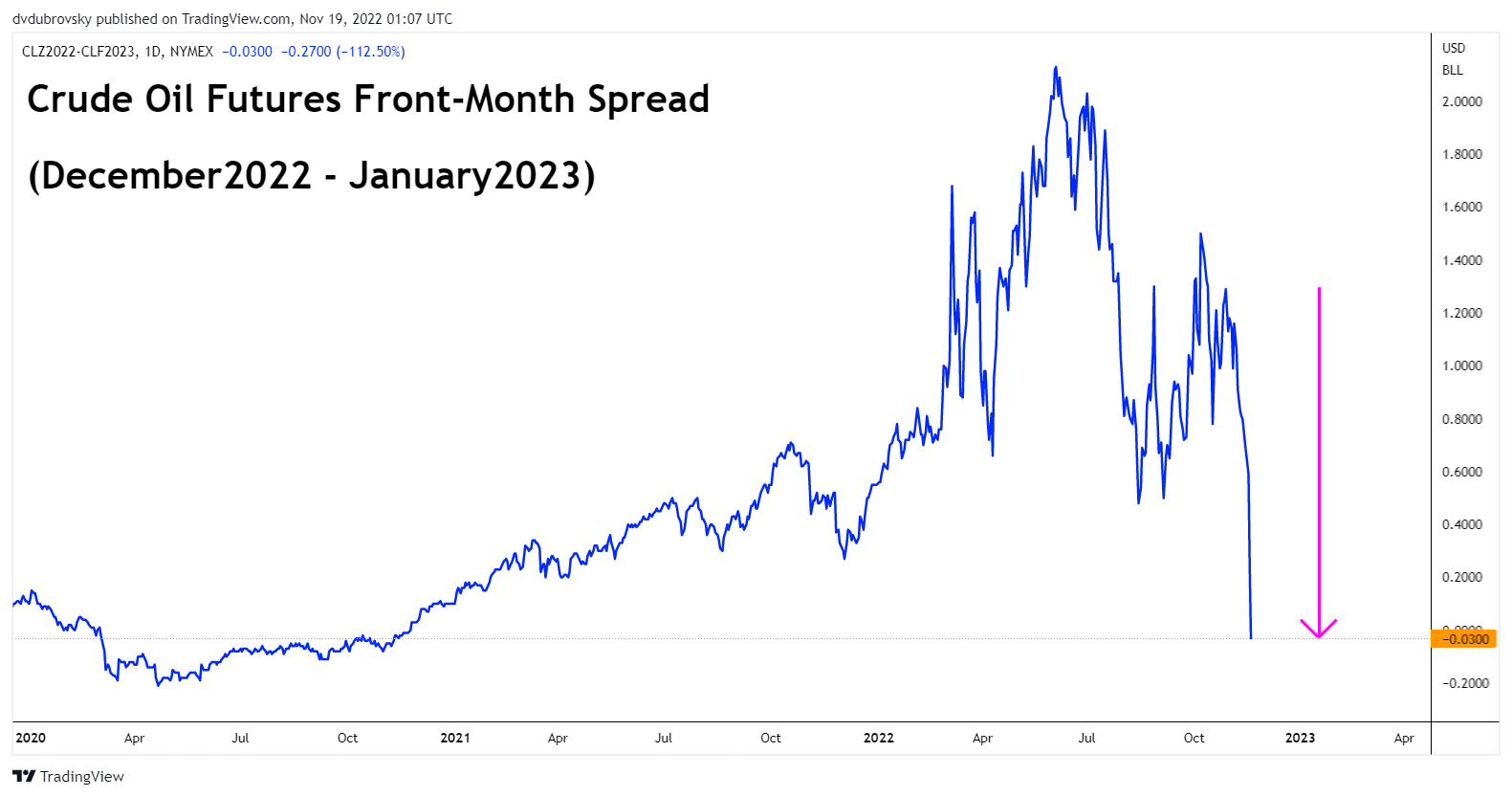

Crude oil prices are looking vulnerable as the new trading week gets underway. On Friday the front-month spread in WTI futures went into contango for the first time in about one year – see chart below. This is what happens when the futures price is higher than the spot level, often an issue of near-term supply-demand imbalances. For the oil market, this is very bearish.

This past week, we have seen a slew of hawkish Fedspeak cross the wires. The messages coming from officials have been pretty straightforward. While the pace of tightening is likely to slow ahead, the Federal Reserve remains committed to raising rates. St. Louis President James Bullard noted that at a minimum, he sees rates around 5 – 5.25%.

In fact, this past week, newsflow from central bank officials has been helping to cool the decline in Treasury yields and bolster the US Dollar. A combination of global monetary tightening and a rising Greenback are working in tandem to depress oil prices. This is despite recent efforts from OPEC+ members to reduce output ahead.

Crude Oil Futures Front-Month Spread

Monday’s Asia Pacific Trading Session – Watch out for Sentiment

Monday’s Asia-Pacific trading session is looking fairly light. New Zealand credit card spending will cross the wires at 2 GMT, but NZD/USD is likely awaiting this week’s RBNZ rate decision for its next big move. The cautious risk aversion from Friday’s Wall Street session may set a sour tone for markets to start things off. That may place crude oil prices at risk.

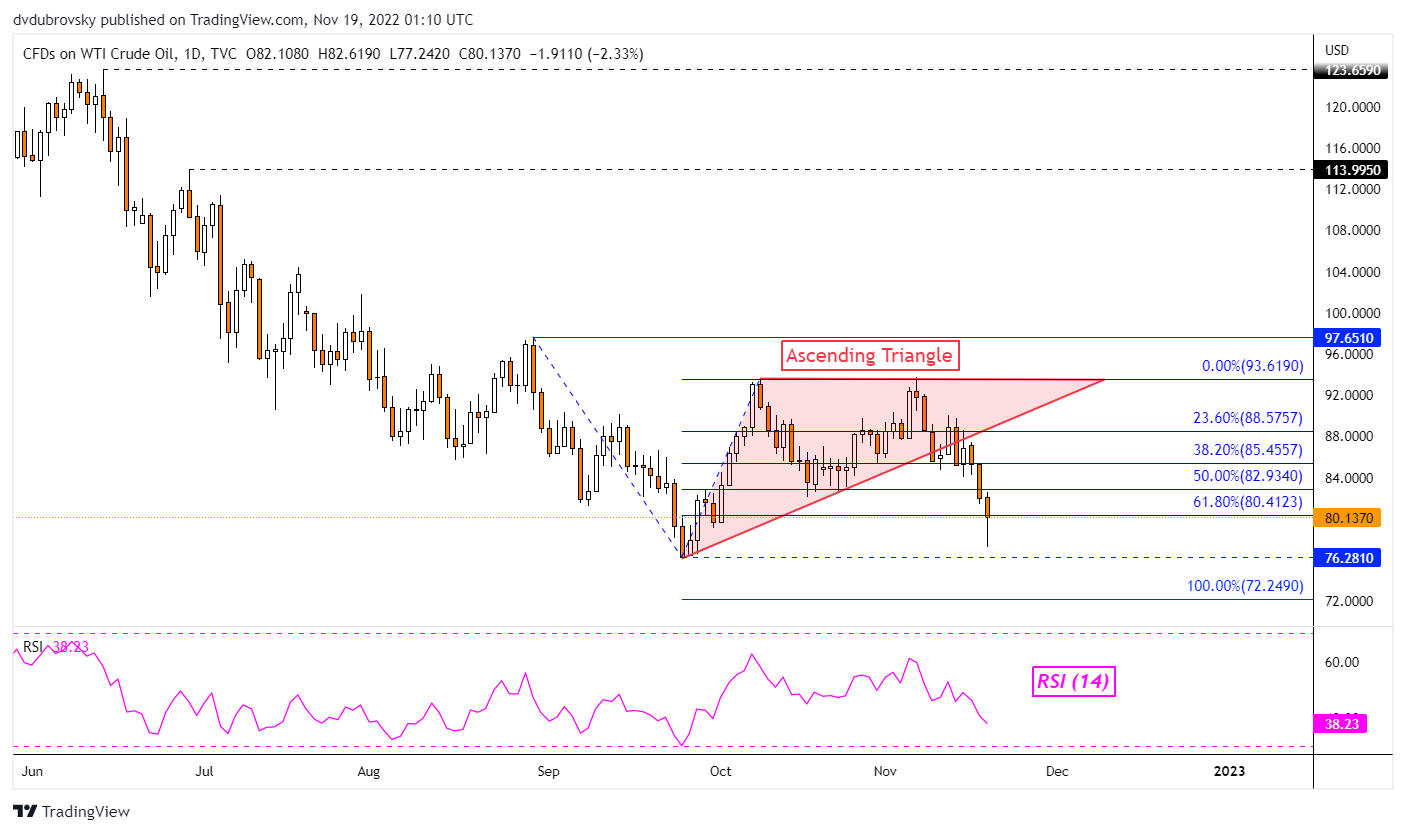

Crude Oil Technical Analysis

Crude oil prices have continued to make downside progress below an Ascending Triangle chart formation. The ultimate target of the triangle could set WTI on course to breach the September low at 76.281, exposing the 100% Fibonacci retracement level at 72.249. Otherwise, a turn back higher places the focus on the midpoint of the extension at 82.934.

WTI Daily Chart

--- Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

To contact Daniel, follow him on Twitter:@ddubrovskyFX