US NFP Preview:

- Consensus forecasts are looking for jobs growth of +268K while the unemployment rate (U3) is anticipated to hold at 3.6%.

- With rates markets favoring another 75-bps rate hike in July, the question for risk assets – stocks, commodities – is good news bad news?

- Will the June US jobs report change the Federal Reserve’s rate hike path? We’ll discuss these questions and more in context of the June US nonfarm payrolls report starting at 8:20 EDT/12:20 GMT. You can join live by watching the stream at the top of this note.

Good News is Bad News? Or…

US recession fears continue to grow after a spat of weaker than expected US data. But the Federal Reserve’s messaging is clear: a recession is possible, if not warranted, if it means bringing down multi-decade highs in inflation rates. There is one area of the US economy that remains resilient, however: the labor market.

According to a Bloomberg News survey, the US economy added +268K jobs in June from +390K jobs in May, with the US unemployment rate (U3) holding steady at 3.6%. The US participation rate is expected to edge higher to 62.4% from 62.3%, while US average hourly earnings are anticipated to come in at +5% y/y from 5.2% y/y.

With rates markets favoring another 75-bps rate hike in July, the question for risk assets – stocks, commodities – is good news bad news? That is, would a strong US jobs report provoke the Fed into a more hawkish stance? On the other hand, elevated Fed hike odds have been one of the major reasons for a stronger US Dollar, so for at least the greenback, good news about the US labor market would be, well, good news.

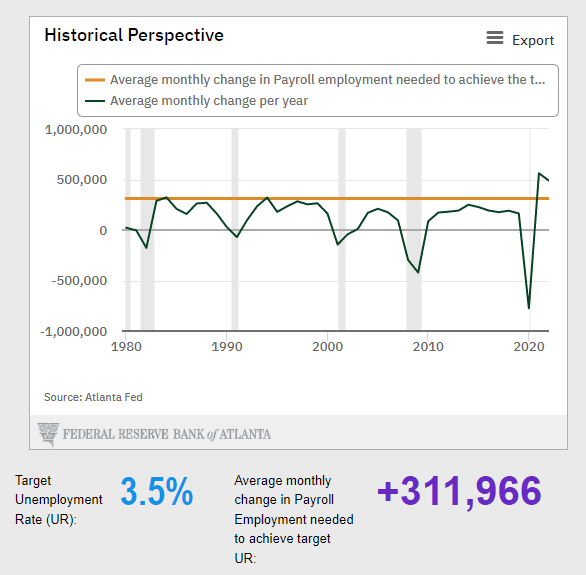

Atlanta Fed Jobs Growth Calculator (June 2022) (Chart 1)

The US economy continues to make steady progress towards ‘full employment’ as experienced pre-pandemic. According to the Atlanta Fed Jobs Growth Calculator, the US economy needs +312K jobs growth per month over the next 12-months in order to return to the pre-pandemic US labor market of a 3.5% unemployment rate (U3) with a 63.4% labor force participation rate.

We’ll discuss these questions and more in context of the June US nonfarm payrolls report starting at 8:20 EDT/13:20 GMT. You can join live by watching the stream at the top of this note.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

--- Written by Christopher Vecchio, CFA, Senior Strategist