Price Action Talking Points:

- It’s been a busy day in the headlines but on the charts, very little excitement has shown in USD or EUR/USD.

- Elsewhere, however, may produce items of interest in a few other pairings, as looked at in this webinar.

- DailyFX Forecasts are published on a variety of markets such as Gold, the US Dollar or the Euro and are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

Yesterday’s FOMC rate decision didn’t offer much in the realms of clarity. The Fed did cut rates again for the second time this year, following nine rate hikes through 2015-2018. But, the dot plot matix was unclear as to whether another cut was coming this year or in 2020 as the FOMC attempted to strike a tone of stability. At this point, nothing has yet broken: The US Dollar remains in a range as does EUR/USD, and the S&P 500 is back above the 3k marker. But -that doesn’t mean that this theme is over and for traders, it may be time to try to look for what may be around-the-next-corner.

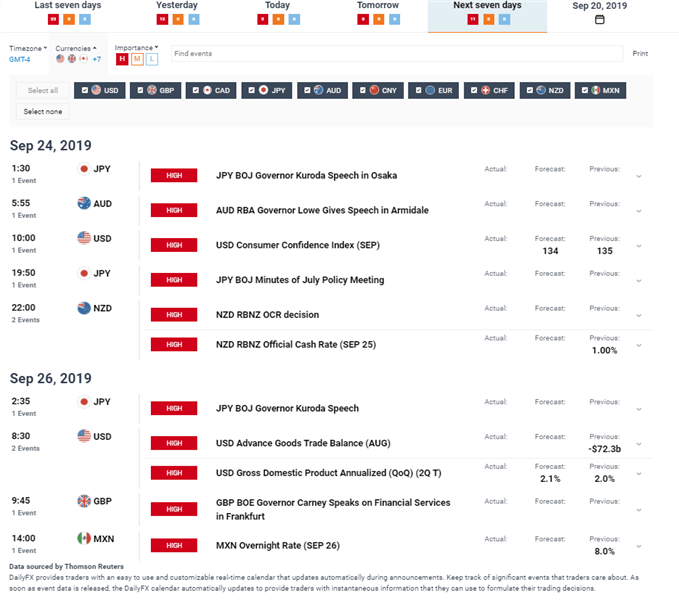

Next week’s economic calendar is rather busy and this could certainly prod some volatility across markets.

DailyFX Economic Calendar – High Impact Events for Next Week

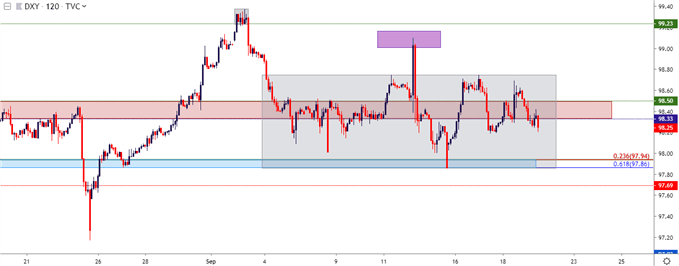

US Dollar Sticks to Range

Given the events over the past day this may be at least a little surprising but, the US Dollar remains in its near-term range. This range has remained in-play through both the ECB QE announcement as well as the FOMC rate cut.

Chart prepared by James Stanley; US Dollar on Tradingview

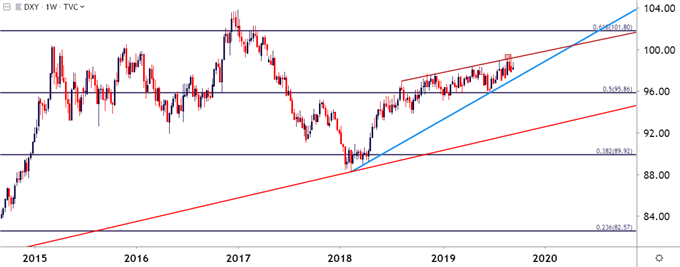

My personal bias here remains bearish, largely taken from the longer-term rising wedge formation that remains in-play.

US Dollar Weekly Price Chart

Chart prepared by James Stanley; US Dollar on Tradingview

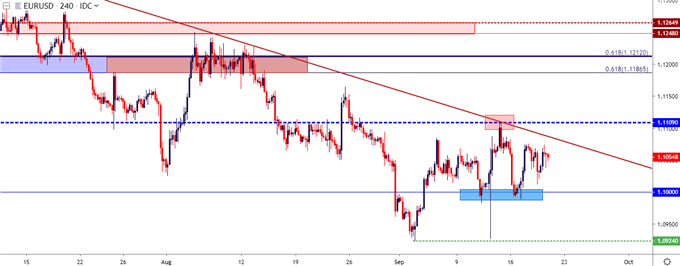

EUR/USD Non-Directional for Now

Similarly, EUR/USD hasn’t shown much for direction of recent, and this keeps the pair in an unattractive spot for picking on trends.

EUR/USD Four-Hour Price Chart

Chart prepared by James Stanley; EURUSD on Tradingview

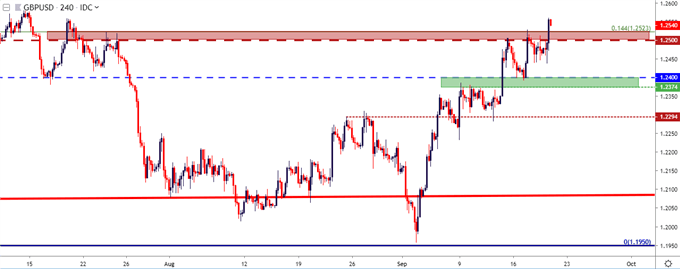

GBP/USD: Fresh Highs, Topside Potential for Bearish-USD Scenarios

I’ve been following GBP/USD for some time now on the long side, looking for a continued bounce from a long-term trendline that came into play in August. During the webinar prices burst up to another fresh six-week-high, keeping the door open for more.

At this stage, support potential exists around prior resistance, as taken from the 1.2500-1.2523 area on the chart.

GBP/USD Four-Hour Price Chart

Chart prepared by James Stanley; GBPUSD on Tradingview

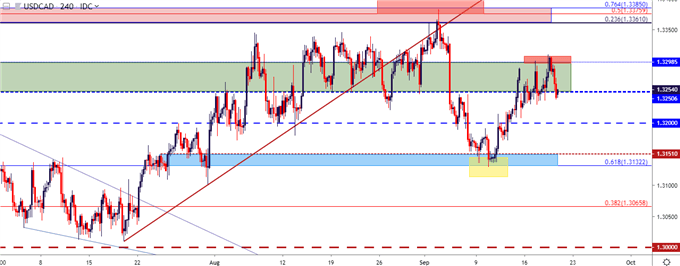

USD/CAD

Also on the bearish side of the US Dollar, USD/CAD can remain as attractive.

USD/CAD Four-Hour Price Chart

Chart prepared by James Stanley; USDCAD on Tradingview

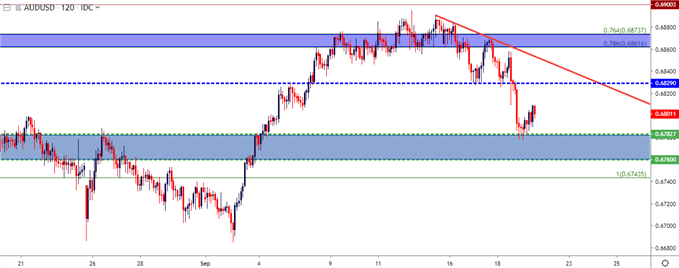

AUD/USD for Bullish-USD Scenarios

On Tuesday I looked at a potential topping setup in AUDUSD as a resistance area had helped to hold the highs. Prices had already begun to tip-toe lower but, in response to the FOMC rate decision, price action quickly ran down to the first target area where a bit of support began to develop. In the webinar, I looked at mannerisms of continuation in that short-side theme.

AUD/USD Two-Hour Price Chart

Chart prepared by James Stanley; AUDUSD on Tradingview

USD/CHF Sticks to Channel

Also on the long side of the US Dollar, USD/CHF can remain of interest. Price action remains in the bullish trend channel that’s been going for a month now, and support potential exists around the .9902 Fibonacci level.

USD/CHF Two-Hour Price Chart

Chart prepared by James Stanley; USDCHF on Tradingview

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts have a section for each major currency, and we also offer a plethora of resources on Gold or USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers an abundance of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX