GOLD MARKET OUTLOOK – SUMMARY:

- Real Vision hosts Rick Rule, President and CEO of Sprott US Holdings, for a discussion on the critical role of gold in investor portfolios and trading accounts

- Gold outlook remains attractive due the cyclical nature of markets and because of the precious metal’s insurance-like properties

- Take a look at What Affects Gold Prices – a Commodity Trader’s Guide

The price of gold has been on an absolute tear this year seeing that spot prices have climbed over 15% through October. The surge higher in gold follows last year’s downturn with the commodity rebounding to its highest level since March 2013 this past August.

More recently the commodity has drifted lower from its year-to-date highs around the 1,550 mark, but Rick Rule – President and CEO of Sprott US Holdings – discusses the benefits of owning gold and why investors should incorporate gold positions along with other commodities into their asset allocations.

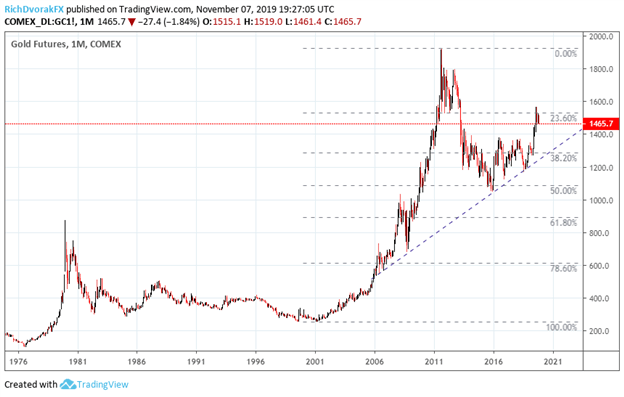

GOLD PRICE CHART: MONTHLY TIME FRAME (JANUARY 1975 TO NOVEMBER 2019)

Chart created by @RickDvorakFX with TradingView

Rick Rule argues that gold holdings, whether it be physical gold (i.e. bullion) or gold securities (e.g. gold related equites), is perceived broadly as a store of value that tends to do well in periods of time when nothing else does well. He further extrapolates that positions in gold should be looked at as an insurance asset or hedge – not solely from the perspective of an income producing asset.

While gold has generally fallen out of favor relative to demand for the commodity 40 years ago, Rick Rule claims that is not necessarily a bad thing for gold bulls. Rick adds that gold and precious metal equities accounted for roughly 8% of investable asset market share in the US, but that figure is now much closer to 0.25-0.50% with the 40-year median running around 1.5% market share. According to Rick, gold does not need to reclaim the same degree of dominance, but demand could potentially triple driven by a mean-reversion back to historical levels.

--- Produced by Real Vision©

GOLD TRADING RESOURCES:

- Check out the top Gold Trading Strategies

- Read up on How to Trade the Gold-Silver Ratio

- Download the DailyFX Gold Forecast for comprehensive fundamental and technical outlook on gold prices

- IG Client Sentiment data provides insight on spot gold trader positioning and details the bearish or bullish bias of market participants