Highlights:

- EUR pullbacks across the board if the ECB attempts to ‘talk down’ the currency could be a gift

- EUR/JPY in focus given dual central bank focus, though no policy adjustments are expected

- Oil Bulls finds notes of hope in weekly EIA numbers with 4.7m barrel draw and pop in demand

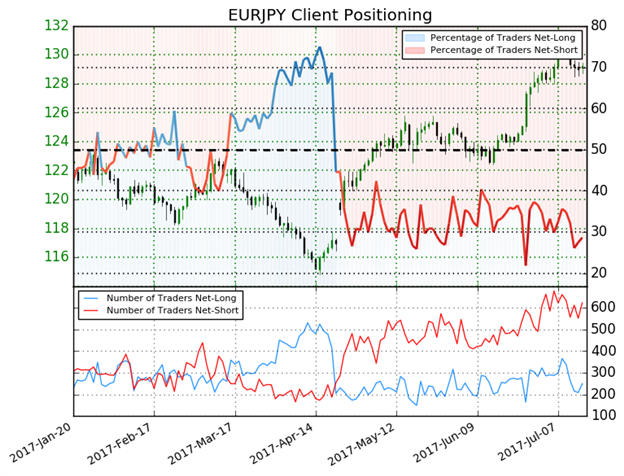

- Sentiment Highlight: Bullish EUR/JPY as Bull’s leave the scene of the crime

The EUR appears to have stalled ahead of the ECB meeting that will share the spotlight with the Bank of Japan (see EUR/JPY trader sentiment below) on Thursday. However, an ECB stall and dip, should one occur post-ECB should not be confused with a top. Calling a top is for the ego more than the trader’s ledger, but it’s worth noting that multiple developments are emerging in the European Bond market that shows the ECB is being taken at their word that tapering will come. Traders appear to be looking for more details to be made available in the coming months with either the Draghi speech at Jackson Hole between August 24-26 (where Bernanke announced QE3 in 2012) or the September ECB meeting when the economic projections are updated. Either way, a dip in EUR may turn out in the wash as a buying opportunity, and a break of the range (see chart below) could be indicative of a fundamental change in the behavior in the currency over the coming years.

Many traders look to EUR value in the eyes of EUR/USD, but EUR/JPY has acted similarly as EUR/USD in that they’ve both moved higher by ~6% on the year. JPY and USD have recently been switching the notorious honor of relatively weakest currency in the G10. However, the JPY bears have one up on the USD bears. The Bank of Japan is expected to be the only major central bank that sits on ultra-easy policy through 2018, and BoJ governor recently said it was “generally unthinkable” that the easing program would be significantly altered without hitting their inflation target. In other words, a EUR dip may be more valuable for EUR/JPY Bulls that EUR/USD Bulls. Either way, we will see.

In today’s program, we took a look at multiple signs from the fixed income market that risk-on remains the default expectation in markets. Whether you look at falling fixed income implied volatility, shrinking sovereign yield spreads, or the rise in Emerging Market FX space there appears to be a harbinger that risk-on sentiment, higher stocks, lower JPY is the anticipation of the market. You can watch the video attached to get a fuller explanation of signs that risk on sentiment reigns.

Are you looking for trading ideas? Our Q3 forecasts are fresh and ready to light your path. Click here to access for FREE.

After an EIA report showing that US Crude inventories fell by 4.7m barrels alongside gasoline stockpiles, Crude found buyers that look to be taking the market toward key resistance of $47.29-$48.20. Oil remains below $50/bbl, but the report showed that Saudi is sending the least supplies to the US since 2010 in efforts to help reduce the Oil glut was encouraging. Of course, US production continues to be a concern, but a push higher through $47.29-$48.20 and close above on a daily basis could cause a short-covering rally that many decide to chase to OPEC’s applause.

Recommended: Crude Oil Price Forecast: Bulls Have Reason To Cheer The EIA Report

Join Tyler in his Daily Closing Bell webinars at 3 pm ET to discuss tradeable market developments.

Closing Bell’s Top Chart: July 19, 2017, EUR/USD may pull-back from resistance, but Bull's shouldn't give up hope

Chart Created by Tyler Yell, CMT

Tomorrow's Main Event: JPY BOJ Monetary Policy Statement + SSEUR ECB President Mario Draghi Holds Press Conference

IG Client Sentiment Highlight: Bullish EUR/JPY as Bull’s leave the scene of the crime

The sentiment highlight section is designed to help you see how DailyFX utilizes the insights derived from IG Client Sentiment, and how client positioning can lead to trade ideas. If you have any questions on this indicator, you are welcome to reach out to the author of this article with questions at tyell@dailyfx.com.

---

Written by Tyler Yell, CMT, Currency Analyst & Trading Instructor for DailyFX.com

To receive Tyler's analysis directly via email, please SIGN UP HERE

Contact and discuss markets with Tyler on Twitter: @ForexYell