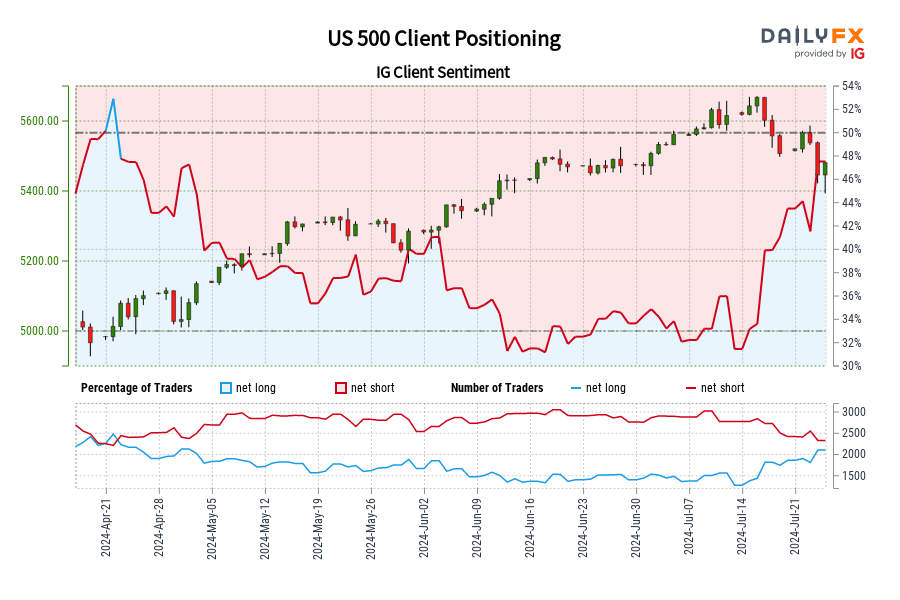

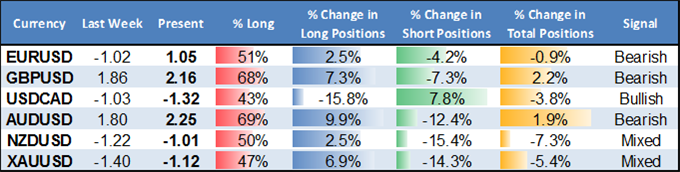

- Retail forex trader sentiment points to further US Dollar gains, Euro declines

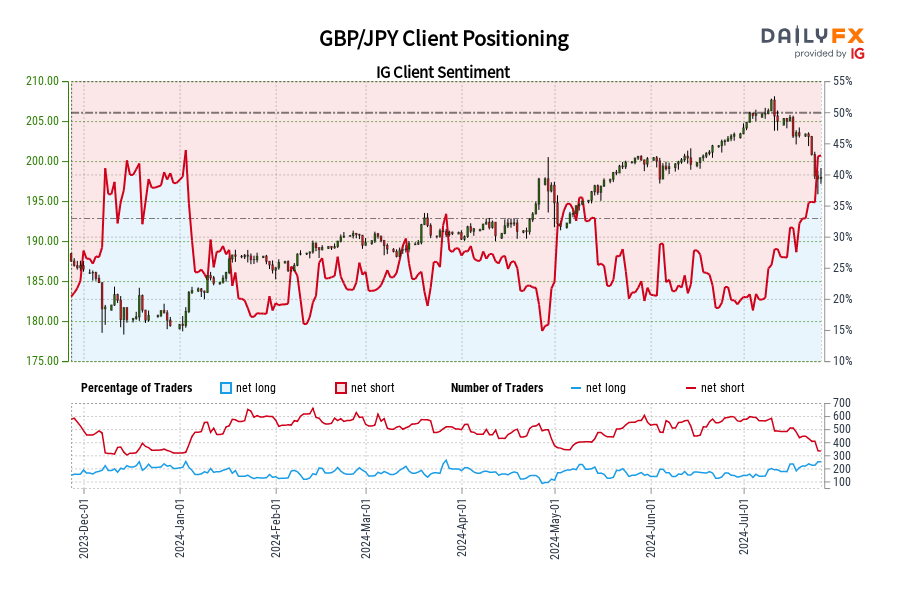

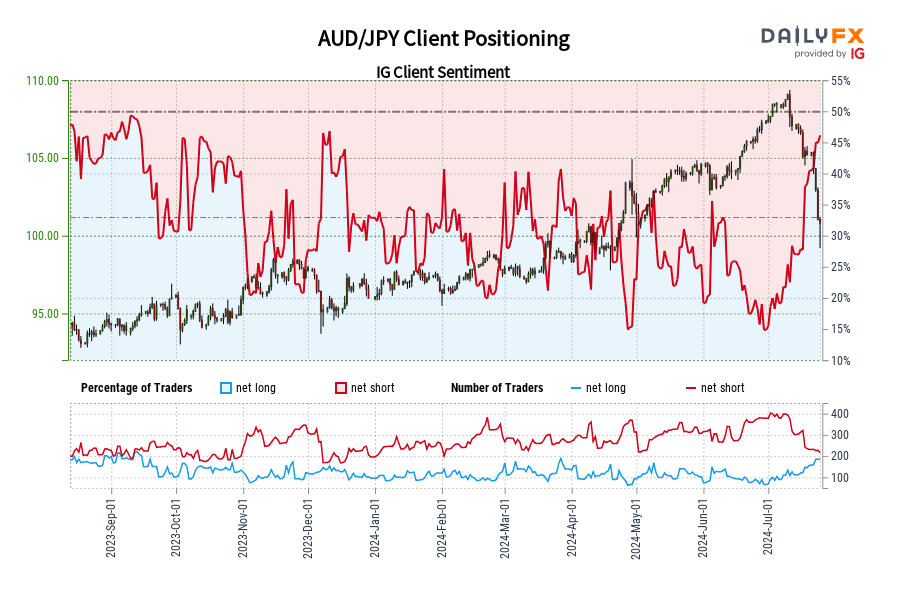

- Yet US Dollar remains in a position to strengthen versus British Pound, Australian Dollar

- Why do we use retail sentiment as a contrarian indicator? View our guide and download here

Receive the Weekly Speculative Sentiment Index report via PDF via David’s e-mail distribution list.

View individual currency sections:

EURUSD - Euro Forecast to Fall even Further until this Changes

GBPUSD - British Pound Remains at Risk of Further Declines

USDCAD - US Dollar Targets Fresh Highs versus Canadian Dollar

AUDUSD - Aussie Dollar Forecast Unchanged – Further Losses Likely

NZDUSD - New Zealand Dollar Rally Proves Short-Lived

XAUUSD - Gold Prices May have Turned versus the US Dollar

Weekly Summary of Forex Trader Sentiment and Changes in Positioning

Our retail forex trader data warns that the Euro will likely continue lower as the US Dollar rallies across the board. Here’s what we’re watching.

Why and how do we use the SSI in trading? View our video and download the free indicator here

See specific US Dollar forecasts in the sections above, and sign up for future e-mail updates via this author’s e-mail distribution list.

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com

To receive the Speculative Sentiment Index and other reports from this author via e-mail, sign up for his distribution list via this link.

Contact David via

Twitter at http://www.twitter.com/DRodriguezFX