Why and how do we use the SSI in trading? View our video and download the free indicator here

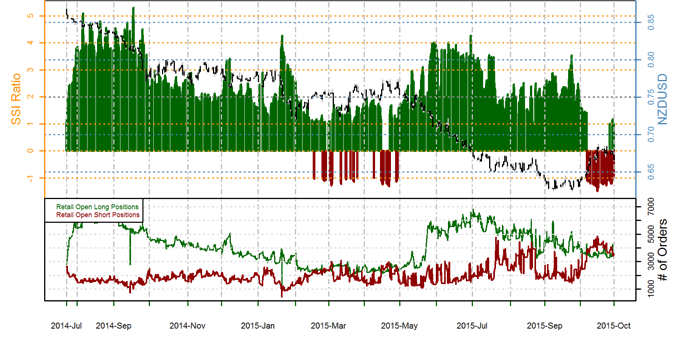

NZDUSD – A shift in retail forex trader positions warns that the recent New Zealand Dollar rally may prove short-lived. Last week we wrote that a strong reversal in trader sentiment pointed to renewed NZD/USD strength as the crowd suddenly sold into Kiwi Dollar gains. Yet total open short positions declined by a notable 15 percent in the past week, and overall positions are now almost exactly flat—leaving us with little clear trading bias in the days ahead.

See next currency section: XAUUSD - Gold Prices May have Turned versus the US Dollar

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com

To receive the Speculative Sentiment Index and other reports from this author via e-mail, sign up for his distribution list via this link.

Contact David via

Twitter at http://www.twitter.com/DRodriguezFX

Facebook at http://www.Facebook.com/DRodriguezFX