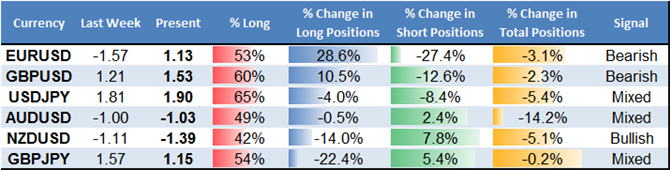

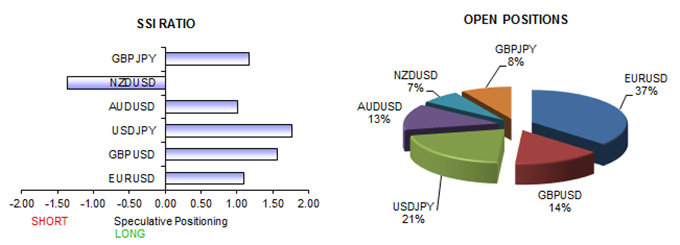

- Sharp shift towards US Dollar-selling gives contrarian warning it may continue higher

- A sharp drop in forex volatility nonetheless gives pause, next market moves are critical

- See full analysis below in individual currency sections

Receive the Weekly Speculative Sentiment Index report via PDF via David’s e-mail distribution list.

View individual currency sections:

EURUSD - Euro Forecast Turns Bearish as it Breaks $1.13

GBPUSD - Sharp Shift in Sentiment Warns of British Pound Weakness

USDJPY - USDJPY Rallies Should be Sold, Dips Bought

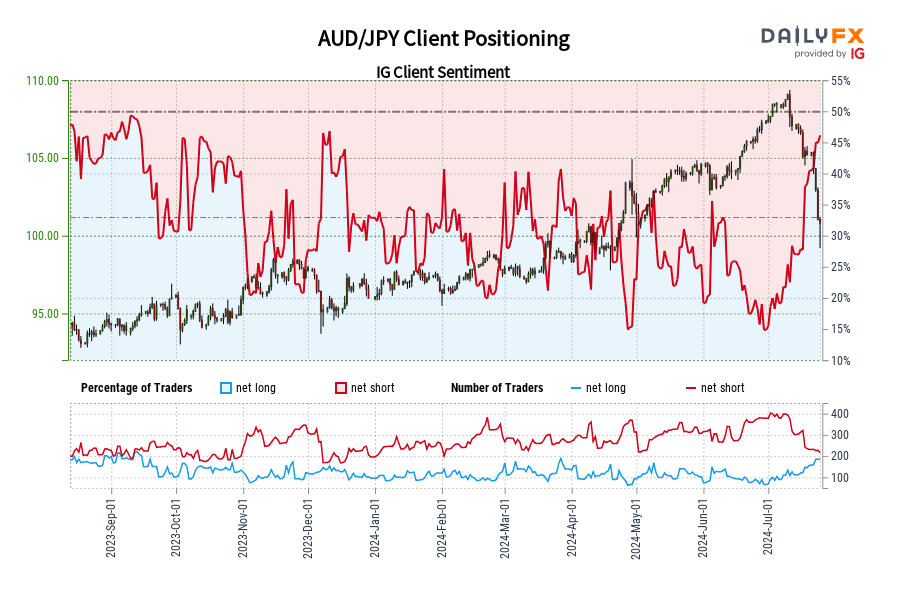

AUDUSD - Australian Dollar at Risk of Turn Lower

NZDUSD - New Zealand Dollar Rally May be Cut Short

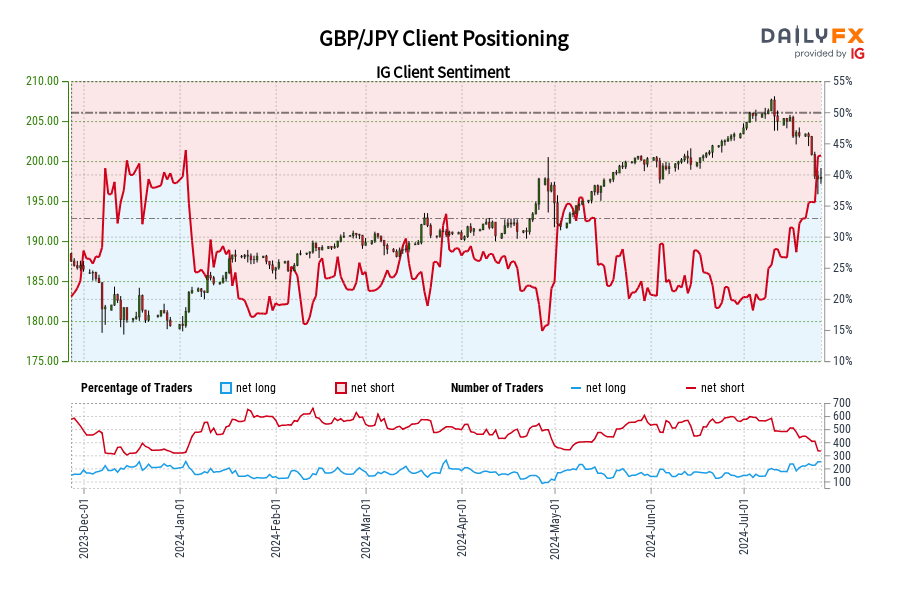

GBPJPY - British Pound May Hold Gains versus Japanese Yen

Weekly Summary of Forex Trader Sentiment and Changes in Positioning

A major shift in retail forex positioning suggests the US Dollar may rally further, but it will be critical to watch the Euro’s near $1.11 for larger moves.

This is especially true given that FX volatility prices have tumbled near multi-month lows on a slowdown in broader financial market tensions. If the Euro holds key lows, those traders who have bought into declines stand to benefit.

See specific US Dollar forecasts in the sections above, and sign up for future e-mail updates via this author’s e-mail distribution list.

Automate our SSI-based trading strategies via Mirror Trader free of charge

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com

To receive the Speculative Sentiment Index and other reports from this author via e-mail, sign up for his distribution list via this link.

Contact David via

Twitter at http://www.twitter.com/DRodriguezFX