SILVER PRICES, US DOLLAR, STOCKS, S&P 500, CORONAVIRUS – Talking Points:

- Silver prices echo traders’ liquidity demand amid Covid-19 outbreak

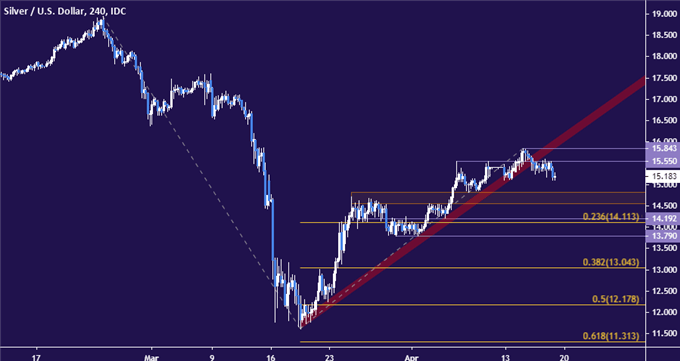

- Break of rising trend support suggests downtrend might be resuming

- Downturn may reflect broader credit stress returning across markets

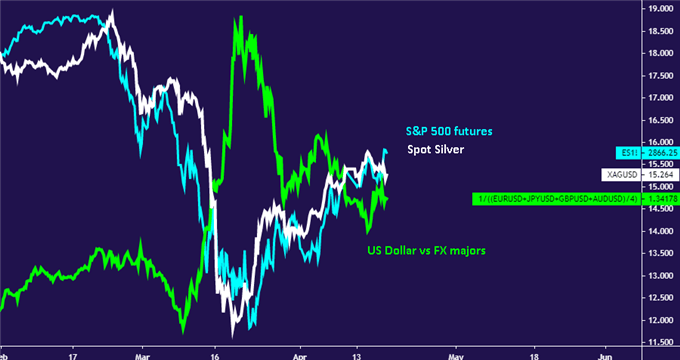

Silver prices have been tracking alongside stocks and inversely of the US Dollar amid the coronavirus outbreak. The metal plunged alongside a broad spectrum of assets such as stocks, most G10 FX currencies, cycle-sensitive commodities and gold in the second half of March as widespread lockdowns brought the global economy to a standstill, pressuring credit markets and inspiring liquidation.

Not surprisingly, the US Dollar thrived against this backdrop. The most liquid form of cash available was a natural beneficiary as financing costs spiked and market participants divested portfolios to assure access to capital and reduce exposure to breakneck volatility. An about-face reversal was triggered as the Fed rushed out a series of back-to-back easing measures, reducing funding stress.

Silver price 4-hour chart created with TradingView

Prices now appear to be re-engaging the downtrend. A break of rising trendline support guiding the recovery form mid-March lows now argues for a bearish pivot in the near-term directional bias. Positioning seems to imply that a corrective upswing has run its course and downside progress is on the cusp of resumption. Immediate support is in the 13.55-82 zone. Breaking above 15.84 may neutralize selling pressure.

Silver price 4-hour chart created with TradingView

What this reversal may imply about broader market sentiment remains to be seen. Still, silver’s gearing toward the pro-risk, anti-USD side of the increasingly binary asset universe is eye-catching. Renewed selling pressure may speak to a broader-based capitulation of recent optimism as markets absorb the Fed’s credit-boosting actions, refocusing on the dire state of the global business cycle.

RESOURCES FOR TRADERS

- Just getting started? See our beginners’ guide for traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free live webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter