Crude Oil Price Forecast Talking Points:

- WTI Crude Oil Technical Analysis Strategy: strong impulsive rise above $58.95 (Nov. high)

- Hedge Funds load into bullish bets per CFTC data as price approached 50% of bear market

- Trader Sentiment Highlight from IG UK: rise in net-bullish position may see price reverse ST

Crude Oil bears are having a hard time at the start of 2018 maintaining a shred of credibility. Naturally, there are arguments on the surface that have merit, but momentum is a cruel opponent as Oil short sellers are finding out. This week, Crude has continued to be bid on optimism that the supply surplus is on its way to a supply deficit relative to rising demand, which has pushed Brent above $70 and both the US and global oil benchmark to 50% of the 2014 drop.

Hedge Funds Look to Be “All In” on Upside

The CFTC’s Commitment of Traders report showed that hedge funds are set to push and look to profit on marginal gains in Crude Oil. Data as of January 9th showed a record long net position of $41,402 MM long. The rally in Crude oil has been backed solidly by the Hedge Funds loading into the trade as positive data such as the 2017 development per the US EIA and China General Administration of Customs showing that China passed the U.S. as the largest oil importer thanks to new refining capacity in China has boosted demand while OPEC holds off on discussing an exit strategy.

The concern, at least as the bear’s argument goes, is that shale production will explode given the high prices. This is possible, but would likely take a long time to make a material impact that would fundamentally shift the supply curve and physical market given the aggressive rise in demand recently seen. Additionally, US crude stockpiles continue to fall so without new supply coming on, price will likely continue to aggressively rise as the sequence of declines per the EIA weekly inventory report is the longest string of declines in a decade.

Technical Levels for WTI Crude Oil

After recently topping the 2015 high, short-term price support can be found at prior resistance at $59.02/05, which was the late-November high and H2 2017 price target that price eventually broke through in late December derived as the 1.618% Fib Expansion off 2017 low. A break below $59.05 would indicate the immediate trend has shifted to neutral, but it would take a break and close below $55.83 to shift from neutral to medium-term bearish.

Technical traders can also look to the 20-DMA as a form of dynamic support, that currently sits at $61.42/bbl whereas short-term traders may look to the 9-day midpoint at $63.07/bbl before getting out on fear that a wash-out could ensue as profit takers may not have much patience for a retracement.

Unlock our Q1 18 forecast to learn what will drive trends for Crude Oil at the open of 2018.

Crude Oil Chart Watch: Trendline & Price Support

Chart created by Tyler Yell, CMT. Tweet @ForexYell for comments, questions

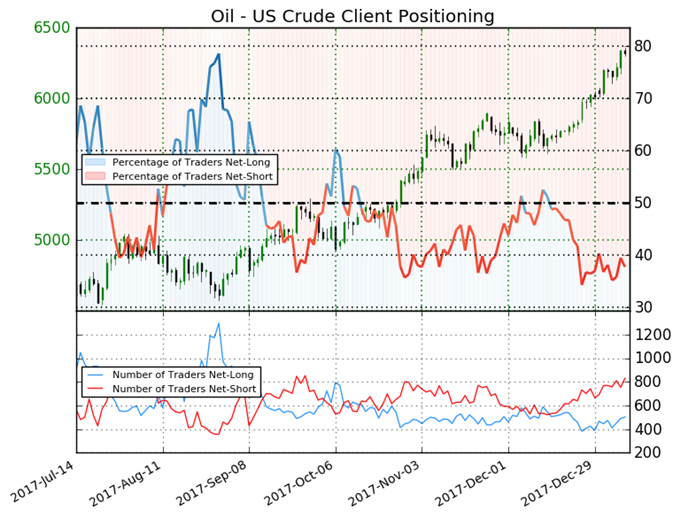

WTI Crude Oil Insight from IG Client Positioning

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests Oil - US Crude prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current Oil - US Crude price trend may soon reverse lower despite the fact traders remain net-short.

---

Written by Tyler Yell, CMT, Currency Analyst & Trading Instructor for DailyFX.com

To receive Tyler's analysis directly via email, please SIGN UP HERE

Contact and discuss markets with Tyler on Twitter: @ForexYell