Key Takeaways:

- Crude Oil technical strategy: hesitant to buy below 200-DMA/ $50/bbl psych level

- WTI Crude Oil closes gap with Brent Oil, both moving higher

- 200-DMA for Crude Oil at $51.06, trendline resistance at $49.79/bbl

- IGCS Highlight: USOIL sharp decrease in net-short position keeps ST focus higher

Talk about bad timing. Data from the CFTC showed that the net-speculative positioning data for Crude futures contractsreported a 75,983 contract drop in bullish oil exposure. The reduction of long positions was the largest on record. In other words, hedge funds that trade crude oil are having a bad week.

Since last Tuesday, when data from the CFTC is collected, the price of crude oil has rebounded 8%. There remains a lot of confusion as to the future direction of crude oil given that the historical “boom/bust” cycle is being questioned due to the large increase in global supply from the hands of shell producers.

Despite the concerns that Hurricane Harvey would leave the gasoline market in disorder as many refineries were flooded and temporarily put offline, there was little to no concern that there be a shortage of oil. Recent inventory data showed there is no shortage of crude, just difficulty in the delivery of refined products.

Much of the volatility around Crude Oil has been on the US Benchmark, WTI. Brent Oil, the global standard remained firm, and the spread between WTI and Brent oil was the widest levels in two years over the past week. Therefore, the gap appears to be closing and doing so with both oil markets moving higher.

As Hurricane Season gets in full swing, check out our free forecast on Crude Oil prices

Either way, the price of crude oil has significant resistance points ahead when looking at the chart below.

Based on internal price action, I was keeping an eye on $48.15 per barrel, which was a terminating price of the triangle before the recent breakdown below $46 a barrel. As of last Thursday, we saw a sharp spike that led to the 8% rally with spoke about earlier as price cleared the internal resistance of $48.15 to trade as high as $49.39 on Wednesday.

There is a confluence of resistance levels to watch between $49.67, which is the 200-day moving average, and the late July high of $50.20 per barrel. Between these two levels, there remains trendline resistance and Fibonacci levels that could resist a further price increase. One component that is helping the price of oil to remain supported is the weak US dollar.

Concerns remain that the US dollar could be in a longer term downtrend as opposed to a correction, which would likely provide longer-term support for commodities priced in dollars. Either way, the oil supply glut seems here to stay that can make it difficult for the price of oil to rally firmly into the $50 per barrel zone.

While keeping an eye on the multiple levels of resistance, a break and close below $45.38 would resume the 2017 downtrend, which is yet to be invalidated as we consistently see lower lows and lower highs throughout the 2017.

Daily USOil Chart:

Chart Created by Tyler Yell, CMT

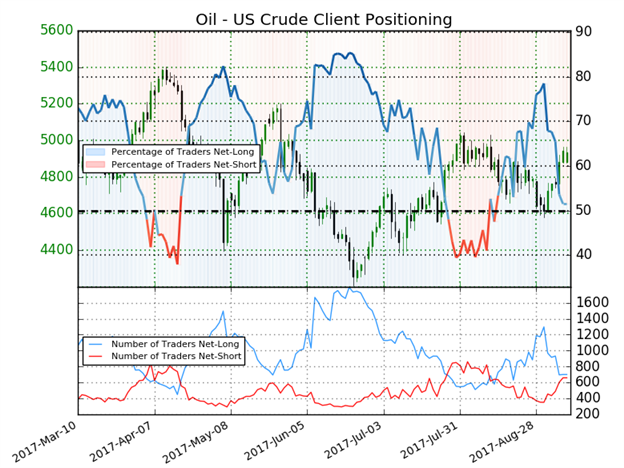

US Oil Insight from IG Client Positioning: sharp decrease in net-short position keeps ST focus higher.

The sentiment highlight section is designed to help you see how DailyFX utilizes the insights derived from IG Client Sentiment, and how client positioning can lead to trade ideas. If you have any questions on this indicator, you are welcome to reach out to the author of this article with questions at tyell@dailyfx.com.

Retail trader data shows 55.1% of traders are net-long with the ratio of traders long to short at 1.23 to 1. In fact, traders have remained net-long since Aug 14 when Oil - US Crude traded near 4894.0; price has moved 0.9% higher since then. The number of traders net-long is 19.5% lower than yesterday and 36.6% lower from last week, while the number of traders net-short is 24.7% higher than yesterday and 53.2% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Oil - US Crude prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current Oil - US Crude price trend may soon reverse higher despite the fact traders remain net-long. (emphasis added.)

---

Written by Tyler Yell, CMT, Currency Analyst & Trading Instructor for DailyFX.com

To receive Tyler's analysis directly via email, please SIGN UP HERE

Contact and discuss markets with Tyler on Twitter: @ForexYell