Highlights:

- Crude Oil Technical Strategy: watching last week’s low at $45.38 as key support

- US Crude inventories fell for the eighth week helping to calm oversupply fears

- IGCS Sentiment highlight: Sharp rise in short positions provides contrarian signal to look for upside

Crude oil looks ready to rally higher, according to shorter term technical analysis. Last week’s low looks to be a strong point of support from Elliott Wave analysis, which holds a potential count where last week’s low was the end of a Bullish Correction. Once a correction is over, trader’s should look for moves higher that can be traded.

When looking at the fundamental picture, it’s worth noting the good, the bad, and the troublesome. First, the good was that US stockpiles fell for the eighth straight week on rising demand led mainly from refiners. Refiners are processing more oil than last year in the US by 60,000 bpd. Aligning with the end of the likely seasonal peak is the potential of the first Gulf Coast Hurricane, currently named Tropical Depression Harvey, to hit Texas since 2008. However, we could see a direct hit effect refiners more, which are laid across the Gulf and are a key demand point of Oil. There was a strong amount of Latin American Imports coming mainly from Venezuela as well as impressive US gasoline exports that were near 700,000 and at the highest since June. The troublesome point is that seasonality is nearing its likely cycle peak that could mean we are about to see a seasonal drop, which could lead to a stall in the aggressive draws of inventory.

Give the strong rise in Crude Oil since Q3 began, click here to see the opportunities we’re watching in Oil.

The chart below shows that we’re not out of the wood’s yet in terms of soon being to break down. As mentioned above a breakdown below last week’s low at $45.38/bbl would favor a further breakdown is upon us. However, if we can see a move above last week’s high at $49.13/bbl would be strong since not seen since the last week in July that we’re breaking above resistance from the 2017 downtrend, which could mean we’re about to see a retest of $50/bbl. If such a move is going to happen, this time of year is a good fundamental time for it to occur.

While price remains below resistance of $49.13, I’ll stay cautiously optimistic as we continue to see a weak dollar, positive signs in the physical market, and other commodity blocs doing well that are correlated to Oil demand. All of this is happening at a time when commodity seasonality trends are bullish.

JoinTyler in his Daily Closing Bell webinars at 3 pm ET to discuss tradeable market developments.

Crude Oil continuing rebound from $45.38, last week’s low

Chart Created by Tyler Yell, CMT

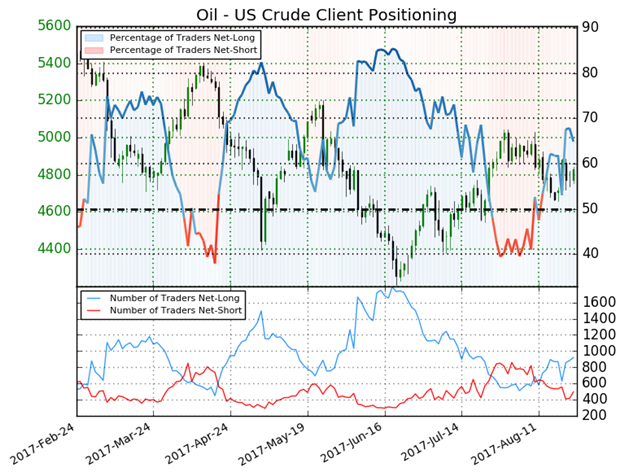

Crude Oil Sentiment: Net-long crude positions bias provides contrarian signal to look lower

The sentiment highlight section is designed to help you see how DailyFX utilizes the insights derived from IG Client Sentiment, and how client positioning can lead to trade ideas. If you have any questions on this indicator, you are welcome to reach out to the author of this article with questions at tyell@dailyfx.com.

Oil - US Crude: Retail trader data shows 64.9% of traders are net-long with the ratio of traders long to short at 1.85 to 1. In fact, traders have remained net-long since Aug 14 when Oil - US Crude traded near 4785.9; price has moved 0.8% higher since then. The number of traders net-long is 2.6% higher than yesterday and 12.7% higher from last week, while the number of traders net-short is 7.8% higher than yesterday and 18.5% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Oil - US Crude prices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed Oil - US Crude trading bias. (emphasis mine).

---

Written by Tyler Yell, CMT, Currency Analyst & Trading Instructor for DailyFX.com

To receive Tyler's analysis directly via email, please SIGN UP HERE

Contact and discuss markets with Tyler on Twitter: @ForexYell